Tellor (TRB) is a decentralized oracle network that provides data to DeFi platforms. The TRB token surged from $10 to $60 between late July and early September 2022, gaining over 500% in just 6 weeks. This article will analyze on-chain data to evaluate whether this price move was driven by fundamentals or manipulation.

What you'll learn 👉

Evidence of Whale Activity

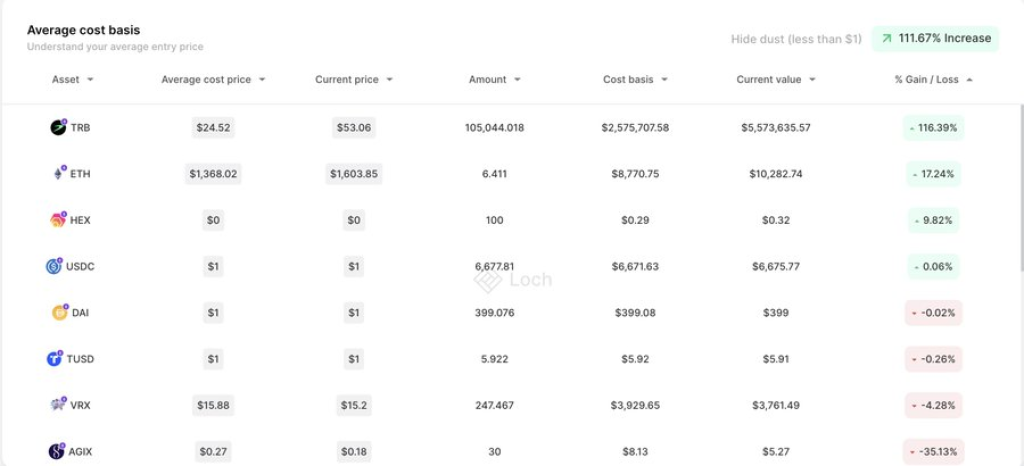

According to on-chain analyst Hitesh Malviya, there are no signs of increased fundamental demand for TRB. Malviya identified 4 whale wallets that appear to be manipulating the TRB price:

- The whales all purchased TRB below $25

- They have started selling TRB in the past 24 hours

- They still hold over $5.6 million worth of TRB combined

- Malviya suspects they intend to pump the price further before dumping their holdings

Using on-chain analytics tools like Loch Chain, it’s clear much of the TRB volume is coming from a few large holders rather than broad adoption.

Beware of a Pump and Dump

Given the lack of major project announcements or adoption news, it appears the 500% TRB price surge was driven by manipulation rather than real demand. The whale activity shows textbook signs of a pump and dump scheme.

These schemes typically involve buying up large supplies of a token when prices are low. The whales then coordinate to dramatically inflate prices to turn quick profits.

However, average investors buying into the hype often end up holding bags when the whales dump and the price crashes. Based on the on-chain data, TRB shows strong signals of this kind of manipulation.

Conclusion

Although past performance doesn’t guarantee future results, investors should be wary of the Tellor price pump. On-chain analytics paints this as a potentially coordinated whale scheme rather than natural growth. Until fundamental drivers materialize, it’s likely safest to observe TRB from the sidelines for now.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.