The crypto market saw low correlation with broader macro assets in Q3 2023, instead reacting more to industry-specific news and capital flows according to Ripple’s latest XRP Markets Report.

Bitcoin’s correlation with the S&P 500 hit record lows of 0.23 during the quarter. XRP also exhibited a low 0.16 correlation. Multiple crypto hacks, exploits and scams totaling $686 million weighed on prices and liquidity.

BTC daily trading volumes reached 3-year lows of $1-2 billion. XRP volumes neared 4-year lows around $300-400 million per day. Activity continued to occur predominantly on major non-US exchanges like Binance, OKX and Upbit.

US exchanges gained some XRP volume share following the court ruling XRP is not a security. Bullish saw growth after listing XRP. XRP options launched on Bit.com and Deribit.

Limited fresh capital inflows led to high leverage across crypto. Retail exchange volumes were similar to pre-2020 levels, indicating market-maker flows likely drove activity.

Institutional interest in SEC approving spot BTC/ETH ETFs in 2024 remains high. Global macro uncertainty also increased, affecting crypto prices.

Ripple had significant legal wins, with the SEC dismissing charges against CEO Brad Garlinghouse and Chairman Chris Larsen. The case now enters the remedies phase.

Singapore granted Ripple a major payments license just 4 months after initial approval. Coinbase and Sygnum also received licenses. The UK FCA and G20 pushed for additional crypto regulation and frameworks.

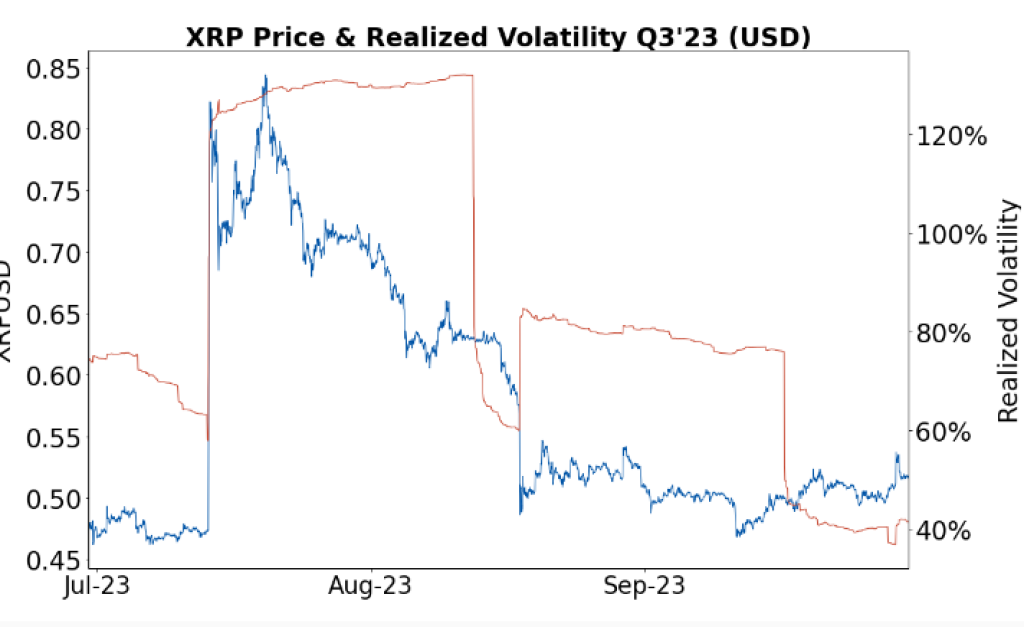

XRP experienced significant price and volatility spikes on July 13, which was the date of the court decision in Ripple’s case with the SEC. Another spike occurred on August 17 amid a large risk-off move in the broader markets. Despite these intermittent spikes, XRP concluded the third quarter around historically low 90-day volatility levels of approximately 40%.

Most XRP trading activity currently involves stablecoins, mainly because the vast majority of exchanges offer XRP trading pairs against USDT. Binance maintained its share of around 60% of XRP volume. More exchanges opened XRP trading, increasing the “Other” category. US exchanges grew to almost 5% of volume.

On-chain XRP activity increased significantly in Q3, with DEX trading volume up over 3x. Other metrics like transactions, burned fees, wallets and trustlines were largely stable from Q2.

Ripple’s total XRP holdings decreased slightly to 5.3 billion. Its escrow holdings decreased to 41.3 billion. Ripple returns most released XRP back into escrow each month.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.