Binance Coin is making serious noise again. The token has been climbing fast, quietly mirroring Bitcoin’s own breakout pattern over the past year.

At writing, Binance Coin price is up about 6%, trading around $1,287, with trading volume soaring by nearly 90%. That makes it one of today’s top gainers, and it might just be following Bitcoin’s exact footsteps.

What you'll learn 👉

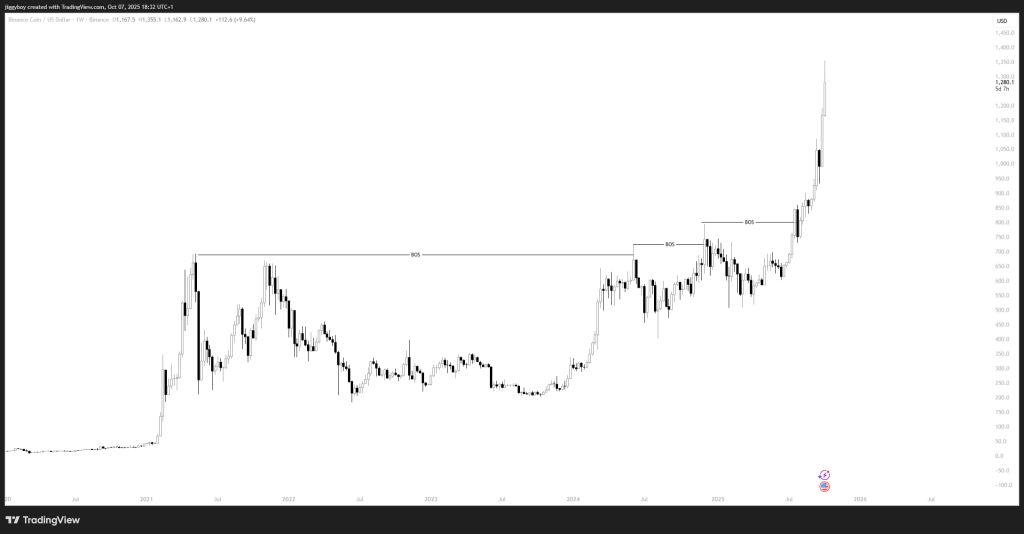

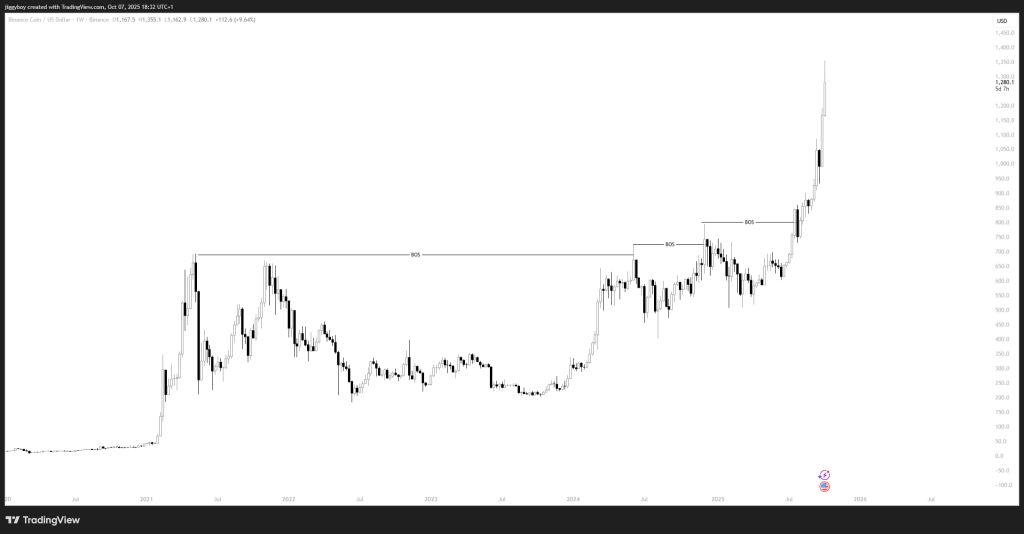

BNB Chart Looks Just Like Bitcoin’s

Take a look at the weekly charts for BNB/USD and BTC/USD side by side; they’re almost identical. Both show a long accumulation base followed by a Break of Structure (BOS) and an explosive move to new highs.

Bitcoin spent most of 2023 consolidating below its $70K resistance before breaking out in early 2025 to reach a new all-time high near $125K. BNB price is now showing that same post-consolidation breakout pattern, a powerful move through its 2021 ceiling around $1,000 that mirrors Bitcoin’s earlier structure.

Every major Bitcoin rally over the last two cycles started this same way: gradual compression, BOS confirmation, then acceleration once liquidity thins out above resistance.

BNB now sits right in that phase. Its RSI is elevated but not overheated, suggesting trend strength is intact. The similarities to Bitcoin’s pre-ATH structure are hard to ignore.

And here’s another milestone worth noting:

Ali pointed out today that BNB has officially overtaken XRP to become the third-largest cryptocurrency by market cap. That’s not just symbolic — it shows how strong the momentum behind BNB really is.

$BNB has officially overtaken $XRP to become the third-largest cryptocurrency by market capitalization. This is a huge milestone. HODL! pic.twitter.com/7W4G4GxQWf

— Ali (@ali_charts) October 7, 2025

3 Key Drivers Behind BNB Price Rally

BNB’s rally isn’t just technical; it’s being powered by major fundamental tailwinds. From surging on-chain activity to institutional accumulation and even regulatory tension, these are the forces shaping the next leg of its move.

1. BNB Chain Activity Surges

In Q3 2025, BNB rallied 80%, hitting a new all-time high near $1,304 as on-chain activity exploded.

Transaction volume quadrupled compared to Q1, with 58 million daily active addresses and a record $80 billion in DEX volume on PancakeSwap, the highest since 2021. The auto-burn mechanism has also wiped out over 1.59 million BNB (worth roughly $2 billion) this year, tightening supply and fueling scarcity.

All that activity creates constant buy pressure, but with a 30% weekly gain, some traders are watching for short-term pullbacks around the $1,300–$1,500 resistance zone.

Read Also: Plasma (XPL) Price Just Tricked the Market – Here’s What’s Really Going On

2. CEA Industries’ $625M BNB Bet

In a move that feels straight out of MicroStrategy’s Bitcoin playbook, Nasdaq-listed CEA Industries revealed a 480,000 BNB treasury worth about $625 million at the all-time high.

The company plans to eventually hold 1% of BNB’s total supply by year’s end. That’s institutional conviction on full display, and it means BNB now has corporate-level buyers accumulating it like Bitcoin.

CEA’s current holdings already represent roughly 0.35% of BNB’s circulating supply, making them one of the largest non-exchange wallets on record.

3. Stablecoin Scrutiny Hits BNB Chain

Of course, not everything is bullish.

According to NYDIG, the USD1 stablecoin, which has ties to the Trump family, has raised some red flags. Roughly 79% of its supply is issued on BNB Chain, with 90% initially held on Binance.

Although those levels have started dropping, the lack of reserve reports since July might catch the regulators’ eye. Analysts warn that if the compliance standards under the GENIUS Act (to be effective in 2027) tighten up, issuers of stablecoins can shift away from BNB Chain, at least temporarily.

Binance Coin Price Short-Term Outlook: The Next Bitcoin-Style Leg?

BNB’s price action right now feels like Bitcoin’s breakout in early 2024, a clean break from resistance, short consolidation, and a push into price discovery.

If this pattern continues, Binance coin price could easily test the $1,500–$1,700 range in the short term, mirroring Bitcoin’s early run to $90K before its massive push higher.

Positive momentum remains, and fundamentals ranging from institutional onboarding to auto-burns confirm that sentiment.

In short: BNB is acting just like Bitcoin acted in the run-up to its parabolic period. History rhymes, and the next few months can be gigantic.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.