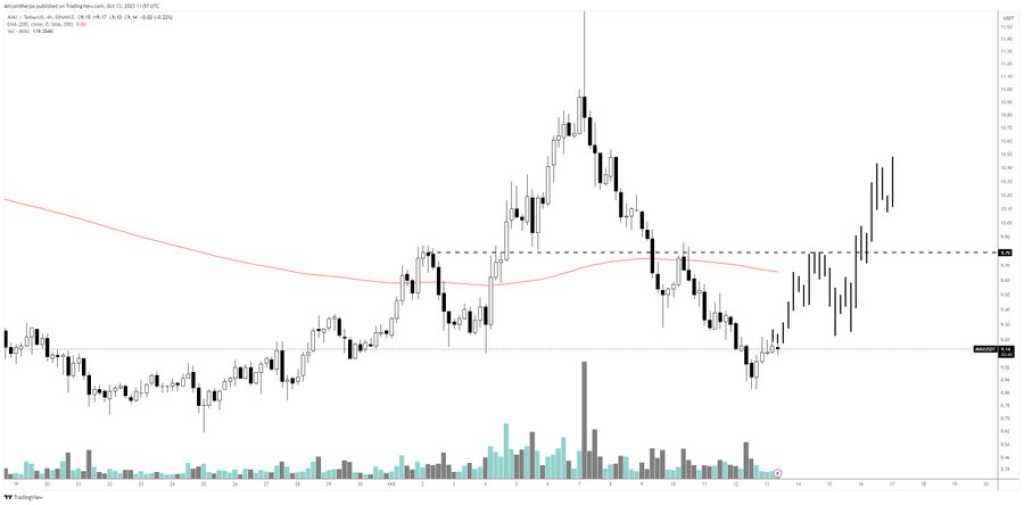

Avalanche (AVAX) has witnessed a steep 14% decline over the last 7 days, falling from its prior price of $11. A major catalyst for this downturn was the October 6th hack of Stars Arena, a social media platform on the Avalanche network, in which $3 million of AVAX tokens were stolen. Despite Stars Arena securing funds to reimburse the loss after the hack, the market still responded adversely.

However, analyst Altcoin Sherpa views the AVAX dip as a potential buying opportunity, pointing to key factors that could spark a rebound:

What you'll learn 👉

Two Factors That Can Spark AVAX Price Rebound

Firstly, refunding hacked funds and reviving Stars Arena helps restore confidence in the network’s functionality and stability.

Secondly, AVAX has pulled back to logical support around its origin point, which could act as a demand zone for an upswing.

Altcoin Sherpa expects AVAX to recover past $10 again in the medium-term based on these factors. Analyst Tony Kols also notes the Stars Arena’s relaunch could attract investments to help reclaim the $10.50 resistance.

Current Technical Outlook

Based on a recent technical analysis of Avalanche (AVAX) by altFINS, a potential shift in its price dynamics is observable, with the cryptocurrency breaking through a downtrend line and surpassing the pivotal $10 support level, hinting at a possible bullish trend reversal. This is especially noteworthy considering the $10 level was sustained in June and December 2022, suggesting traders might set a price alert for future developments.

Source: altFINS – Start using it today

However, despite this potential uptick, AVAX’s trend remains neutral in the medium term and exhibits a downtrend in both short- and long-term analyses, with bearish momentum indicated by the MACD line being below the MACD Signal Line and an RSI below 45. The nearest support and resistance zones are identified at $8.5 and $10.0, respectively, followed by a sturdier resistance at $14.0.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.