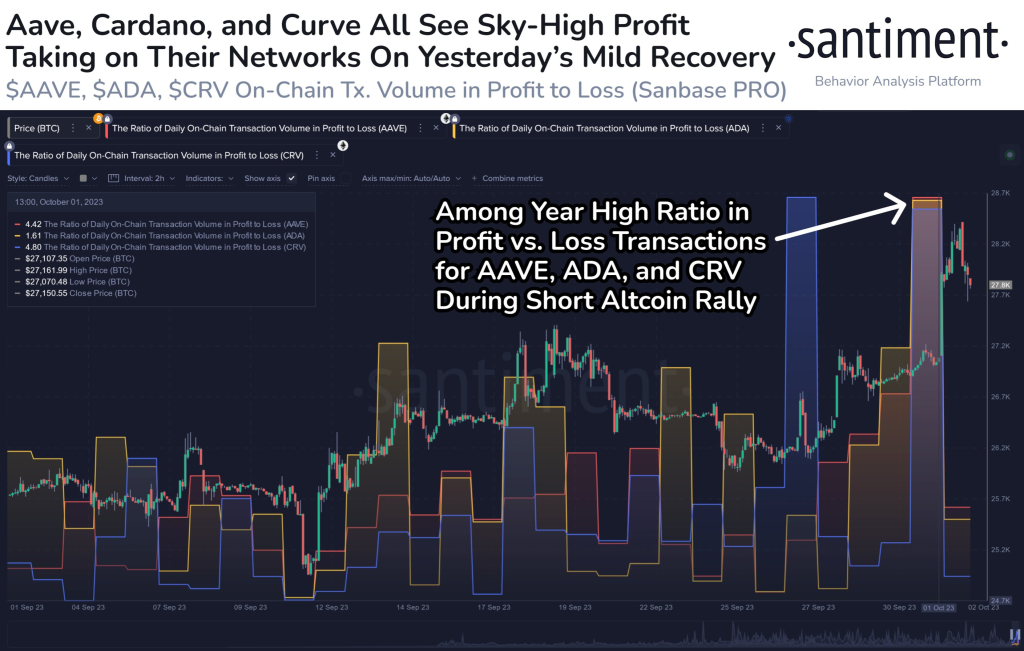

Analytics provider Santiment highlighted three altcoins poised for potential decoupling from Bitcoin based on on-chain activity during recent price spikes. According to Santiment, AAVE, ADA, and CRV saw significant profit-taking when Bitcoin briefly moved above $28k in early October. This behavior may foreshadow greater volatility relative to the wider market.

Essentially, Santiment’s analysis identified major coin movements by opportunistic traders capitalizing on short uptrends against Bitcoin. Cashing out gains quickly points to savvy investors who remain cautious in choppy conditions.

But it also reflects a reluctance to hold through pullbacks, indicating holders are primed to react swiftly to next rallies. When assets exhibit this kind of sensitivity to price swings, Santiment argues they become prone to volatility decoupling from broader trends.

Assets responding rapidly to Bitcoin momentum shifts tend to see exaggerated selling – or buying – during market-wide corrections or recoveries. Their on-chain footprint shows less commitment to holding long-term compared to others sticking firmly with positions.

Based on the metrics, Santiment considers AAVE, ADA, and CRV at greater risk of overreacting as Bitcoin oscillates near key levels around $28k. Their technical and fundamental backdrop makes sharp swings in either direction more likely.

Of course, quantifying decoupling potential remains more art than science. But identifying coins already swayed by Bitcoin’s technical posturing provides valuable perspective on relative stability.

Traders can monitor on-chain signals like emerging profit-taking to strategize entries and exits accordingly. The data offers clues on where fickle capital flows may magnify volatility risks in choppy conditions.

As always, compelling project developments could outweigh trading-driven activity. But Santiment’s observations spotlight which cryptos may amplify market volatility based on recent holder actions.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.