XRP price has slipped into another uncomfortable zone where confidence feels thin and conviction appears tilted in one direction. After failing to hold above $2 again in mid January, XRP has continued to drift lower, mirroring broader market weakness. This pullback comes just weeks after a strong rally earlier in the year, making the shift in tone feel abrupt rather than gradual.

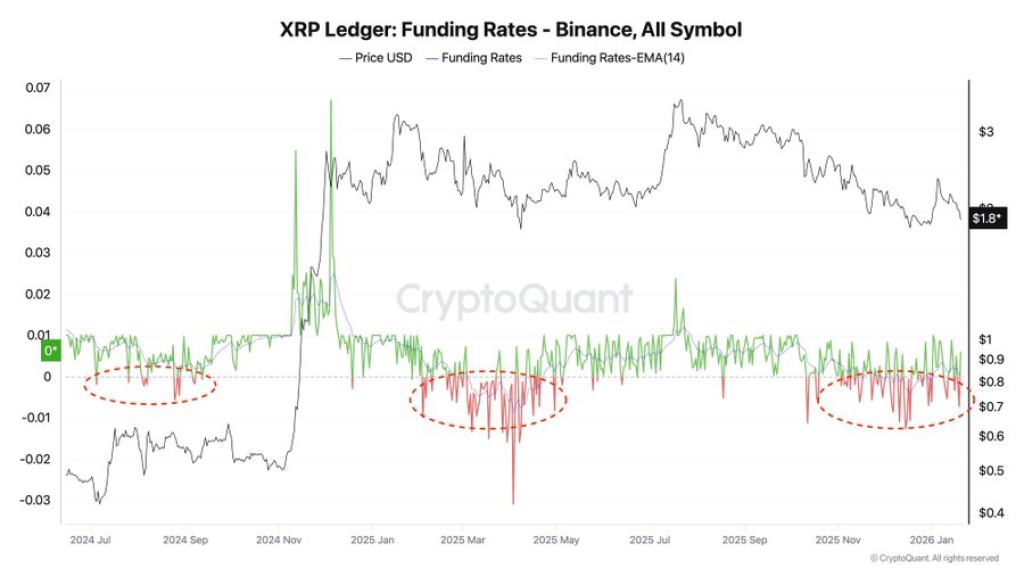

What makes the current phase stand out is not only the price action itself, but what futures data is quietly showing underneath. Funding rates on Binance have now turned predominantly negative, a condition that has historically mattered more for what it reveals about positioning than sentiment alone.

What you'll learn 👉

XRP Funding Rates On Binance Reflect Growing Bearish Positioning

Data shared by TheCryptoBasic highlights that XRP funding rates on Binance futures have flipped negative as price struggles below $2. This shift follows XRP’s early January move to $2.41, which marked a 30% recovery from Q4 2025 losses before meeting resistance and reversing.

Negative funding rates signal that short positions dominate the futures market. Traders betting against XRP are now paying to maintain those positions, reflecting expectations of further downside. This trend has persisted since late 2025, aligning closely with XRP’s broader pullback from recent highs.

XRP Price Correction Comes After A Powerful Multi Month Rally

CryptoQuant verified analyst Darkfost points out that XRP price has fallen roughly 47% from its July 2025 peak near $3.6. That decline follows a massive 600% rally that began in November 2024, a move that reshaped long term charts and attracted significant speculative interest.

Darkfost describes the current phase as distribution, framing it as a normal and even healthy part of market structure. Strong rallies often require extended cooling periods, especially after exponential moves. The detail that matters now is not the correction itself, but how traders are positioning late into that decline.

Bearish Consensus Forms Late As XRP Funding Rates Stay Negative

According to Darkfost, a bearish consensus has emerged after much of the downside has already played out. This timing is critical. As XRP price pulled back from its highs, more traders opened short positions on Binance futures, pushing funding rates deeper into negative territory.

Spikes in negative funding rates during downturns show increasing confidence among short sellers. Many expect prices to keep falling, reinforcing one directional positioning. The risk appears when that positioning becomes crowded, leaving little room for further downside without forcing reactions in the opposite direction.

Notably, spikes in negative funding rates during price downturns mean that more traders are opening short positions and paying to keep those trades open. This shows bearish sentiment, as many expect prices to keep falling, and it indicates growing confidence among short sellers.…

— TheCryptoBasic (@thecryptobasic) January 22, 2026

XRP Price History Shows Negative Funding Can Precede Sharp Rebounds

Historical context adds weight to the current setup. Between August and September 2024, XRP price traded within a narrow range between $0.43 and $0.66. That stagnation encouraged rising short exposure and increasingly negative funding rates.

When XRP began recovering in November 2024, those short positions faced liquidation pressure. Forced exits helped fuel a rally that carried XRP to $3.4 by January 2025. A similar pattern unfolded again in April 2025, when XRP price dropped to $1.61 and funding rates spiked negative before a rebound pushed price toward $3.66 by July.

These episodes show how deeply negative funding often reflects late stage positioning rather than fresh conviction.

Read Also: This Kaspa (KAS) Biggest Problem Is Exactly Why It’s Struggling

Negative funding does not predict exact price levels or guarantee reversals. It highlights vulnerability. When most traders lean short, markets become sensitive to even modest upside moves. A small bounce can cascade into liquidations, creating relief rallies even during broader corrective phases.

XRP price now sits at a point where bearish positioning dominates while historical patterns suggest caution around consensus trades. Whether price moves lower first or reacts sooner remains uncertain, yet the structure forming beneath current levels looks familiar.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.