Blockchain analytics firm Santiment has revealed information about the cryptocurrency market through two tweets. Their analysis highlights a significant accumulation of Bitcoin and Tether by influential market participants known as whales. This accumulation suggests a resilient and optimistic market, although the possibility of short-term corrections is also acknowledged.

Santiment’s comprehensive analysis provides a multifaceted view of the current crypto landscape, offering valuable information for investors and enthusiasts. In this article, we will explore Santiment’s key findings, examining the implications of whale accumulation and the potential market dynamics that may result from it.

Source: Santiment – Start using it today

What you'll learn 👉

A Glimpse into Bitcoin’s Current Landscape:

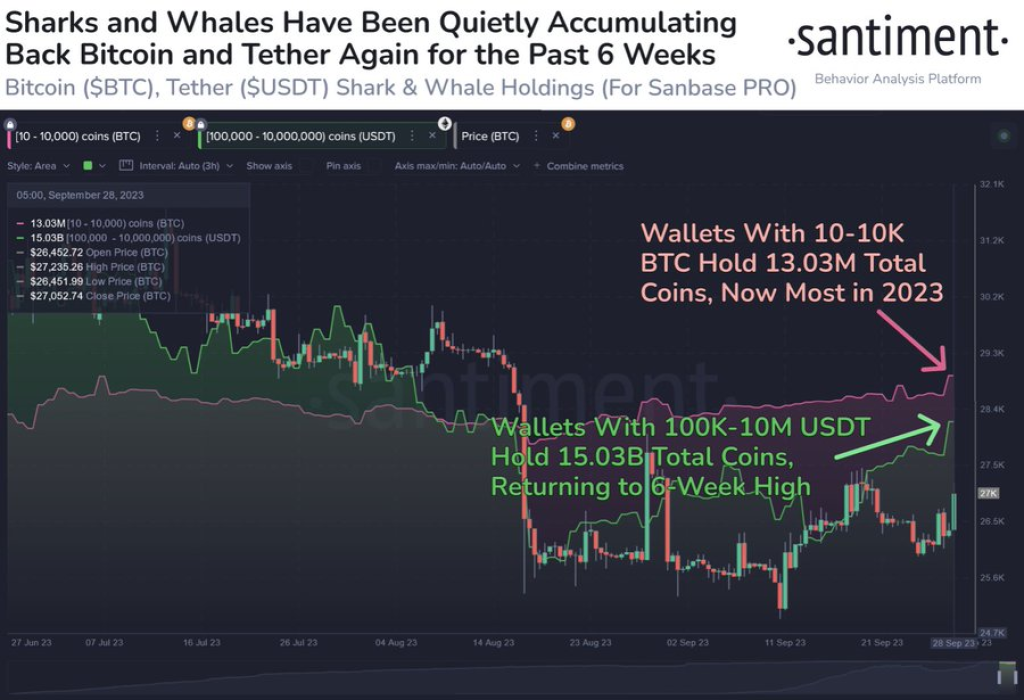

Bitcoin has long been the focal point of discussions, speculations, and investor strategies within the cryptocurrency realm. The insights procured by Santiment delve into the behaviors and accumulation patterns of Bitcoin whales, defined as entities holding between 10 to 10,000 BTC. The reported accumulation, amounting to 13.03 million BTC in 2023, is indicative of a deep-rooted belief in Bitcoin’s long-term potential and growth trajectory despite intermittent market volatilities and corrections.

Tether’s Stability Attracts Whales:

Parallelly, the accumulation of Tether (USDT) is emerging as a noteworthy trend. Tether’s reputation as a stable refuge in the tumultuous crypto environment is contributing to its substantial accumulation by whales. This pattern is indicative of a strategic consolidation of buying power and a preparation for imminent, substantial crypto investments. The simultaneous accumulation of both Bitcoin and Tether is suggestive of a synergistic bullish outlook, potentially catalyzing further market growth.

Anticipating Market Corrections:

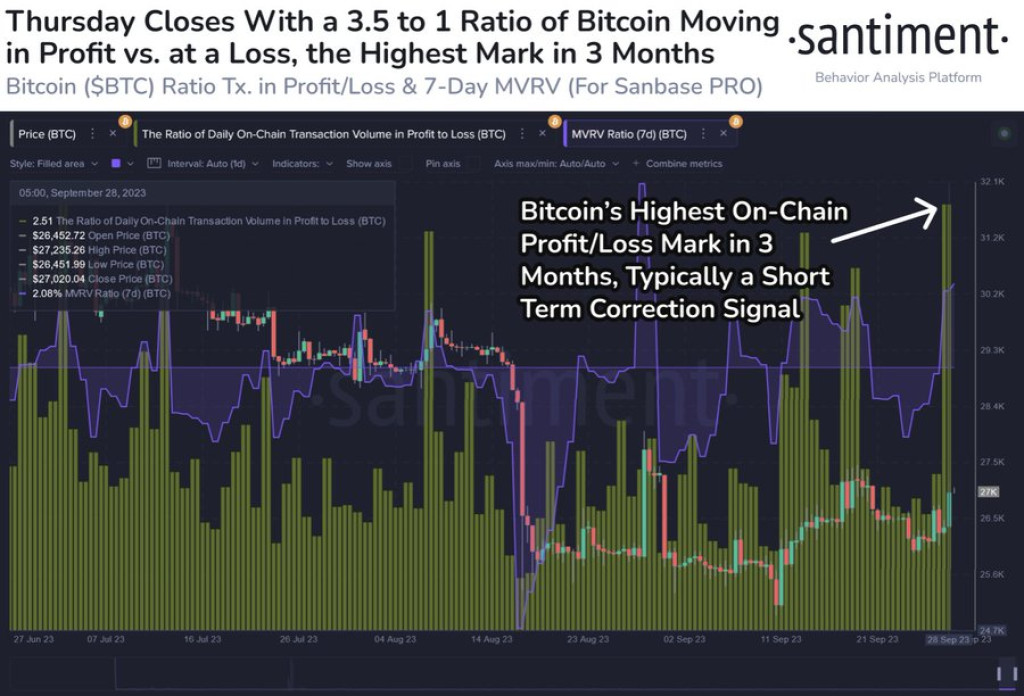

While optimism pervades the market, there is a discernible anticipation of upcoming short-term corrections. The market is currently characterized by prevalent profit-taking actions, which may lead to a transient market recoil. Seasoned market analysts and enthusiasts often consider the 7-Day MVRV (Market Value to Realized Value) as a pivotal indicator, with values below 0 signaling lucrative market entry points and foreshadowing potential market rallies.

Source: Santiment – Start using it today

Unraveling Market Dynamics:

The insights presented by Santiment underscore the intricate and dynamic nature of the crypto market. The interlaced narrative of impending corrections and robust accumulation offers a nuanced perspective on the market’s evolving trajectory. The scenario underscores a prudent and well-calibrated approach by market participants, reflecting both caution and long-term optimism. The developing strategies and adaptative responses to market rhythms are indicative of a mature and sophisticated cryptocurrency ecosystem.

Strategic Accumulation and Market Sentiments:

The ongoing strategic accumulation provides an invaluable glimpse into the prevailing market sentiments and the tactical considerations of major market players. The melding of optimism and caution exemplifies the evolution and maturation of the cryptocurrency ecosystem. It illuminates the adaptive strategies employed by market participants, tailored in response to the market’s pulsating dynamics and potential opportunities.

Conclusion:

Santiment’s analytical revelations exemplify the market’s adaptative and resilient nature, illustrating the enduring allure of cryptocurrencies even amidst potential short-term uncertainties. The extensive accumulation activities, juxtaposed against the backdrop of market corrections, reflect the transformative potential and the evolving strategies within the crypto domain. As the market continues to mature, the intricate convergence of diverse market elements is forging a resilient and dynamic path forward, teeming with opportunities and advancements in the evolving crypto landscape.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.