This Monday greeted the markets in a much better state than the previous one. While there was some red on the charts, most of it could be attributed to consolidation and preparation for another move. Everything is waiting for BTC to decide on where it wants to go next, and the more time it takes to make its decision, the more worried and bearish will the overall sentiment get. Naturally, if BTC decides to break towards 10k all those negative feelings will disappear. Let’s take a look at what traders suggest might happen next:

Bitcoin (BTC)

We looked at Turningmecard from TradingView and he feels that the king of the market is nearing the “moment of truth”. He made a comment on BTC hurting many short positions yesterday after a brief run upwards and added the following insights:

“Last week, i told you guys that it would go to 62~63.3 level, i bingo’ed it, came right back up. However, we do face resistance at 66 levels, but we did make a HH in lower timeframes, considering the RSI level in time and daily frames, for more divergence whether it is bullish or not, it will try higher levels in the coming 2 days. Also, the weekly candle close is pretty bullish , increased a bit, and this tells it will try high levels. But i think, there is a chance this trip might be short lived at 66~68 level. Over 7k, is now little unlikely.”

His final comment on this analysis said:

“Selling pressure is very high. If 6380 is broken, next stop is 6330ish, not looking good at the moment. I got in 6388. See for the next 2~3hours if it holds, goes over 6450, things can look better. If not, you can sell it keep secure profits.”

Check out the complete analysis here.

@rektcapital from Twitter had a similarly bearish outlook:

$BTC #BTCUSD #btc #bitcoin

– Price failed to successfully retest the 7-month triangle & breakdown past the iH&S OB

– Price coiled upwards within a bearish rising wedge on declining volume & brokedown afterwards as expected ✅

– Price barely missed my red dashed line $crypto pic.twitter.com/TcA8PReeLm— rektcapital (@rektcapital) August 20, 2018

Some more bullish and riskier thoughts are offered by a trader calling himself pixi:

“Bitcoin seems drawing a rounding bottom since the low at $6000. As long as prices are closing above $6100, I’m targeting 9100/9200$ to complete a bearish gartley. I will close my long position (long at $6088) and will short BTC -0.34% for targeting a retest of $6600 (likely gartley structure with nice correlation of previous support and resistance area). Finally, i will buy at $6600 to target 13.5K to retest the POC of December/January volume range. Need a lot of confirmation to “play” this trade.”

Finally, we turn to bibboyne for a more FA-based look at the overall picture. He claims that Bitcoin is “embarking on a journey to 10k and possibly beyond” as the market awaits the upcoming ETF frenzy. Listing August 23rd, September 15th, September 21st and September 30th as the dates of several ETF decisions, he expects to see some interesting developments in the closing quarter of the year of 2018.

Ethereum (ETH)

TheChartGuys on TradingView see Ethereum stuck in a daily bear break:

“Very similar setup to BTC on the 4 hour but a bit different which has led to both LTC and ETH breaking their daily inside bar bearish already. This increases the odds a bit that BTC will end up with a bear break but we are still watching close as bull break in BTC could negate these bear breaks. The daily charts need to form a higher low and break the top of these bounces up to this point. It continues to be a long road ahead for bulls, as the bears remain confident and comfortable with daily EMA 12 and 26 resistances. Still a patient game until we get some clarity and a break from the range we have been in the past few days.”

Meanwhile, junothehuskypup feels this bearish break was false and remains long:

Ripple (XRP)

XRP was analyzed in a short, concise way by YouHaveNieds:

“Looking for a pullback to the support,” was what he expects the currency to do next. He further adds that he expects BTC to break out towards $6800 again, which would support his trading idea.

Other thoughts

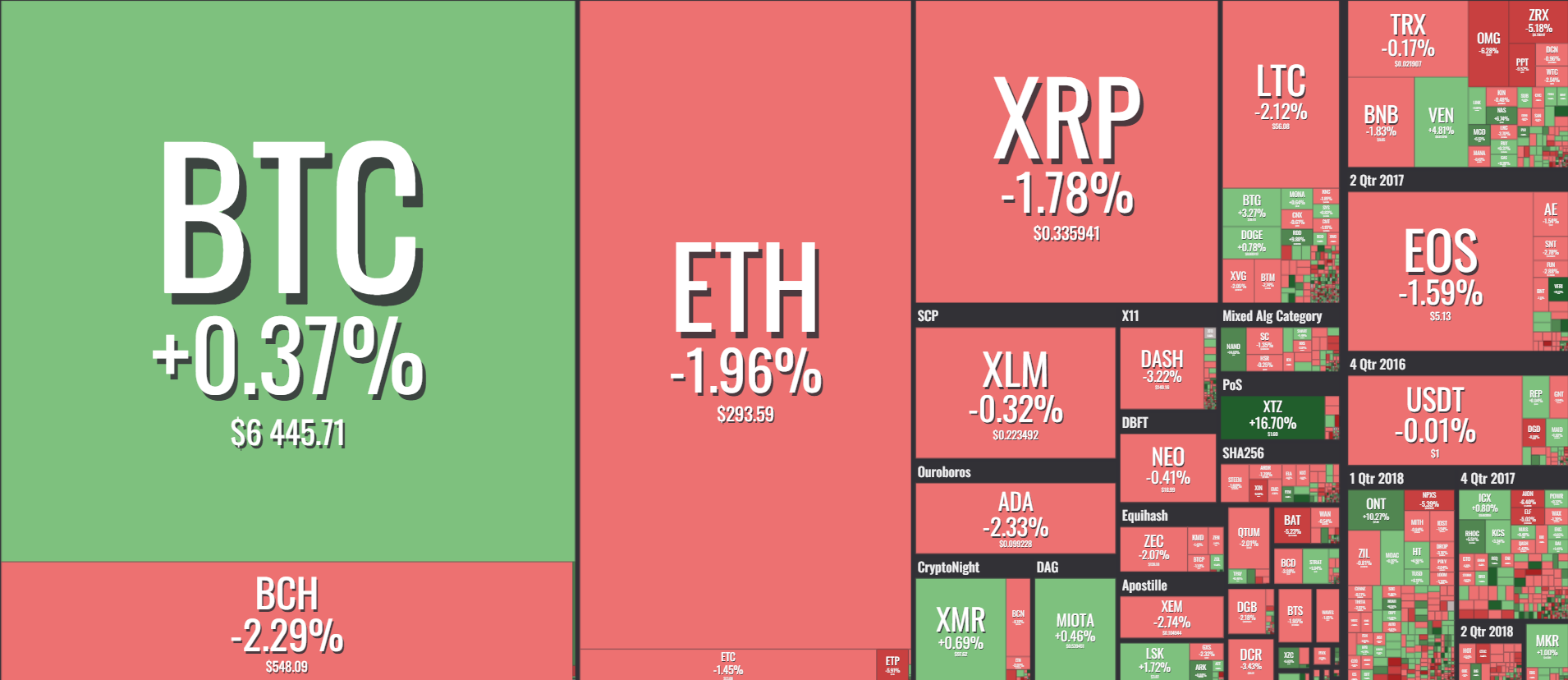

BTC will be the main market mover here. The alts seem to be universally sitting tight for the next BTC action, with only Veritaserum (VERI) and Tezos (XTZ) recording gains of over 10% in the last 24 hours. Market “losers” were similarly humble, with last week’s standouts Cortex (CTXC) and Populous (PPT), alongside DigixDAO (DGD), being the sole currencies that dropped more than 10% in the mentioned time frame. The market remains stable for now, let’s see where BTC takes things next.