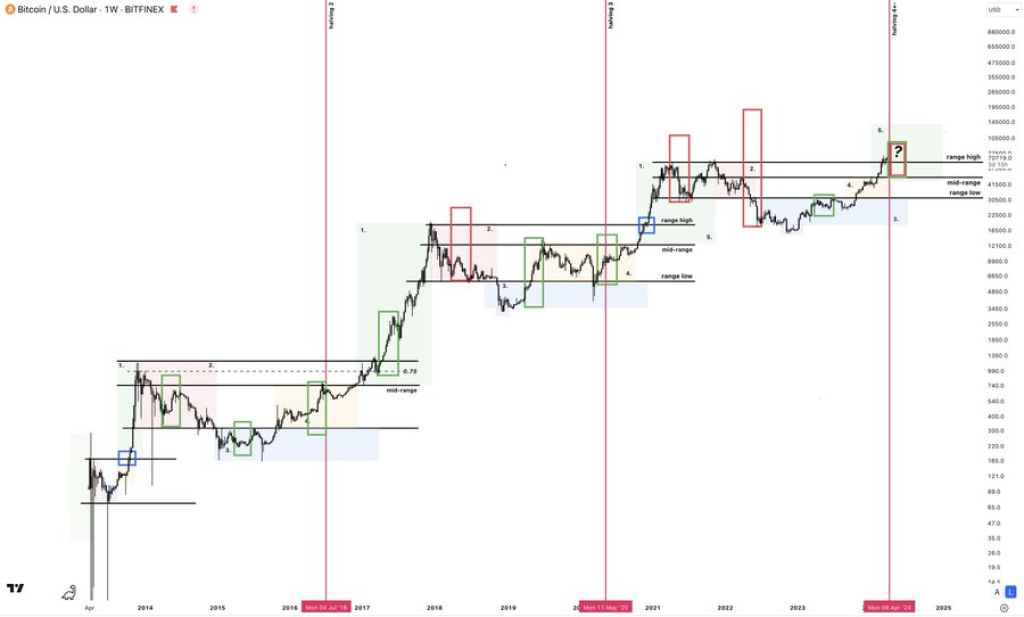

With Bitcoin’s next halving event just 23 days away and the crypto market structure pointing to a bull market, historical data suggests the second quarter and April could be a prime period for price gains in Bitcoin (BTC) and Ethereum (ETH).

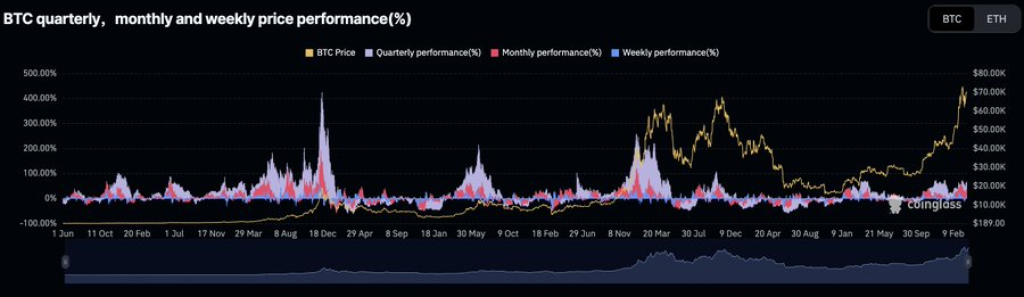

According to analysis from analyst @damskotrades, over the past 11 years April has seen positive returns for Bitcoin 7 out of 11 times, or nearly two-thirds of the time. The average April gain for BTC is not provided, but the data implies the month has tended to be markedly green more often than red.

When looking at full second quarters, the picture is fairly similar with BTC closing Q2 in the green a solid 7 out of the last 11 years. The analyst notes that the 4 negative Q2 instances all came during either confirmed bear markets or after massive bull rallies that had already taken Bitcoin well past its previous all-time high.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +“Crypto never had a red Q2 after flipping the previous all-time high in a bull run,” @damskotrades summarizes. “All red Q2s were either in a bear market or AFTER a bull rally above the previous ATH.”

For Ethereum, the historical returns are even more bullish. ETH has ended April higher a robust 6 out of 8 times, with an average April gain of +27%. Q2 as a whole has been positive in 7 out of the past 8 years, with ETH averaging a stellar +78% return during that three month period.

The data seems to align with @damskotrades’ “view on Altcoins; 2nd part of the bull is when they catch up,” suggesting Ethereum and other altcoins could begin accelerating their uptrends soon if Bitcoin’s halving catalyzes another crypto bull run as many expect.

With Bitcoin having already reclaimed its previous $69,000 all-time high from 2021 and the overall market showing signs of a bull market structure, the stats imply the current second quarter could bring meaningful upside for the top two crypto assets.

Of course, past performance is no guarantee of future results. But the historically bullish April and Q2 numbers will likely be a point of optimism for crypto investors anticipating more fireworks over the weeks and months ahead.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.