As the broader crypto market enters a period of renewed volatility, long-time investors are reassessing established projects against emerging DeFi crypto contenders. Cardano (ADA), once seen as a leading blockchain for smart contract scalability, has paused near $0.55, signaling a period of consolidation after limited momentum in recent months.

Meanwhile, Mutuum Finance (MUTM) is capturing attention as one of the fastest-growing new crypto projects of 2025. With its presale nearing full allocation and a product-driven roadmap, many market watchers are beginning to compare the two, questioning which might deliver stronger results heading into 2026.

What you'll learn 👉

Cardano (ADA)

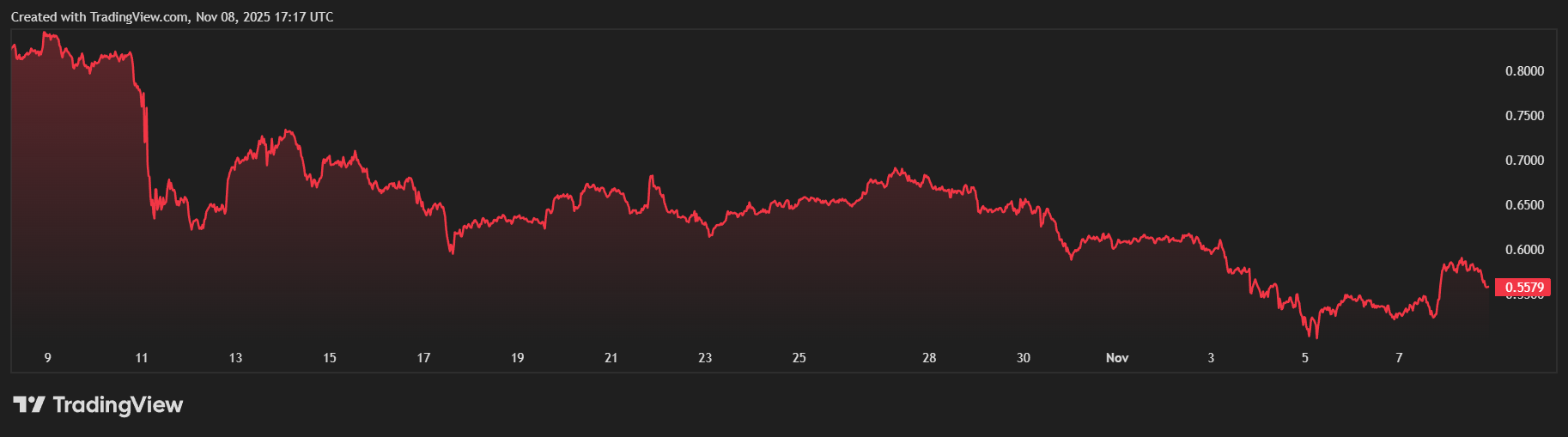

Cardano currently trades around $0.55, supported by a market capitalization of approximately $24 billion, ranking it among the world’s top digital assets. Founded by Charles Hoskinson, Cardano’s layered blockchain and Proof-of-Stake (PoS) consensus have earned it a reputation for security, low energy consumption, and scalability. Its native ADA token plays a key role in network governance and staking rewards, drawing institutional and retail participation alike.

However, despite its strong fundamentals, ADA’s price momentum has softened throughout 2025. After testing resistance near $0.75–$0.80, the coin pulled back toward $0.55, where it now consolidates. Technical analysts identify major resistance levels between $0.78–$0.90, with further obstacles at the psychological $1.00 mark. These barriers have repeatedly capped ADA’s rallies, creating a pattern of lower highs that limit upward traction.

Mutuum Finance (MUTM)

Mutuum Finance (MUTM) is a new crypto project designed to make decentralized lending and borrowing more efficient, transparent, and rewarding for users. It runs on Ethereum and introduces a dual-market architecture that allows lenders and borrowers to interact through automated smart contracts. Instead of relying on intermediaries, Mutuum’s structure ensures users maintain full control of their assets while generating yield directly on-chain.

At the center of the system are mtTokens, which act as yield-bearing receipts when users deposit assets into liquidity pools. Borrowers receive Debt Tokens that track their positions, while a Liquidator Bot ensures market stability by monitoring collateral levels and triggering automatic liquidations when necessary.

The project’s presale performance underscores growing investor interest. Mutuum Finance has already raised over $18.6 million, attracted 17,950 holders, and sold more than 800 million tokens. Phase 6 is currently over 85% allocated at a token price of $0.035, representing a nearly 300% increase from its initial Phase 1 price of $0.01.

ADA vs MUTM

Cardano’s price action remains largely dependent on overall market conditions. Even under optimistic projections, most analysts expect ADA to face challenges breaking above $1.00 without a major catalyst such as institutional adoption or regulatory clarity. From its current level, this represents a potential upside of 40–50%, respectable but relatively modest for a mid-cap asset.

By contrast, Mutuum Finance offers a much lower market base and therefore higher relative upside potential. Once the protocol’s V1 launch and product deployment succeed in attracting liquidity, it could establish revenue-driven demand for MUTM. Analysts tracking DeFi growth models suggest that early-stage projects tied to platform activity often see outsized growth once they transition from presale to mainnet.

From its $0.035 presale price to a $0.06 launch price, investors already anticipate a significant initial jump. A post-launch climb toward $0.15–$0.20 over the next year would represent a 300–450% MUTM appreciation from today’s levels. The contrast is clear, MUTM represents early-stage expansion potential supported by structural buy pressure and tangible utility.

Security, Transparency, and Whale Activity

Mutuum Finance has completed a CertiK smart contract audit, achieving a 90/100 Token Scan score, which signals a strong level of security and reliability. In addition, the project runs a $50,000 bug bounty program, encouraging external developers to identify vulnerabilities before the mainnet launch. This proactive approach strengthens investor confidence and aligns with industry-standard DeFi safety practices.

The 24-hour leaderboard and transparent on-chain reporting make Mutuum’s presale one of the most open in 2025. Large-scale investors, often referred to as “whales,” have begun accumulating allocations, with several six-figure purchases recorded as the Phase 6 window narrows. This pattern often signals growing institutional or high-net-worth interest before wider retail adoption begins.

Cardano and Mutuum Finance both represent distinct categories in the crypto landscape. ADA stands as a proven, reliable blockchain asset, an established name with institutional recognition and a large global community. Yet, its high market cap and technical resistance zones mean that dramatic price growth may remain limited without new catalysts.

In contrast, Mutuum Finance (MUTM) is positioning itself as a DeFi crypto with active development, real utility, and measurable investor traction. With $18.55 million raised, 17,850 holders, and 85% of Phase 6 already sold, the project’s presale momentum shows no signs of slowing. Backed by a certified audit, transparent community mechanics, and a defined Q4 2025 V1 launch, Mutuum Finance is increasingly viewed as one of the top cryptos to watch heading into 2026.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.