PEPE), the crypto asset inspired by the iconic internet meme Pepe the Frog, continues its vertical trajectory – advancing over 600% in the past month alone. However, with greed metrics flashing signs of unsustainable upside velocity, analysts urge caution around potential sharp pullbacks interrupting the frenzy. Still, evidence suggests more room to run exists before exhaustion sets in.

What you'll learn 👉

Pepe Follows Dogecoin and Shiba Inu Cycles

Veteran analyst Max, CEO of crypto fund BecauseBitcoin which holds a PEPE position, compares current price action to previous meme coin speculative manias with Dogecoin (DOGE) and Shiba Inu (SHIB) during past market cycles.

Max spots some similarities in how both Doge and Shiba underwent parabolic advances that eventually climaxed with a final blow-off top, but not before a “pit stop” consolidation phase marked a brief pause before their culminating spikes.

“Notice how both Doge & Shib took a pit stop (purple dots) before their global tops?” Max tweeted. “I’m now keeping an eye out for our purple dot region. It is probably much higher than here, so enjoy the ride until it comes.”

This analytical framework suggests PEPE maintains fuel to propel even higher, but prudent traders should prepare for short-term choppiness that ultimately gives way to continuation.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Individual PEPE Investor Reaps Over $14 Million In Gains

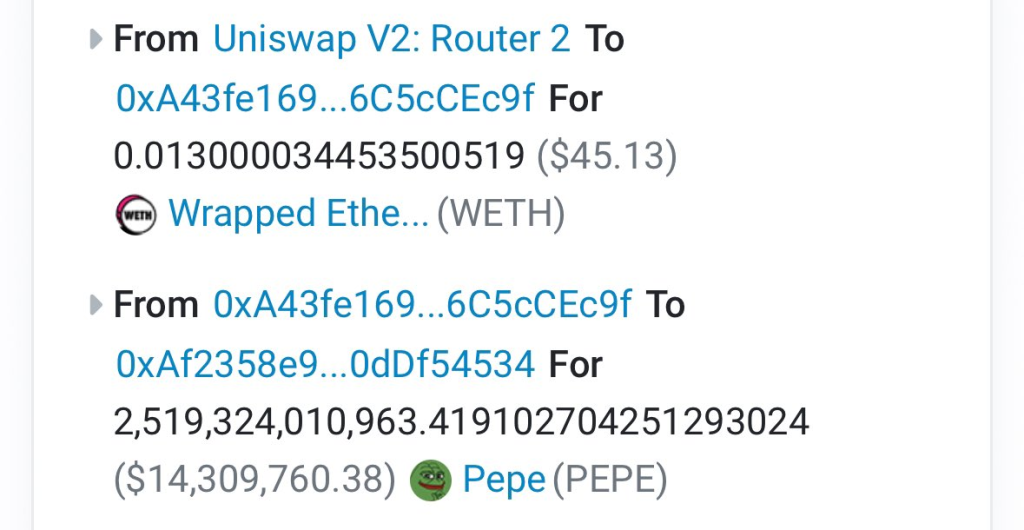

Underscoring the memecoin capital rotation narrative, analyst Borovik spotlights how one single wallet purchased just $27 worth of PEPE and has now worth over $14 million for an almost inconceivable return.

“The $27 PEPE wallet is now worth $14,309,760, 0.013 ETH to OVER 4,100 ETH,” Borovik observes. As stories like this permeate social discourse, virality entices new speculators to chase quick riches – creating self-fulfilling buying pressure.

However, such vertical advances foreshadow subsequent crashes once the last buyers capitulate. Hence conservative plans limit upside risk exposure despite positive momentum.

Daily RSI Screams Overbought At 92

For Pepe Coin, the daily chart RSI stands at a lofty 91.71. Typically, an RSI above 70 indicates that an asset might be overbought, suggesting that it is trading higher than its intrinsic value and might be due for a correction.

An RSI nearing 92 is exceptionally high, pointing towards a significant overextension in the market. While this does not guarantee an immediate pullback, it signals traders to exercise caution, as the asset may be entering a zone where the risk of a downturn increases.

Over various time frames, the coin has consistently outperformed, with increases of 3.7% in the last hour, 62.9% over 24 hours, 376.1% over the past week, 447.2% in the last two weeks, and a 606.6% over the past month. These figures not only reflect the coin’s current bullish momentum but also hint at the growing investor interest and speculative trading driving its ascent.

So in summary, while crypto meme summer reruns should afford speculators ample volatility to generate outsized returns, preparing for almost inevitable blow-off tops and drawdowns gives investors confidence to maximize opportunities however the trends play out – rather than panic once gravity returns.

You may also be interested in:

- Polkadot (DOT) Is Now ‘Basically Open Air’ With No Near Term Resistance as ‘Epic Pump’ Begins, Top Analysts Set Their Targets

- Meme Coin Wave Lifts PEPE to New Heights, Price up Over 300% – But Here’s the Catch

- Can DeeStream (DST) Revolutionize Streaming as Ethereum (ETH) & Binance Coin (BNB) Surpass All-Time Highs for 2024

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.