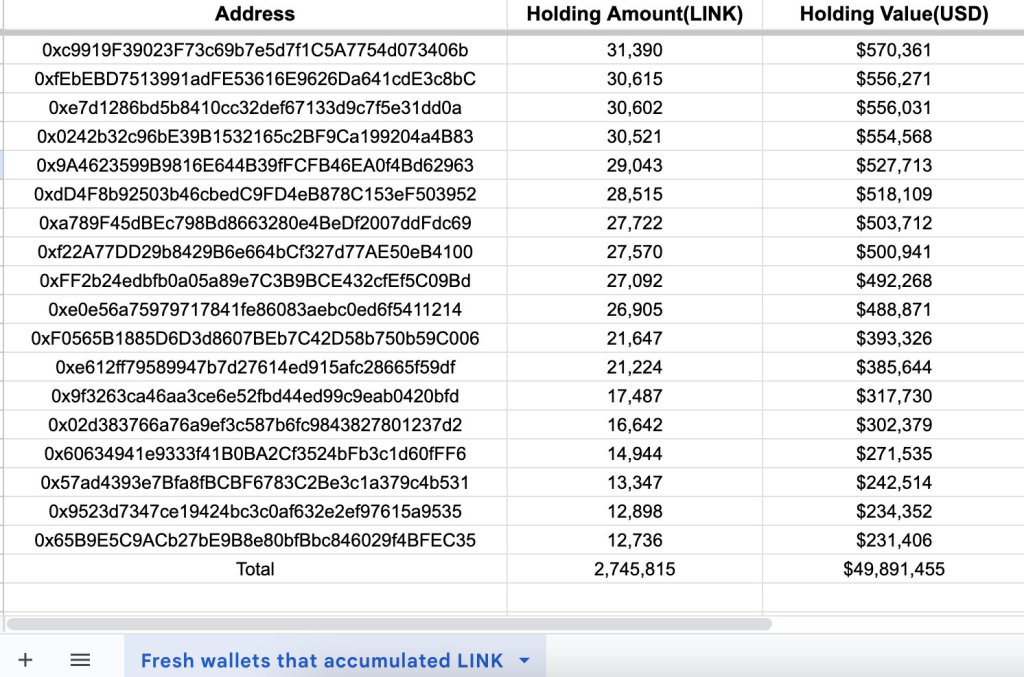

According to on-chain insights provided by Lookonchain, large whales and institutions are actively accumulating Chainlink’s LINK token. One incident shows an unknown whale recently withdrawing 2,745,815 LINK worth $49.9 million from Binance via 49 newly created wallets.

Lookonchain also identified the “0x2A19” wallet, pulling nearly $9 million worth of LINK from Binance over the past 10 days. The timing and nature of these large transactions signal concentrated buying by entities with substantial financial resources.

However, not all analysts remain entirely bullish on LINK in the near term. CryptoBusy points out that after pumping nearly 9 days straight, LINK shows signs of exhaustion as it approaches multi-year resistance levels and the golden ratio extension around $8.

The YouTuber suggests seasoned traders should watch for a rejection play off this major confluence point where the risk/reward favors loading up puts or short positions. Selling pressure stands to emerge given LINK’s technically overextended rally.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +On the other side, crypto trader Elite Crypto claims he identified LINK as undervalued, allowing his followers to capture a nearly 4x return from around $5. Despite the impending resistance, he expects another 4-5x price multiplication from LINK over the course of the current bull market.

In summary, while institutional and whale-buying activity continues in LINK, providing a long-term bullish backdrop, short-term risks remain elevated around all-time high resistance after such a parabolic advance.

You may also be interested in:

- Cardano’s ADA Can ‘Easily’ Hit $5 Says Top Crypto Analyst – Here’s When

- Why is Monero’s XMR Token Price Crashing?

- Twitch Gets Nervous as DeeStream (DST) Platform Sees Huge Investment from Avalanche (AVAX) & Chainlink (LINK) Investors.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.