The fintech narrative is becoming one of the strongest forces shaping the current crypto cycle. Investors are starting to focus less on speculation and more on projects that can challenge existing payment systems.

The idea of decentralizing financial services is not new, but this time the technology is far more advanced, and adoption is picking up speed. Several tokens are now standing out as direct challengers to traditional fintech players.

Among the most discussed are Digitap ($TAP), Stellar (XLM), World Liberty Financial (WLF), and Ripple (XRP). These projects each approach the payments challenge in different ways, but they share one crucial trait: they aim to bring real financial infrastructure on-chain. Many analysts have placed them among the best cryptos to buy in 2025.

What you'll learn 👉

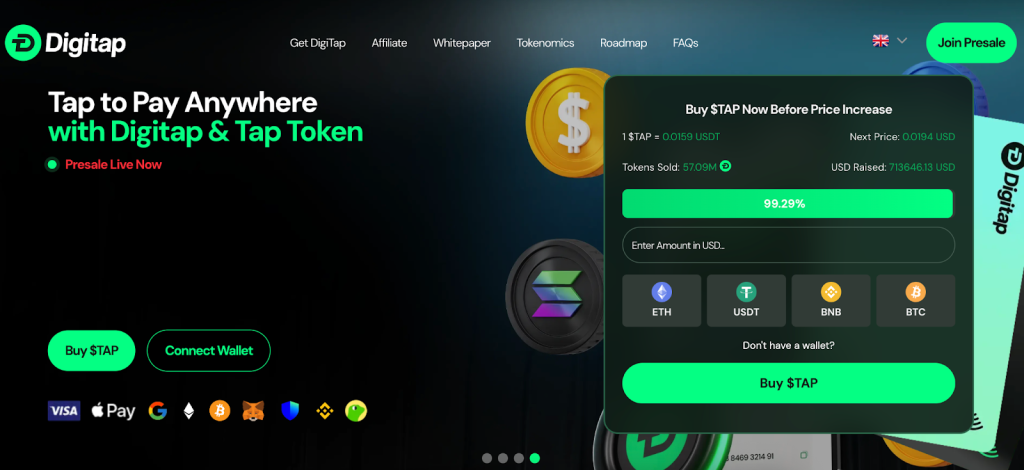

Digitap ($TAP): The Payment Challenger

Digitap has emerged as one of the most notable presales of the year. What sets it apart from most early-stage projects is its working product. The app is already live in the Apple App Store and Google Play Store. Users can register, spend with the card, and move funds between crypto and fiat. That kind of utility at the presale stage is rare.

The project has raised over $700,000, with close to 60 million $TAP tokens already sold. The current presale price is $0.0159, and it will rise 22% to $0.0194 in the next stage. That structured pricing has attracted early investors looking for a clear entry point with upside. Its 50% buyback and burn model also serves to promote long-term price appreciation.

Digitap’s omni-bank model is aimed at the 1.4 billion unbanked people globally. It uses a zero-KYC approach, which removes the barriers found in traditional banking, and also assists the new demographic of remote work professionals who want flexible finance.

With early infrastructure already in place and a clear use case, many see $TAP as one of the best cryptos to buy as the payments sector continues to evolve.

Stellar (XLM): A Proven Player in Global Payments

Stellar has been around since 2014, making it one of the longest-standing payment-focused blockchains in the space. Its core mission has always been to make cross-border transactions fast, cheap, and accessible — particularly in regions where banking access is limited.

Unlike many newer projects, Stellar has a strong track record of building genuine partnerships. It has worked with banks, remittance companies, and fintech platforms worldwide. Its focus on stablecoin settlement has made it a preferred network for some cross-border payment flows.

While XLM has had quieter years compared to more hyped assets, its steady integration into real payment channels has kept it relevant. If the payments narrative gains more traction in 2025, Stellar could see renewed momentum.

World Liberty Financial (WLF): A New Contender with Big Backing

World Liberty Financial is a much newer name in the fintech token conversation, pushed forward by President Trump. The project has gained attention because it blends on-chain payment tools with a structured vision for compliance and large-scale financial access. Unlike older payment projects, WLF is built with institutional integration in mind from day one.

Its team has emphasized building real infrastructure, not just a token. This focus on practical adoption has drawn early support from strategic backers in the fintech sector. WLF’s approach combines stable value settlement, asset-backed functionality, and seamless interoperability with existing financial systems.

While still early in its growth, WLF’s role as a bridge between traditional finance and blockchain payment rails has established it as a serious name to watch heading into 2026. It focuses more on institutions than retail options.

Ripple (XRP): The Legacy Fintech Fighter

Ripple has spent years trying to disrupt the banking system from within. XRP’s core use case — replacing slow and expensive cross-border transfers — remains one of the clearest real-world applications of blockchain technology. Despite legal challenges, Ripple has retained strong institutional partnerships with banks, fintech firms, and payment processors.

What makes XRP stand out is its scale. While many new projects are still finding their footing, Ripple already has a global network in place. That gives it a strategic advantage if the fintech disruption narrative accelerates. Ripple is also known as a fast, stable, and low-cost chain. There are no question marks about its technology – it’s a working, real-time gross settlement ecosystem for financial institutions.

A Market Poised for Payment Innovation

Fintech disruption is no longer an abstract concept. It’s happening in real time. Traditional banks and payment processors are slow to adapt to changing user demands, leaving space for blockchain projects to offer faster and more accessible alternatives.

Digitap brings a live omni bank app to the table. Stellar brings years of cross-border settlement experience. WLF aims to bridge traditional finance with decentralized rails. Ripple holds the institutional card with a massive network already in place. Together, these projects represent a clear break from the past.

Only Digitap, however, offers a working zero-KYC application that bridges crypto and fiat, designed to cater to a global population rather than a specific group. The other fintech disruptors are a little behind, and they might also be priced at a premium as established brands rather than early-stage presales.

Discover how Digitap is unifying cash and crypto by checking out their project here:

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.