Kaspa (KAS) continues to push forward on the development side even as market conditions remain difficult. A new non-profit initiative, KII, is now driving Kaspa adoption in regulated industries.

However, the network rolled out a governance upgrade through formal KIPs, while K-Social is expanding Kaspa’s presence into censorship-resistant communication. These moves point to a project that is still building, even while price struggles.

Against that backdrop, a new on-chain signal has quietly emerged that could matter for KAS price.

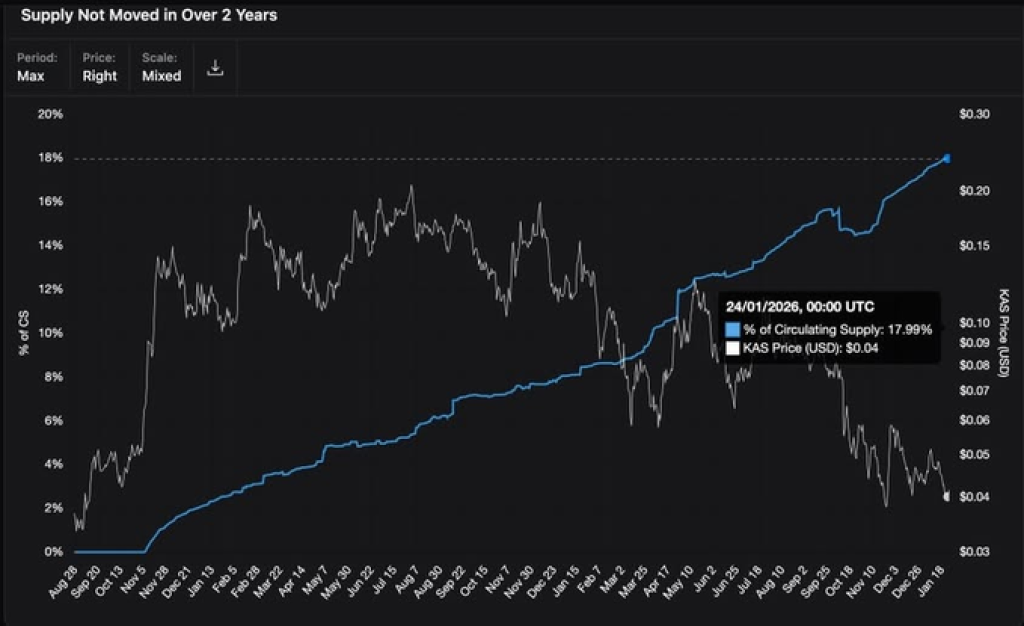

DEX.cc Commons shared on X that the share of Kaspa supply that has not moved in over two years just hit a new all-time high at 18%.

This means nearly one-fifth of all KAS in circulation has remained untouched for more than two years. In simple terms, a growing part of the market is no longer trading or reacting to short-term price moves. Those coins are being held with a long-term view.

This is happening even while KAS price and hash rate continue to swing. That contrast matters because it shows that some holders are becoming less sensitive to volatility and more focused on long-term value.

What you'll learn 👉

What the Kaspa Chart is showing

On the chart, the blue line tracking long-term unmoved supply has been rising steadily over time. It has moved from near zero to 18% without major pullbacks, which tells us this is not a short-term trend.

At the same time, the KAS price line has moved up and down sharply. There were strong rallies, followed by deep corrections, yet the long-term supply continued to grow almost without interruption.

That kind of divergence usually points to quiet accumulation. While price reacts to news, market cycles, and broader sentiment, a portion of the market keeps holding through it all.

Why this matters for KAS price

When more coins are locked away long term, fewer coins remain available for trading. That reduces liquid supply on exchanges and in the open market.

If demand picks up at any point, even modest buying pressure can have a stronger effect on price because there is less KAS actively for sale. In other words, rising long-term holding can amplify future moves when buyers return.

It does not mean price will rise immediately. But it does change the structure of the market in a way that favors stronger moves later when sentiment improves.

Read Also: Why Gold and Silver Are Exploding at the Same Time – And What It Signals for Markets

Moreover, what stands out is that this long-term holding behavior is increasing while Kaspa is still in a volatile phase. Usually, long-term supply rises most clearly after strong bull runs, not during uncertain periods.

This suggests that some investors are building positions based on Kaspa’s network progress rather than short-term price action. With governance upgrades, industrial use cases, and social platforms now forming around the network, that conviction is being backed by real development.

What to watch next for Kaspa

For KAS price, this metric is not a trading signal by itself. It is a structural signal. As long as more KAS stays locked away, fewer coins are available for trading.

If price starts to rise while this continues, moves higher could become sharper than before. The main point is simple: more Kaspa is being held long term, and that changes how price can move in the future.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.