XRP is getting hammered across social media right now. Traders are angry, tired, and loud. Many are calling for lower prices after XRP dropped almost 19% from its January 5 high. The mood is ugly, and that alone makes this setup interesting.

When everyone lines up on one side of the trade, markets usually find a way to punish that crowd. This is exactly the type of moment where things can flip fast.

Let’s break down what the chart and sentiment are really saying.

What you'll learn 👉

XRP Sentiment Has Reached an Extreme

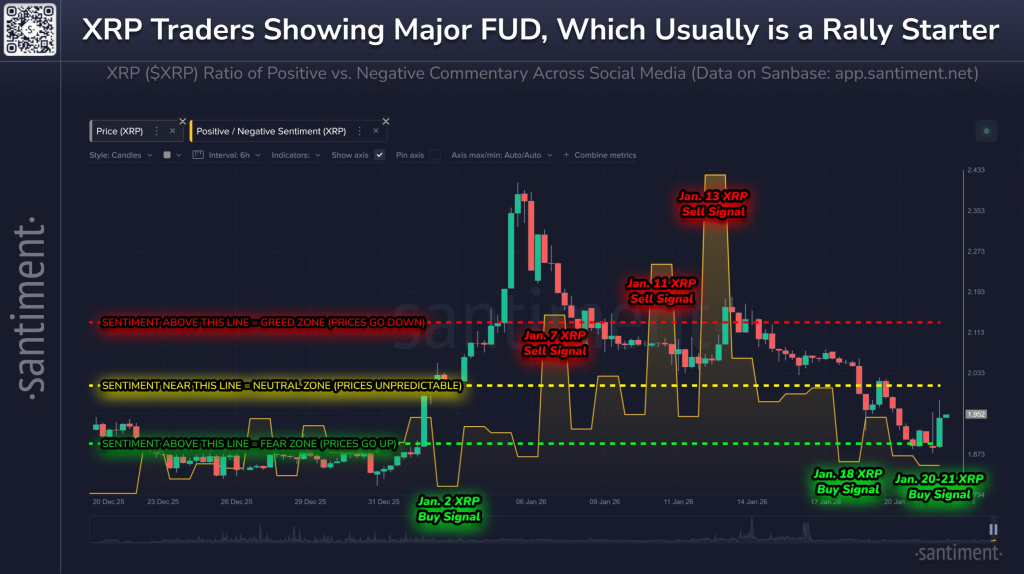

Data from Santiment shows the XRP price has moved into what they label as “Extreme Fear.” That means negative comments heavily outweigh positive ones across social platforms.

Retail traders are openly bearish. Many are expecting another leg down. That matters because retail sentiment often peaks right near local bottoms, not tops.

Markets rarely reward the obvious trade. When most traders expect lower prices, selling pressure tends to dry up. At that point, it does not take much buying to push price higher.

This does not guarantee a rally. But it creates the right environment for one.

What the XRP Chart Is Telling Us

The Santiment chart overlays price with positive and negative sentiment levels. It shows something very clear.

When sentiment spikes into greed, price tends to stall or fall. That happened around January 7 and January 11, where sentiment moved too optimistic and price rolled over shortly after.

Now look at the opposite side.

On January 18 and again around January 20–21, sentiment dropped into fear. Both moments marked buy signals. Price did not explode higher, but it stabilized and bounced shortly after.

This is classic crowd behavior. Fear forms near lows. Greed forms near highs.

Right now, XRP sentiment is again sitting near those fear levels. That puts bears in a risky position.

Why This Can Turn Into a Trap for Bears

Bears feel comfortable right now. The market looks weak. Bitcoin struggles. Altcoins are bleeding. XRP already broke down from its local high.

That makes short positions feel safe.

But that is exactly when traps tend to form.

If sellers are already exhausted and most of the fear is priced in, price does not need strong demand to move up. It only needs selling to slow down. Once that happens, short sellers become the fuel for the next bounce.

This does not mean XRP will suddenly go parabolic. But even a modest move higher can force bears to cover, adding more pressure to the upside.

Read also: Why Is the Crypto Market Down as Bitcoin Price Dips to $90,000?

The Reality Check: The Market Is Still Weak

It is important to stay grounded.

The broader market is not healthy right now. Liquidity is thin. Bitcoin dominance is high. Altcoins struggle to build strong trends. That limits how far any XRP rally can go.

A reversal here would more likely look like a relief bounce or short-term recovery, not a full trend change.

XRP would need to reclaim and hold key resistance levels before any real bullish structure forms. Until that happens, this remains a tactical setup, not a long-term signal.

Still, tactical setups are where many profitable trades are born.

Read also: How High Could XRP Price Climb Over the Next 4 Months?

What to Watch Next on XRP

If XRP holds above recent local lows while sentiment stays deeply negative, that is a strong sign bears are losing control.

A slow grind higher with declining bearish commentary would support the trap narrative even more.

On the other hand, if fear remains high and price breaks down cleanly, then the setup fails. No indicator works all the time.

But right now, the risk is shifting toward those betting aggressively on lower prices.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.