The open interest in Bitcoin futures and options contracts saw an enormous $1 billion increase within a single hour of trading. Open interest refers to the total number of outstanding derivative contracts that have been opened but not yet settled by closing out the position or letting the contract expire.

In the world of derivatives trading, open interest is a key metric that quantifies the number of active contracts in the market. A sudden spike in open interest, especially one as significant as $1 billion, is not just a random occurrence. It’s a strong indicator of market sentiment and liquidity. High open interest generally suggests that there is a large number of investors willing to either buy or sell at various price levels, thereby creating a more liquid and efficient market.

In this case, the spike followed a positive news event and was accompanied by a surge in Bitcoin’s price above $28,000. These factors collectively point to a bullish sentiment in the market. Traders are likely expecting further upside and are positioning themselves accordingly through derivatives contracts.

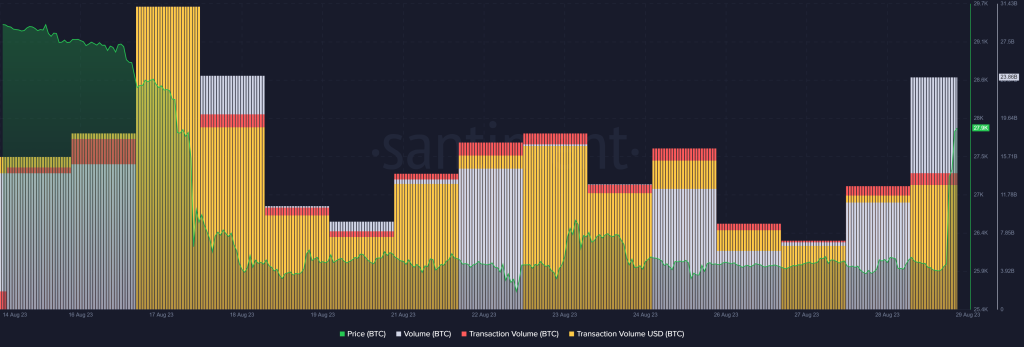

Bitcoin volume has also jumped today and was on a similar level on August 17th, when the market crashed.

Source: Santiment – Start using it today

What you'll learn 👉

The Catalyst: Grayscale’s Legal Triumph

The colossal spike can be attributed to a landmark legal victory by Grayscale Investments against the United States Securities and Exchange Commission (SEC). The appeals court ruled that the SEC’s decision to reject Grayscale’s Bitcoin ETF application was “arbitrary and capricious.” This ruling has not only overturned the SEC’s previous decision but also breathed new life into Grayscale’s aspirations to convert its over-the-counter Grayscale Bitcoin Trust (GBTC) into a listed Bitcoin exchange-traded fund (ETF).

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The Legal Backdrop

Grayscale had initially filed an application to convert its GBTC into a spot ETF, which the SEC rejected on grounds that the products were not “designed to prevent fraudulent and manipulative acts and practices.” Grayscale subsequently sued, and the decision has now been overturned. The court’s ruling has been hailed as a significant win for the crypto industry, given that Grayscale Bitcoin Trust is the largest Bitcoin fund traded over-the-counter, with over $14 billion in assets under management.

Market Implications

The legal win and the subsequent surge in Bitcoin’s price above $28,000 have had a ripple effect on the market. The spike in open interest is a testament to heightened investor confidence.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.