Earlier this month, the cryptocurrency world was shaken when the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Binance, one of the largest and most influential cryptocurrency exchanges globally. The immediate aftermath was a significant financial blow for the exchange, with a negative netflow of $1.43 billion within the first 24 hours.

Netflow, a critical metric in the crypto world, refers to the difference between the amount of cryptocurrency being deposited into an exchange and the amount being withdrawn. A positive netflow indicates that more funds are entering the exchange than leaving, while a negative netflow signifies the opposite.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The SEC’s legal action prompted a wave of withdrawals from Binance users, who collectively pulled out over $3 billion across multiple chains in the wake of the announcement. This mass exodus resulted in a negative netflow of $1.43 billion as of 3 PM UTC on the day following the lawsuit’s announcement.

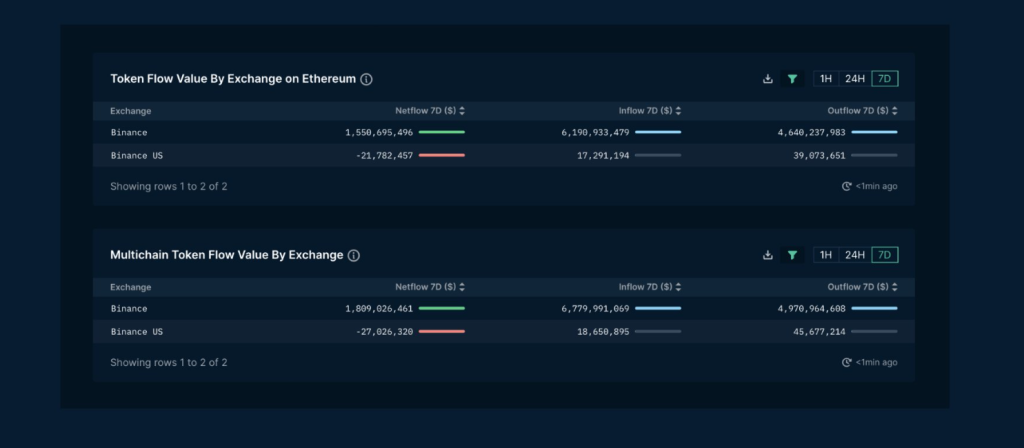

However, the tide appears to have turned for Binance. In a remarkable display of resilience, the exchange has seen a positive netflow of $1.8 billion across different chains, excluding Bitcoin, over the past seven days. This means that more funds are being deposited back into the exchange than are being withdrawn, indicating a return of user confidence.

This turnaround underscores the volatile and rapidly changing nature of the cryptocurrency market. It also highlights the resilience of Binance and its users, who have weathered the storm of the SEC lawsuit and are now contributing to the exchange’s recovery.

As the situation continues to unfold, the importance of on-chain data in understanding the dynamics of cryptocurrency exchanges becomes increasingly clear. It provides a real-time snapshot of user behavior and market trends, offering valuable insights into the health and stability of exchanges like Binance.

In the face of regulatory scrutiny, Binance’s ability to bounce back demonstrates the robustness of the cryptocurrency market and the enduring faith of its participants. As the dust settles on this legal battle, the crypto world will be watching closely to see how Binance continues to navigate these choppy waters.