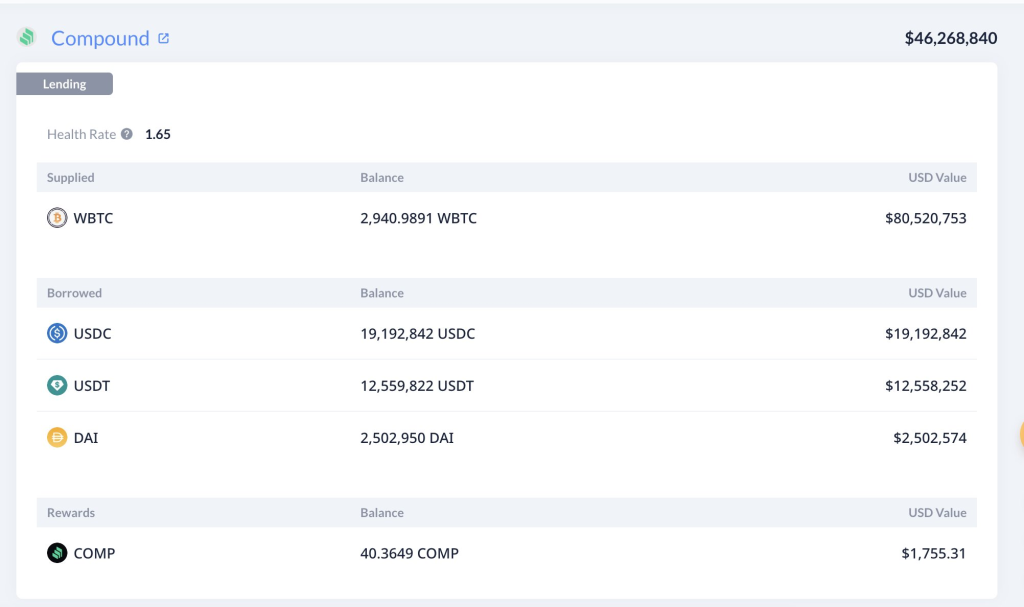

According to the details from Lookonchain, a whale has taken a notably large position in Wrapped Bitcoin ($WBTC) on two prominent decentralized finance platforms—Compound and Aave.

According to available data, this unidentified investor has withdrawn a staggering 3,107 $WBTC—equivalent to approximately $92.2 million—from major cryptocurrency exchanges Binance and Bitfinex. These withdrawals occurred since July 6 and averaged at a price of $29,672 per $WBTC.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +In a move that adds layers of complexity to the strategy, the whale has also borrowed an additional $36 million worth of stablecoins. This could imply various potential tactics such as yield farming or leveraging positions.

While the exact motivations behind these moves remain speculative, they indicate a growing confidence in decentralized finance platforms. High-net-worth investors appear to be increasingly willing to leverage these decentralized platforms for large scale operations, a clear shift from traditional finance systems.

The unknown whale’s massive $WBTC position, combined with significant stablecoin borrowing, presents a compelling narrative of where the big players might be steering the crypto market. Whether a signal of an impending bullish trend for $WBTC or a calculated strategy to capitalize on DeFi opportunities, these activities are worth keeping an eye on for anyone invested in the crypto space.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.