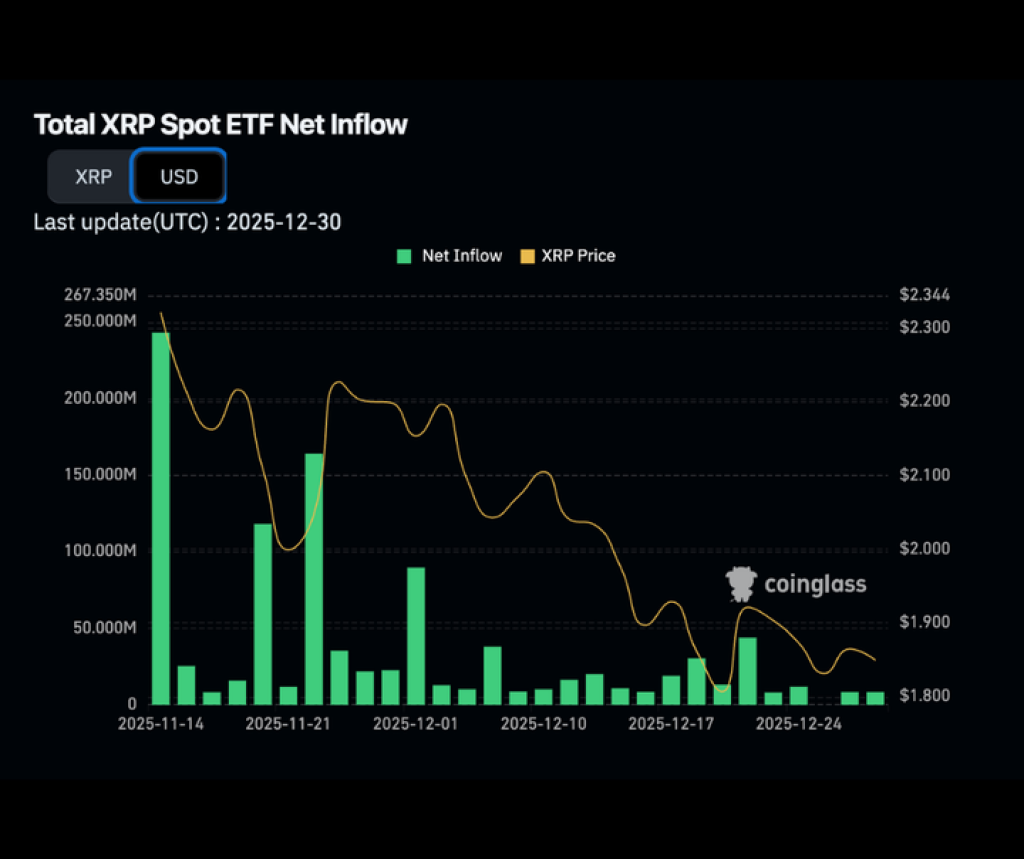

A CoinDesk post paired with a CoinGlass chart makes a simple point: spot ETF flow has become a steady source of demand for XRP, even while price action has struggled to hold its earlier momentum. The chart tracks “Total XRP Spot ETF Net Inflow” in USD terms, with green bars for net inflow and a yellow line for XRP price. The last update stamp shows 2025-12-30, and the timeline spans mid-November through late December.

The biggest signal sits at the start of the window. Net inflow prints a large spike in mid-November, then settles into a pattern of smaller but frequent positive days. A second burst appears around late November, followed by another noticeable inflow pop around early December. After that, the bars compress, but they do not disappear. In plain terms, inflows cool from the initial surge, yet they keep showing up.

The XRP price tells a different story. The yellow line starts near the top of the chart’s range and trends lower through the period, moving from the low $2.30s toward the high $1.80s. There is a brief rebound into mid-December, but the line fails to reclaim earlier levels and drifts back toward the lower end by late December. The key takeaway is divergence: inflows persist while price grinds down.

CoinDesk frames the move as aggressive absorption. The post says XRP ETFs pulled in over $1B in about 50 days and locked 746M XRP, which it labels as 1.14% of circulating supply. It also notes only one zero-inflow day since launch, which supports the “consistent bid” narrative. From there, the post extrapolates: at a $27.7M-per-day pace, ETF assets could reach $5B by mid-May 2026, potentially locking 2.6B XRP, or roughly 4% of supply. It adds another pressure point: exchange balances are down 58% in 2025.

The bullish case makes sense on structure. If a large buyer keeps absorbing spot supply while exchange balances fall, liquidity tightens and the market needs less incremental demand to move higher.

The risk sits in the extrapolation. Flow pace rarely stays linear. A few quiet weeks can break the “daily run-rate” math, and price can still drift if broader crypto sentiment turns risk-off. Even so, the chart supports the core idea: XRP has a consistent demand source in the background, and that changes the setup heading into 2026.

Read also: “The Timeline Was Wrong”: XRP Community Confronts Reality After 7 Years of Waiting

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.