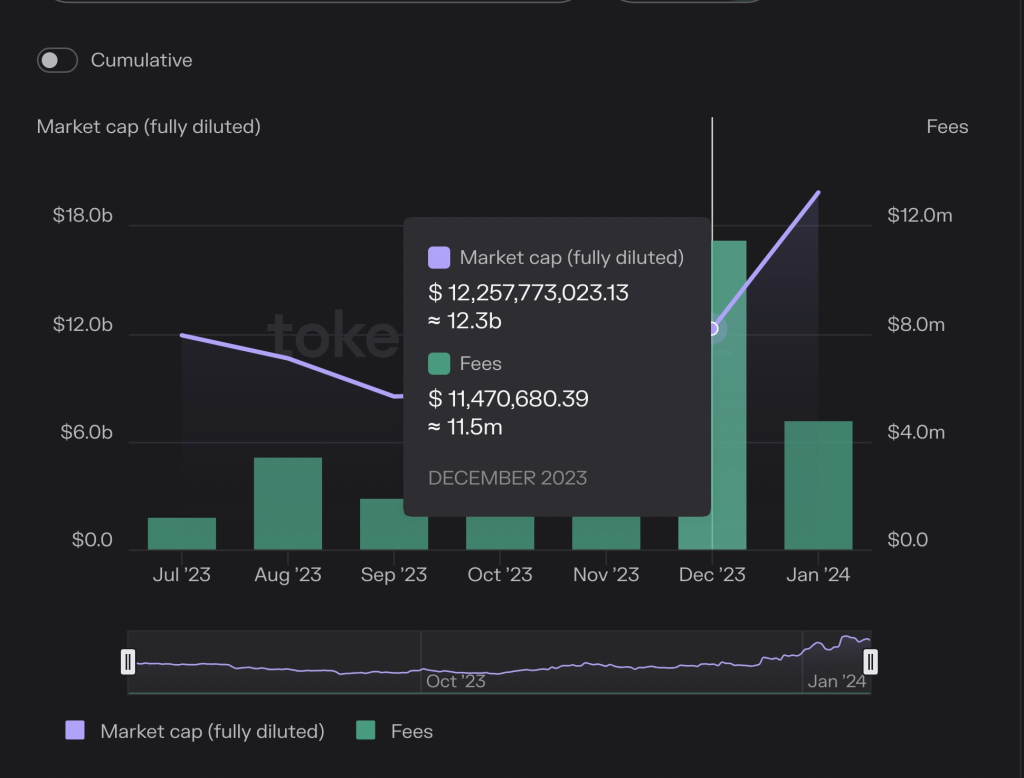

Arbitrum, the leading Layer 2 scaling solution for Ethereum, capped off a monumental 2023 with its best month yet in December. According to hitesh.eth, an Ethereum analyst, Arbitrum generated $11.5 million in revenue last month. This puts the network on pace to reach $100 million in annual recurring revenue (ARR).

Despite the broader crypto market decline in early 2024, Arbitrum’s growth story shows no signs of slowing down.

The network’s fundamental value continues to accelerate, even as the ARB token price faces short-term volatility. ARB dropped 7% on January 19th to around $1.88, amid a market-wide pullback. This is still up significantly from September last year for instance, when ARB traded below $1.

As hitesh.eth noted, Arbitrum’s fully diluted valuation (FDV) stands at 180x its ARR multiple. While that may seem high compared to traditional finance standards, it is not unreasonable given the network’s explosive adoption curve. As long as the community remains bullish on Arbitrum, the token price should catch up with the platform’s soaring underlying value over time.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +There are several key reasons why Arbitrum’s growth is poised to continue through 2024:

- Spot Bitcoin ETF approvals shift focus to Ethereum. A spot ETH ETF could be approved soon, shining the spotlight on Ethereum’s demand growth.

- Ethereum Dencun Upgrade

- Total Value Locked (TVL) in Ethereum Layer 2s like Arbitrum hitting new all-time highs regularly, showing where the momentum in DeFi is heading.

- More ETH and ERC-20 tokens moving off exchanges and into productive DeFi use cases. This decreases selling pressure.

With its best-in-class developer experience and growing network effects, Arbitrum sits at the forefront of Ethereum’s booming Layer 2 ecosystem. As more dApps onboard to the network, revenue and adoption should continue surging. Arbitrum is cementing itself as one of the primary scalability solutions for Ethereum, and 2023 was just the beginning of its exponential rise.

You may also be interested in:

- Choppy Waters Ahead? Here’s the Risk of a Pre-Halving Bitcoin Selloff

- Solana (SOL) Turns Bullish Across All Timeframes but Analyst Insists This Resistance Must Break First

- BlockDAG Unveils Miners for Profitable Mining as Bitcoin’s Funding Rate Hits 66%, and Litecoin Expects a Rally

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.