Crypto market sentiment often moves in cycles, and recent trends show Bitcoin (BTC) and Ethereum (ETH) facing uncertainty while optimism for XRP grows. Investors are increasingly looking beyond single-asset narratives toward projects built to perform across markets. In this context, Mutuum Finance (MUTM), a DeFi-focused crypto in presale phase 7, is positioning itself as a platform offering cross-market stability through functional utility rather than speculation.

What you'll learn 👉

XRP Optimism and New Defi Project Traction

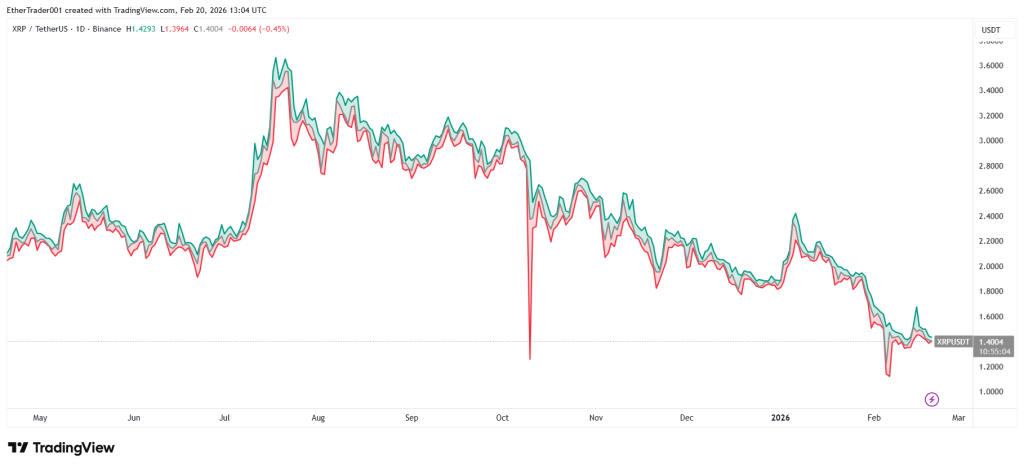

XRP’s market sentiment has reached a five‑week high as Bitcoin (BTC) and Ethereum (ETH) face growing doubt and stalled momentum, according to on‑chain analytics firm Santiment. While bullish commentary around BTC and ETH has dropped sharply and both assets remain in tight consolidation, XRP is showing higher lows, suggesting stronger demand and growing investor interest.

Social chatter around XRP has increased, making it one of the most discussed cryptos after Bitcoin, driven by rising demand, partnerships, and institutional attention. This divergence signals that capital may be rotating toward assets with stronger short‑term narratives as traders seek clearer market direction.

Weaker sentiment around Bitcoin (BTC) and Ethereum (ETH) often leads investors to explore alternatives rather than exit the market. XRP’s rising optimism reflects this search for stability, while DeFi protocols with functional products, especially in lending and borrowing, are gaining attention for their utility regardless of broader market trends.

Shifting Sentiment Creates Room for Mutuum Finance (MUTM)

Mutuum Finance (MUTM) is entering this market with a clear focus on functionality. The project has already taken a major step forward by officially launching its V1 lending and borrowing protocol on the Sepolia testnet. This milestone validates the platform’s technical direction and demonstrates that development is actively progressing rather than remaining theoretical. For investors watching sentiment fluctuate across major cryptocurrencies, this type of delivery helps reduce uncertainty.

The testnet launch has also coincided with growing investor confidence. During the ongoing presale, a single whale transaction of $175,000 was recorded, pushing total funds raised to more than $20.62 million. Over 19,000 holders are now participating, suggesting that interest is broadening beyond early adopters. Within just 72 hours of the testnet announcement, the presale attracted an additional $200,000, indicating that tangible progress is translating into renewed momentum.

V1 Testnet Features and Long-Term Stability

The V1 protocol now live on the Sepolia testnet offers users a hands-on look at how Mutuum Finance (MUTM) will operate once it reaches the mainnet. Using test tokens rather than real assets, participants can explore the platform’s core lending and borrowing mechanics in a risk-free environment. This approach allows the team to gather feedback, refine features, and ensure stability before full deployment.

The testnet currently supports ETH, USDT, LINK, and WBTC, giving users the ability to mint, supply, borrow, and stake assets within the protocol. Participants can deposit test tokens to earn simulated yield, use those deposits as collateral, and borrow testnet USDT. The platform also allows users to stake and experience the dividend distribution mechanism tied to MUTM tokens, providing insight into how incentives will function in live conditions.

Transparency is central to this experience. Each user has access to a portfolio dashboard that tracks lending and borrowing positions in real time. This feature reinforces user control and aligns with broader DeFi expectations around visibility and self-management — qualities that become especially important during periods of market uncertainty.

Several core components highlighted in the testnet demonstrate Mutuum Finance (MUTM)’s utility-focused design. When users supply assets, they receive mtTokens, which represent their deposits and accumulate simulated yield over time. These mtTokens can also be staked to earn MUTM rewards, integrating lending activity with token incentives. On the borrowing side, debt tokens track both principal and interest owed, ensuring clarity around obligations.

Risk management is addressed through an automated liquidator bot that monitors positions and triggers liquidations when collateral health falls below safe thresholds. This process is guided by the health factor metric, where a value above 1.0 indicates a safe position and anything below signals potential liquidation. By embedding these safeguards into the protocol, Mutuum Finance (MUTM) aims to maintain system stability across different market conditions.

Conclusion

With over $20.62 million raised, a live V1 testnet, and growing whale participation, Mutuum Finance (MUTM) is emerging as a serious DeFi contender ahead of 2026. As crypto sentiment fluctuates, platforms focused on practical utility and controlled growth are increasingly attractive. In a market of shifting optimism, MUTM’s focus on delivery, transparency, and cross-market functionality makes it a project closely watched by investors seeking stability beyond traditional crypto cycles.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.