The cryptocurrency market is witnessing a significant downturn, with the overall market cap dropping by 4.89% to approximately $2.5 trillion. Major cryptocurrencies like Bitcoin, Ethereum, XRP, Cardano, and Dogecoin have all experienced substantial price declines over the last 24 hours.

What you'll learn 👉

Price Drops for Top Cryptocurrencies

According to CoinMarketCap data at the time of this publication, Bitcoin’s (BTC) price was at $66,055.61, down by 4.28% in the last 24 hours. Similarly, Ethereum (ETH) is down 5.22%, trading at $3,528.50, while XRP’s price has dropped 4.65% to $0.608123.

Cardano (ADA) and Dogecoin (DOGE) have experienced even more significant declines, with ADA down 7.94% at $0.661698 and DOGE plummeting 10.95% to $0.142870.

Factors Contributing to the Market Downturn

Austin Hilton, a crypto analyst, in his YouTube video, attributes the market downturn to several factors. These factors include profit-taking after notable gains lately, macroeconomic factors such as the hotter than expected US Producer Price Index (PPI) data, and reduced inflows into spot Bitcoin ETFs.

I think that right now we will see opportunities to pick up different Blue Chip assets like Bitcoin, Ethereum, Solana, BNB, XRP, Cardano, you name it,” Hilton says, suggesting that the market needed a pullback after the recent significant uptrends.

He adds, “I think this is just kind of a standard pullback.”

Macroeconomic Factors and Market Sentiment

The video also discusses the impact of bond yields and the negative Coinbase premium, indicating bearish sentiment from US markets. Additionally, the upcoming Bitcoin halving event is mentioned as a potential factor contributing to the typical pullback before such events.

Despite the downturn, Hilton remains optimistic, viewing this as an opportunity for long-term investors to accumulate blue-chip assets at lower prices.

“I think that right now we will see opportunities to pick up different Blue Chip assets like Bitcoin, Ethereum, Solana, BNB, XRP, Cardano, you name it,” he states.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Historical Patterns and Market Cycles

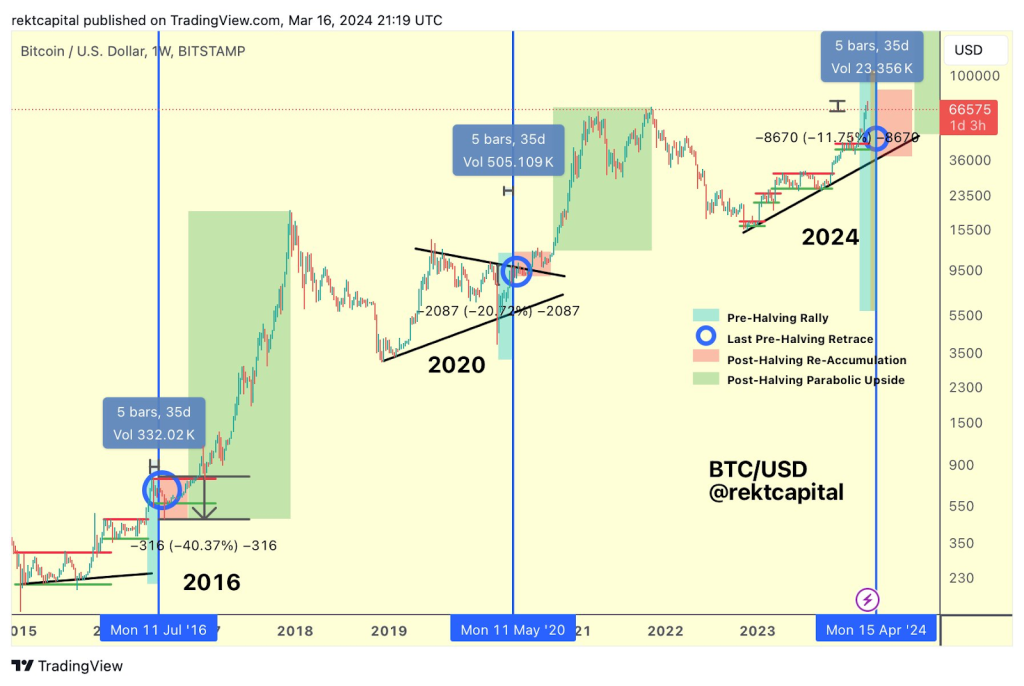

Rekt Capital, a top crypto analyst, weighs in on the market downturn, tweeting, “#BTC ‘This cycle is different because of the ETF’ Sure but it looks like that doesn’t protect price from a Pre-Halving Retrace which tends to happen in every cycle.”

This tweet highlights the historical patterns observed in cryptocurrency market cycles, suggesting that the presence of ETFs may not necessarily prevent the typical price retracement before Bitcoin halving events.

You may also be interested in:

- Grayscale Prepares for a Bitcoin Sell-Off, But Should This Worry Us?

- Ripple’s XRP Could Soon Soar to $1 According to This Analyst’s Charts

- Worldwide Crypto Magnetism Intensifies as Avalanche (AVAX) & Tether (USDT) Adopt Raffle Coin (RAFF) Presale for Anticipated 100X Upswing

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.