Bitcoin decided to move today, as we saw it jump from $6400-ish levels to $6849, gaining almost $200 in a single move before additional growth led it to the mentioned high. And many people saw it coming, mostly because our favorite counter trade signal suggested we are in for “more pain”.

#Bitcoin stuck below $6,500, and @AnthonyGriz is betting on more pain to come pic.twitter.com/4vIGptyuAr

— CNBC Futures Now (@CNBCFuturesNow) August 21, 2018

And as many rushed to cancel their shorts upon hearing these news, others were already expecting yesterday’s price movement and had a strategy prepared for it. Knowing that, we decided to take a deeper look into what exactly happened and how did these traders know about the incoming move.

Bitcoin (BTC)

The indicator these market insiders noticed was the fact that BitMEX was about to perform a scheduled maintenance.

Scheduled Maintenance to begin in a few minutes at 01:00 UTC.

— BitMEX (@BitMEXdotcom) August 22, 2018

The maintenance took place from 9 pm to 10 pm EST yesterday and began at almost the same moment that Bitcoin price spiked. Insiders immediately suggested the spike was caused by the BitMEX shutdown:

“It is a silly short term trade,” Hunter Horsely, CEO of Bitwise claimed. “Buy when maintenance starts. Sell when ends.”

BitMEX going offline removed a lot of the selling pressure from the market, causing the prices to start rising. This created price differences across the board and opened up arbitrage trading opportunities for traders/whales who clearly took advantage of them. The move indicated one issue with the current market: BitMEX has too much influence (the exchange is responsible for over 40% of BTC trading) and a strong competitor needs to emerge to prevent moves like this in the future.

This just goes to show how important BitMEX is to the market. EVERYONE needs to familiarize themselves with the ins and outs of the BitMEX due to this ripple effect on the market. pic.twitter.com/d1TvZqYUYf

— Flood [Bitmex] (@ThinkingUSD) August 22, 2018

The move was analyzed by a Youtuber called Bitraged, who thinks this was actually a textbook case of market manipulation. According to him, the move was orchestrated by the exchange themselves in order to liquidate shorts (which have reached ATH levels in the last couple of days). He points out several key details, including the fact that BitMEX tweeted about a DDOS attack on their servers just minutes after they completed the maintenance. This perhaps wouldn’t be that strange if an exact similar pattern of events didn’t unfold on April 12th, when BTC saw an $1100 pump in a very short time with almost 17 thousand shorts getting liquidated.

April 12 shorts liquidation

“This is a scam, these are con artists, they’re milking the market, they are liquidating to take a profit and this could be coming to a head soon,” concludes Bitraged. He notes that Bitfinex and BitMEX are working together but feels they will be punished soon; he also notes that their demise won’t kill the market. Once these manipulators are exposed and removed, he claims the market will consolidate and start operating in more natural patterns. Check out the complete video with his analysis here.

Ethereum (ETH)

We turned to CryptoWolfSignal for the analysis of Ethereum:

“Such a trade last time ended up rising to the level of Fib 0.236 relative to the last wave of decline. The market can repeat own fractals and from the current levels we can see a similar movement. Level 250 showed good support, but if the asset drops it at the next decline, then it is expected to cancel the possibility of opening long positions and is preparing to continue to follow a downtrend. At the same time (in the medium and long term), the price from further global growth is kept by a dense resistance of 350-375, overcoming this range one can count on further upward movement. On a smaller scale, based on a positive scenario for this market, one can note immediate targets in the form of resistances of 288 and 300, but it should be noted that we are facing an important resistance of the downtrend, not breaking through which can direct the price down to the last lows. The possibility of growth (in the short term) is due to the finding of the price in the triangle template, at the moment we are at its lower edge (which is a good support) and can bounce back to the resistance of the upper edge.”

Meanwhile, Motrok feels Ethereum might have been saved by this latest BTC move:

“There is a clear symmetrical triangle on 4h here, which is also itself part of a bigger Ascending triangle on the same timeframe. It has been trying to break down over the past 12 hours and has been most likely saved by btc’s rally. Would open a short if we have a good confirmation of breaking the lower line, since its part of both the symmetrical and the ascending triangles, so odds are good. Still, I believe that it is still to early to call on the ascending, and the symmetrical could break today or tomorrow at the latest, giving itself a good entry for a long up until 305ish, which is a nice profit per coin traded. In case you decide to trade the symmetrical one and go long, have in mind that the 0.618 fib at 312 has proven itself strong and would definitely take some profit there, as there is sure to be, at the very least, a small retrace.”

Ripple (XRP)

CryptoWolfSignal has analyzed the XRP price as well and saw a strong downwards resistance on the chart:

On a large scale, for a long-term perspective, Ripple has very good levels to form a reversal. Corrective rollback on a global scale exceeded the price reduction by more than 80% and thus overcame the level of Fib 0.786. On a 12-hour scale, we can single out a long-term resistance line of a downtrend, which the asset is trying to overcome. On a smaller scale, one can see the formation of a symmetrical triangle on an uptrend, which can push the price even higher (short-term period, small scales!), But we can face false breakdowns and subsequent downward movement, as we overcome the long-term resistance of the downward trend of large scales difficult task.” Check out his complete analysis to gain insight into the market movements for the next few days.

Other thoughts

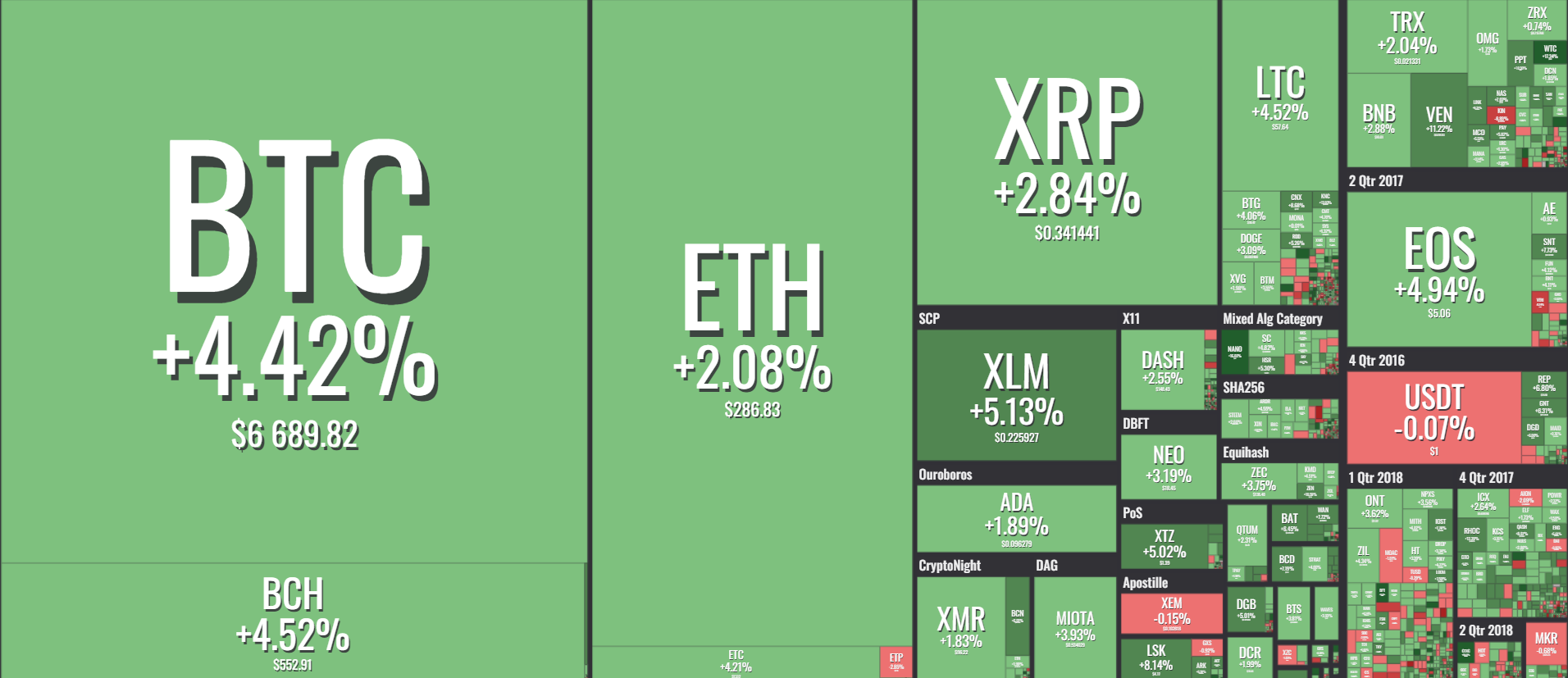

The rest of the market stayed somewhat neutral, as this latest Bitcoin move clearly wasn’t convincing enough to make more investors pour in. Cortex, Waltonchain, Aurora, QASH and PIVX recorded solid double digit gains over the last 24 hours. Meanwhile, the biggest losers were Kin (6.36%) and Veritaserum (5.38%).

Bitcoin has made the long-anticipated move out of the $6000-$6500 channel, seemingly due to manipulation and CNBC providing a counter-push. To their credit, CNBC decided to be a good sport about people trolling them for their at times shoddy calls:

https://twitter.com/CNBCFastMoney/status/1032079290861535234

The calls of market manipulation were definitely not trolling; BitMEX has so far not responded to the calls of manipulation, and it’s likely they won’t be doing it in the future. After all, the evidence of them doing something bad here is still not definitive. One wonders if this entire manipulation controversy will have any influence on the upcoming ETF decision. It’s yet unclear how will the market react to this latest “short squeeze”. Right now a retracement is expected, likely back to $6500 levels. From there Bitcoin should decide on its next move, likely after the ETF decision is made.