Ripple has emerged as one of the companies most frequently mentioned among potential large IPO candidates for 2026, according to a widely shared industry graphic outlining the largest private firms that could go public. At the same time, derivatives data paints a very different short-term picture for XRP, with futures open interest falling to levels not seen since early 2024.

The combination of long-term corporate expectations and near-term market caution has sparked renewed debate around XRP’s positioning heading into 2026.

What you'll learn 👉

Ripple Ranked Among Potential Mega IPOs

The first image circulating on social media lists Ripple among the world’s largest private companies that could pursue an initial public offering, placing it ninth overall with an estimated valuation of $50 billion. The list, sourced from Yahoo Finance data and shared by Investing Visuals, includes major names such as SpaceX, OpenAI, ByteDance, and Stripe.

Ripple’s inclusion alongside these firms reflects its scale as a payments-focused blockchain company rather than any confirmed IPO plans. While Ripple has not announced a public listing timeline, market participants continue to view an IPO as a possible medium-term outcome following improved regulatory clarity in the U.S.

Importantly, this ranking refers to Ripple as a company, not XRP as a token. Still, speculation around a future IPO often feeds into broader discussions about the long-term relevance of the XRP Ledger and Ripple’s role within global payment infrastructure.

XRP Open Interest Drops Back to Early-2024 Levels

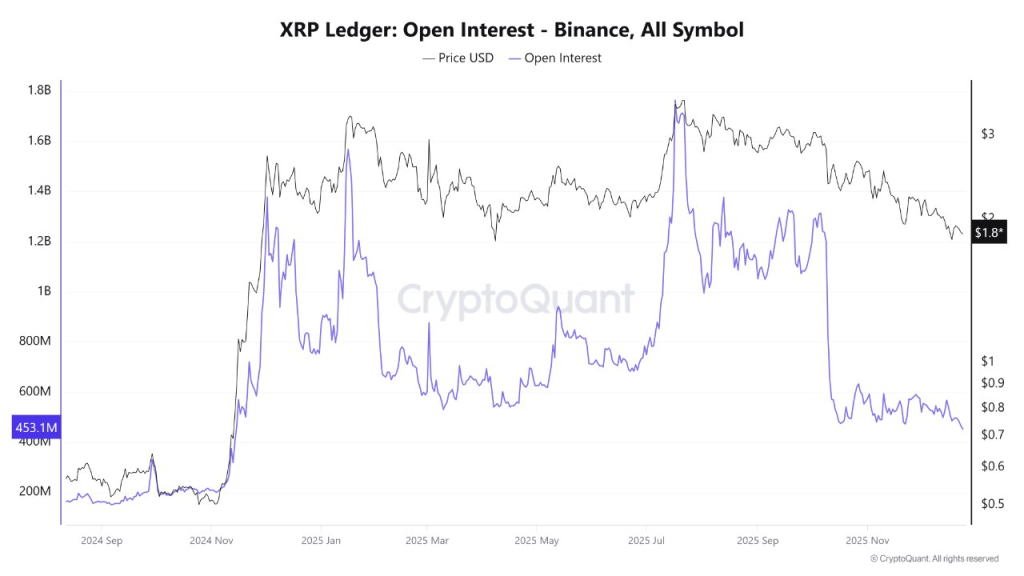

In contrast to IPO optimism, derivatives data shared by Coin Bureau shows a notable reset in XRP futures positioning. According to the XRP Ledger Open Interest chart from CryptoQuant, Binance XRP open interest has fallen to approximately $453 million, its lowest level since early 2024.

Earlier in 2025, XRP futures open interest exceeded $1 billion during periods of strong price momentum. The current decline indicates that leveraged exposure has been reduced significantly, with traders taking a more cautious stance after months of volatility.

The chart shows that while XRP price has declined from its mid-year highs, the sharper move has occurred in open interest rather than spot price. This pattern often points to position unwinding rather than panic-driven selling, as leverage exits the system without necessarily triggering aggressive spot market pressure.

What the Reset Means for XRP Market Structure

A drop in open interest is not inherently bearish. In many cases, it reflects a cooling-off period where excess leverage is cleared out, reducing the risk of sharp liquidation-driven moves. With fewer leveraged positions in play, price action can become more stable, though often slower.

Coin Bureau noted that previous peaks in XRP open interest coincided with strong rallies earlier in the year. The current reset indicates that traders are waiting for clearer directional signals before rebuilding exposure, particularly amid broader market uncertainty.

From a structural standpoint, XRP now trades in an environment with lower speculative pressure, which can set the stage for more organic moves if demand returns through spot markets or institutional flows.

For now, Ripple’s IPO narrative remains a long-term discussion, while XRP’s futures market signals patience rather than conviction.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.