Binocs Crypto Tax Software Review: Features, Pricing, Supported Exchanges, Wallets, Countries

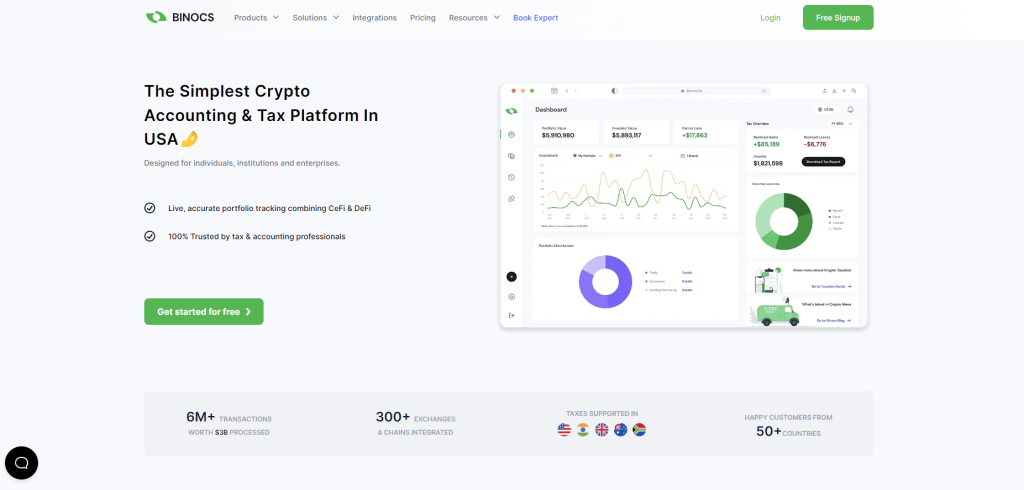

Are you tired of the hassle and confusion that comes with calculating your crypto taxes? Look no further than Binocs, a crypto tax calculation and accounting platform designed for individuals, institutions, and enterprises in the USA.

With Binocs, you can simplify taxes for various crypto-related activities, including NFT trading, ICOs, and renting out land on the metaverse. One of the key features of Binocs is its unified dashboard, which allows you to view trades from CeFi and DeFi, as well as realized and unrealized gains/losses across multiple exchanges/wallets. This makes it easier to keep track of your crypto investments and ensure that you are accurately reporting your taxes.

But is Binocs the right choice for you? In this review, we will explore the features of Binocs and assess its suitability for individual investors, tax professionals, institutional investors, and crypto companies.

| 📚 Topic | Summary |

|---|---|

| 🔍 Overview | Binocs is a crypto tax calculation and accounting platform designed for individuals, institutions, and enterprises in the USA. It simplifies taxes for various crypto-related activities, including NFT trading, ICOs, and renting out land on the metaverse. |

| 🛠️ Features | Binocs offers a unified dashboard to view trades from CeFi and DeFi, as well as realized and unrealized gains/losses across multiple exchanges/wallets. It also offers performance tracking, access configuration, collaborative planning, Gantt charts, and what-if scenario analysis. |

| 💰 Pricing | Binocs offers a freemium model for individual investors with basic features. The enterprise plan offers more benefits such as data quality reports, what-if scenario analysis, and access rights configuration. Pricing for the enterprise plan is not readily available on the website. |

| 🔄 Supported Exchanges and Wallets | Binocs supports over 300 wallets and exchanges, including popular ones like Bitbns, WazirX, Binance, and Coinbase. It offers end-to-end encryption protocols, a no KYC policy, and 2FA to ensure the security of your data. |

| 🌍 Supported Countries | Binocs is tax compliant in the U.S., U.K., Australia, South Africa, and India. As more countries begin to regulate crypto investments, Binocs is expanding its reach to emerging markets. |

| 🔄 Alternatives | Some alternatives to Binocs include monday.com, Moovila, Adobe Workfront, and BigTime, each offering their own advantages and disadvantages. |

| ❓ Frequently Asked Questions | Binocs can generate tax reports for crypto investments made in several countries, including the US, UK, Australia, South Africa, and India. The platform is customizable and offers training and support after implementation. It integrates with over 300 wallets and exchanges and has a reconciliation engine for handling discrepancies or errors in transaction data. |

| 📝 Conclusion | Binocs is a comprehensive crypto tax software that offers a range of features to simplify tax calculations for individuals, institutions, and enterprises. It provides 24/7 support and IRS compliant reports. However, it is currently tax compliant in a limited number of countries and pricing information is not readily available. |

Regenerate response

What you'll learn 👉

Background and Overview

You’re about to discover the ultimate guide to simplifying your crypto accounting and tax woes with a platform that’s been praised by industry experts and investors alike. Get ready to say goodbye to headaches and confusion with this game-changing tool!

Binocs is a crypto tax reporting app that helps users navigate regulations and simplifies taxes for various crypto-related activities, including NFT trading, ICOs, and renting out land on the metaverse. The platform offers a unified dashboard to view trades from CeFi and DeFi, as well as realized and unrealized gains/losses across multiple exchanges/wallets.

Users can connect from over 300 wallets and import their trades for tax calculation. With a no KYC policy, 2FA, and end-to-end encryption protocols, Binocs ensures data privacy and prevents unauthorized access to user data. Binocs is suitable for individual investors, tax professionals, institutional investors, and crypto companies.

The platform offers 24/7 support, IRS compliant reports, and a modular and scalable system. Customer support is one of Binocs’ strongest suits, with a technical support team available during implementation and prompt assistance from the Binocs team.

Binocs has a permanent data deletion feature to ensure user information is wiped from their servers if they decide to delete their account. Security measures are top-notch, with end-to-end encryption protocols and a no KYC policy. Integration options are also vast, with Binocs supporting more than 300 exchanges and wallets, including Bitbns, WazirX, Binance, and Coinbase.

Industry-specific use cases include fund houses, traditional financial institutions, banks, and crypto-native businesses. Binocs offers a range of customization options and training or support after implementation, making it a powerful tax and accounting platform for any user.

Features

Looking beyond the obvious benefits of simplifying taxes for crypto-related activities, Binocs offers a range of powerful features for resource planning and scheduling.

With performance tracking, access configuration, collaborative planning, Gantt charts, and what-if scenario analysis, the platform provides users with comprehensive tools to manage their crypto investments effectively.

The drag-and-drop functionality and timeline maps allow for easy visualization of tasks and deadlines, while the data quality reports ensure that users can track their progress accurately.

Binocs also offers advanced logging history tracking, enabling users to keep track of all changes and updates made to their portfolio. This feature is particularly useful for tax purposes, as it provides an audit trail for regulatory compliance.

Access rights configuration ensures that only authorized personnel can make changes to the portfolio, further enhancing security and data privacy.

With these features, Binocs offers a powerful resource planning and scheduling tool that can help users streamline their crypto investments and ensure regulatory compliance.

Pricing

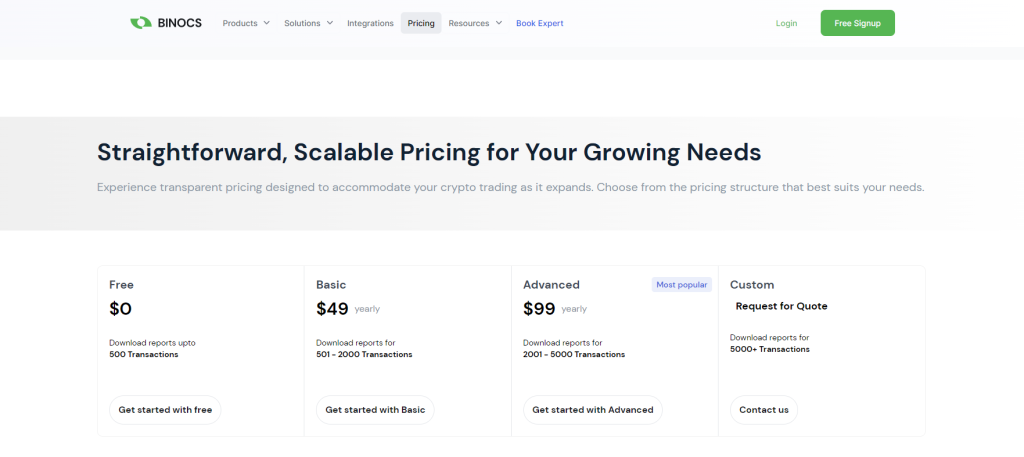

Now let’s take a look at how much it’ll cost to access all of the features and benefits that this powerful resource planning and scheduling platform has to offer. Binocs offers a freemium model for individual investors with basic features such as equipment scheduling, performance tracking, and priority setting.

However, the enterprise plan offers more benefits such as data quality reports, what-if scenario analysis, and access rights configuration.

Pricing comparison between different resource planning and scheduling platforms shows that Binocs is moderately priced. There are no hidden costs, and users can choose between monthly and annual payment options.

However, the pricing for the enterprise plan is not readily available on the website, and users will have to contact the support team for more information. It is also unclear whether there are customization options or training/support after implementation, which may be an additional cost for some users.

Supported Exchanges and Wallets

As you explore this section, you’ll discover which exchanges and wallets are supported by the platform, providing you with a comprehensive overview of the data you can import into the resource planning and scheduling tool.

Binocs supports over 300 wallets and exchanges, including popular ones like Bitbns, WazirX, Binance, and Coinbase. This wide range of integration options ensures that you can easily import your trades for tax calculation and accounting. Additionally, Binocs offers end-to-end encryption protocols, a no KYC policy, and 2FA to ensure the security of your data.

The platform also has a reconciliation engine that prompts users about any discrepancies in their transactions, ensuring data accuracy.

Read also:

- Mastering The Art Of Calculating Your Crypto Taxes: Fifo, Lifo, And Beyond

- Cryptio Review: Comprehensive Guide on Features, Use Cases, and Pricing

- How are Crypto IRAs Taxed? Benefits, Risks, and Tax Implications

In terms of customer support, Binocs offers 24/7 assistance to users. The platform also provides IRS-compliant reports to ensure that you are tax compliant. Moreover, Binocs is suitable for a range of users, including individual investors, tax professionals, institutional investors, and crypto companies.

With its user-friendly interface and extensive integration options, Binocs provides an excellent user experience. Overall, Binocs is a reliable and secure platform for crypto tax calculation and accounting, offering both data accuracy and customer support.

Supported Countries

If you’re curious about which countries Binocs currently supports, you’ll be glad to know that the platform is tax compliant in the U.S., U.K., Australia, South Africa, and India. With the global adoption of cryptocurrency, Binocs is expanding its reach to emerging markets to accommodate the needs of crypto investors worldwide.

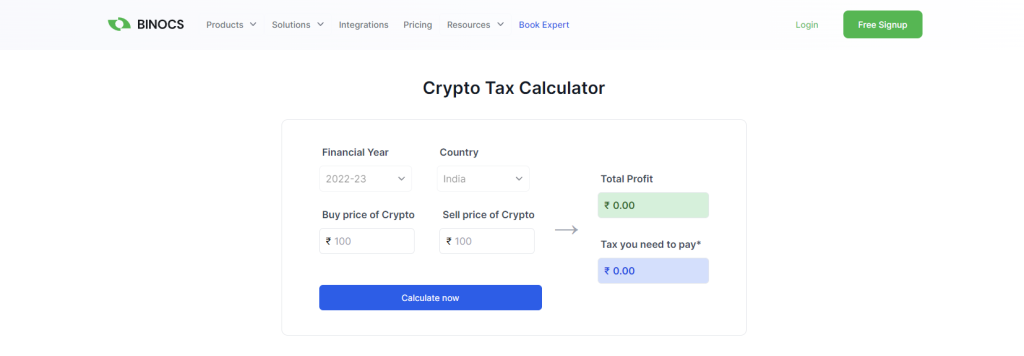

As more countries begin to regulate crypto investments, tax regulations can become complex and confusing. Binocs simplifies the reporting and accounting process for crypto investments, allowing users to focus on their investment strategies without worrying about tax compliance. Binocs’ ability to provide tax reports in less than 30 minutes and track return on investment, profits and losses, and capital exchanges is useful for both retail and institutional investors.

As the crypto industry continues to grow, Binocs plans to add more markets to its list of tax compliant countries. With blended taxes of about 20% and a potential tax liability of $300 billion by 2026, crypto investors need a reliable and efficient tax reporting and accounting platform like Binocs to stay compliant with tax regulations and optimize their investment strategies.

Alternatives

Before considering any alternatives, it’s important to note that the total market cap of the crypto industry rose from about $325 billion in September 2020 to $1 trillion in September 2022, highlighting the significant growth and potential of this industry.

With this in mind, it’s important to evaluate and compare different crypto tax software options to determine which one will best suit your needs. Some alternatives to Binocs include monday.com, Moovila, Adobe Workfront, and BigTime, each offering their own advantages and disadvantages.

monday.com is a popular project management tool that can also be used for resource planning and scheduling. It offers a user-friendly interface, drag-and-drop functionality, and customizable workflows. However, it may not have the same level of specialized features for tax reporting as Binocs.

Moovila is another option that offers collaborative planning, performance tracking, and timeline maps. It also has a comprehensive data quality reporting system. However, it may not be as customizable as other options and may not offer the same level of support for crypto-specific tax reporting.

Adobe Workfront and BigTime are other alternatives that offer resource planning and scheduling tools. However, they may not have the same level of integrations with crypto exchanges and wallets as Binocs, making it more difficult to import and track trades.

Ultimately, it’s important to evaluate each option and determine which one best suits your needs.

Frequently Asked Questions

Conclusion

Overall, Binocs is a comprehensive crypto tax software that offers a range of features to simplify tax calculations for individuals, institutions, and enterprises.

With its unified dashboard, users can easily view their trades from CeFi and DeFi, as well as realized and unrealized gains/losses across multiple exchanges/wallets. The platform also supports various crypto-related activities, including NFT trading and renting out land on the metaverse.

According to a recent survey, 65% of US cryptocurrency investors haven’t reported their crypto transactions to the IRS. This highlights the importance of using a reliable tax software like Binocs to ensure compliance with tax laws and regulations.

With its user-friendly interface and automated tax calculations, Binocs can help users save time and reduce the risk of errors when filing their taxes.

Overall, Binocs is a solid choice for anyone looking for a reliable and easy-to-use crypto tax software. While it may not be the cheapest option on the market, its range of features and support for various exchanges and wallets make it a worthwhile investment for individuals, tax professionals, institutional investors, and crypto companies alike.