XRP has been taking a pretty hard hit lately after its last big run higher. What looked like a strong breakout earlier in the cycle has cooled off fast, and now the XRP price is down more than 50% from its recent peak.

That drop has pushed XRP back into some major trading zones that have mattered in past cycles, which is why traders are paying close attention here. The big question now is whether the XRP price can settle and find support around these levels, or if the market still has another dip left in it.

XRP After the 58% Drop: The First Accumulation Zone Is in Play

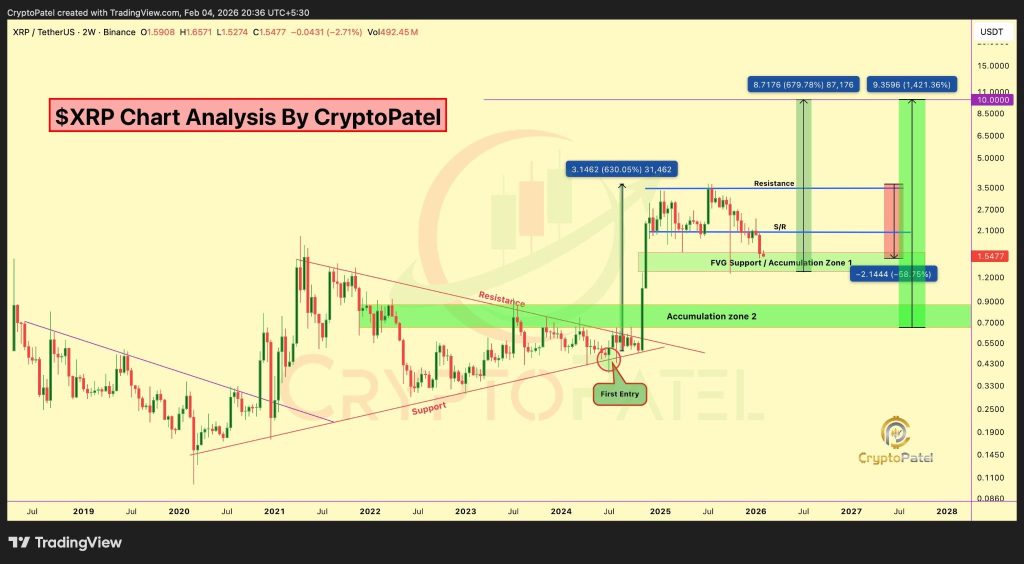

Crypto Patel shared a fresh XRP chart after a pretty brutal move lower. The XRP price has now fallen around 58% from its recent peak, and he’s basically saying this is the kind of dip where the real opportunities start showing up again. On the two-week XRP/USDT chart, price is sitting near the mid-$1.50s, right inside a zone he’s been watching for a while.

The main focus here is the first accumulation area between $1.50 and $1.30. Patel points out that the XRP price has now entered this band, and he sees it as a place to start buying slowly, without rushing.

The zone also lines up with an old support level that used to act like a floor before XRP pushed higher, so the reaction here matters a lot. If $1.30 breaks, the next zone is lower.

Patel also lays out the risk clearly. If the XRP price slips under $1.30, he’s looking much lower, with bids planned between $0.90 and $0.70.

That second accumulation zone is another major historical base area where XRP spent a long time trading before its last big breakout. If price ever reaches that region again, Patel views it as the kind of dip that could offer the best entries for the next cycle.

Read Also: XRP Has 300+ Bank Partners… So Why Is Billion-Dollar Volume Still Missing?

Resistance above and the bigger target

On the upside, the chart shows resistance sitting in the low-$2 range, with a stronger ceiling closer to the mid-$3s. Those are levels where the XRP price struggled before rolling over into this decline.

Patel is still holding onto a $10 long-term target, and his reasoning is straightforward: if the goal is that high, buying after a huge pullback makes far more sense than chasing at $3 or $2.

He also reminds everyone of his last bear market call near $0.50, when the XRP price eventually ran to $3.66 for over 600% gains. Now he’s watching to see if this $1.50–$1.30 zone holds, or if the market gives an even deeper entry closer to $0.90.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

![$100M Backed ZKP Is A Clear Winner In February Over DeepSnitch AI & Bitcoin Hyper [Best Presale Coins 2026]](https://captainaltcoin.com/wp-content/uploads/2026/02/image-131-336x220.jpeg)