In an article recently published by Financial News, three renowned world’s economists Joseph Stiglitz, Nouriel Roubini and Kenneth Rogoff launched a scathing attack on the crypto world, claiming that the prices will see even more drops in the future as the space should prepare to get “regulated into oblivion”.

Stiglitz was awarded a Nobel Prize for his work in economy and currently teaches at the Columbia University. His take on cryptocurrency was pretty clear:

“You cannot have a means of payment that is based on secrecy when you’re trying to create a transparent banking system,” he said. He further expanded on his point by adding: “If you open up a hole like Bitcoin, then all the nefarious activity will go through that hole, and no government can allow that.”

Stiglitz feels that the lack of government regulation so far can be attributed to the fact that the crypto market is still relatively small. “Once it becomes significant they will use the hammer,” Stiglitz concludes. What he said here can be tied to comments he made in January, when he claimed that Bitcoin actually won’t even have a reason to exist in the near future.

“We have a good medium of exchange called the dollar. We can trade in that. Why do people want Bitcoin? For secrecy. My feeling is that when you regulate it so that you couldn’t engage in money laundering and all these other things, there would be no demand for Bitcoin. So by regulating the abuses you are going to regulate it out of existence.”

Rogoff, former IMF’s chief economist and currently a professor at Harvard University, had similar feelings about the space. He claims that a wave of government intervention will cause an even stronger price downfall for all the major cryptocurrencies.

“Bitcoin could easily be worth just $100 in 10 years. People in power will move to regulate anonymous transactions. That you can be sure of.”

Roubini has generally been bearish with his financial predictions, so much so that he earned the nickname “Dr. Doom”. His contempt towards the currency has been known for a while now, as he previously called it “bulls**t”. He said that Bitcoin must become a stable store of value, a unit of account and a means of payment before becoming accepted as a legitimate currency. To his point he adds:

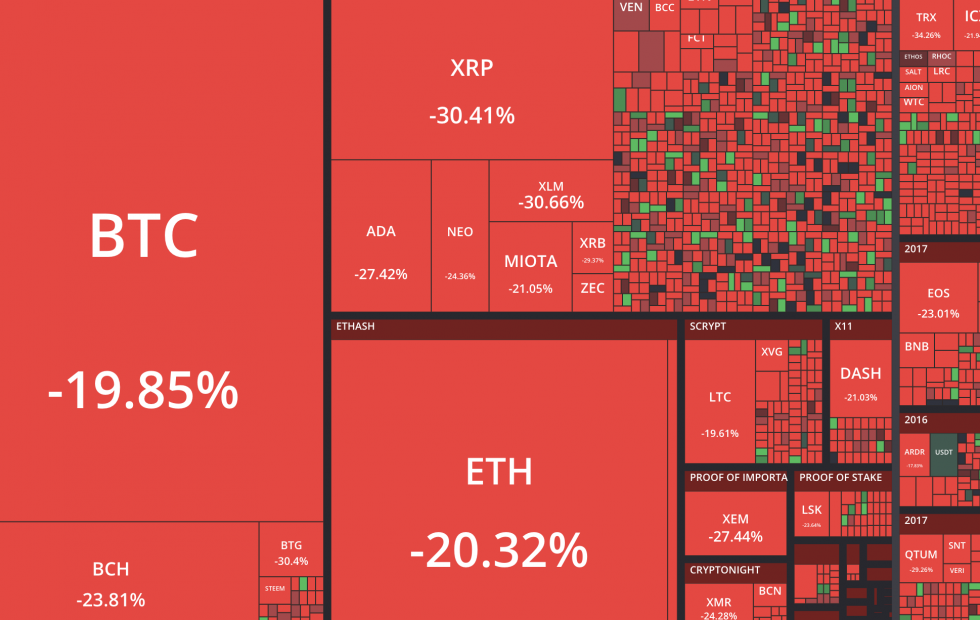

“How can something that falls 20% one day and then rises 20% the next be a stable store of value?”

This isn’t the first time nor will it be the last time that “old money” talks down on cryptocurrency. JP Morgan and Goldman Sachs previously had strong feelings about Bitcoin’s lack of future, after which they started making moves to invest money into the crypto market. For now, traditional asset managers and analysts remain skeptical, with Warren Buffet’s words from April summing up their feelings:

“If you buy something like Bitcoin or some cryptocurrency, you don’t really have anything that has produced anything. You’re just hoping the next guy pays more.”

While this might be true the same can be said about fiat, except there you have an additional centralized element (the bank) which controls the price and tells the people how much they should pay for a certain currency. There are similar elements in the crypto world (the exchanges) but DEX’s are on their way to solve these issues of supply and demand centralization.

Moves have been and are being made to create a crypto economy where people are ready to use these decentralized currencies for payment, store of value and accounting purposes. The privacy, commodity, ease of application and distribution which comes with cryptocurrencies is unparalleled by anything fiat. It’s quite ironic to hear these experts talk about fiat being backed and stable when the countries behind them are running trillions of dollars of debt, with ever-expanding public spending and lending infrastructures which balloon said debt every year. So while it’s too early to think of Bitcoin and the rest of the crypto sphere as commercially viable and ready to become actual currencies, it is also too early to write them off.