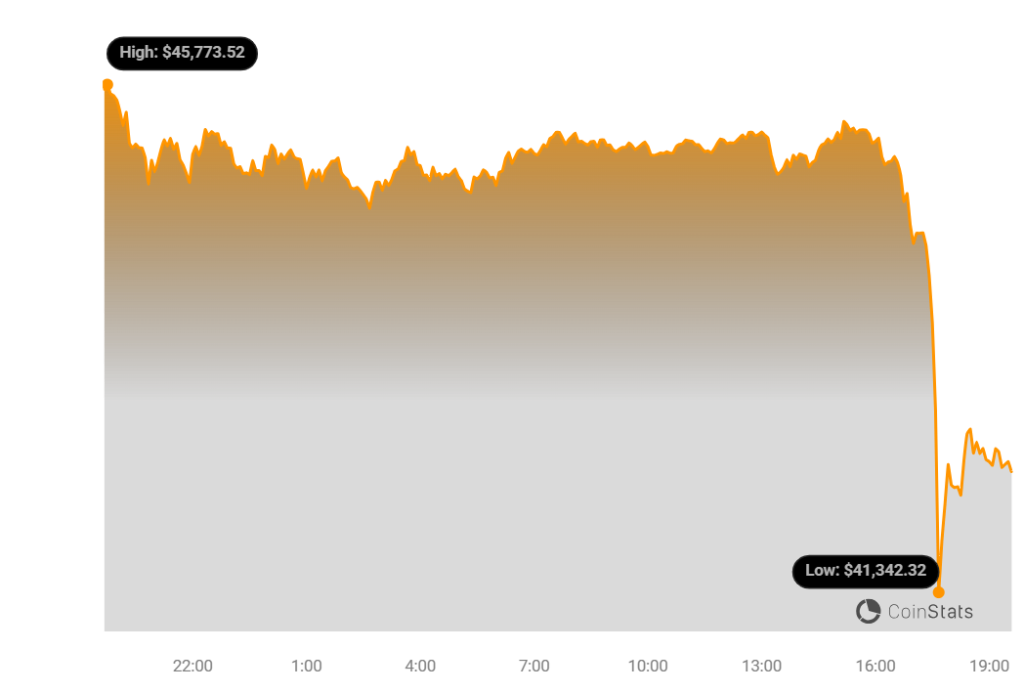

Renowned cryptocurrency trader Aditya Singh noted in his market commentary today that Bitcoin saw a sharp dump from $45,000, invalidating its recent breakout.

Bitcoin failed to hold support at the key breakdown point of the descending triangle pattern that has been forming over the past month, around $43,500. Instead, the leading cryptocurrency plunged below this level, putting it back inside the triangle after a fake breakout.

The inability to hold above the descending triangle breakpoint confirms the breakout was a bull trap. Bitcoin remains stuck in a month-long descending triangle, pointing to further downside risk.

Source: CoinStats – Start using it today

Traders should watch for ETF-related news, which could strongly impact Bitcoin’s price. Major support sits around $40,400; a drop below here would confirm a bearish breakdown from the pattern.

Looking ahead, Bitcoin is approaching a critical juncture at the apex of this descending triangle, which has tightened its trading range considerably.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +A decisive break below the lower trendline, which currently aligns with the $40,400 support, would open the door for an acceleration lower, with potential downside targets around $37,000. Alternatively, a breakback above resistance at $46,000 would invalidate the bearish setup.

In summary, Bitcoin remains vulnerable amidst this descending triangle squeeze, especially after the failed breakout attempt. Traders should monitor ETF developments and $40,400 support closely in the coming days to gauge Bitcoin’s next major move.

You may also be interested in:

- Kaspa Moves Similar to Solana in the Last Cycle, Analyst Shares Next Area of Interest for KAS

- Crypto Analyst Spots Bullish Pennant for Cardano (ADA) – But There’s a Catch

- Pullix (PLX) to Solve Liquidity and Transparency Issues – Captures Interest From Axie Infinity (AXS) and NEAR Protocol (NEAR) Traders

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.