XRP price might be gearing up for a breakout. The charts are starting to look bullish, especially on the short-term timeframes. We’re seeing an inverse head and shoulders pattern form, which usually signals a possible move higher. But while the setup looks good on paper, there’s a catch: on-chain activity is fading, and that’s making some traders nervous.

Right now, XRP price is sitting just below the key $2.20 resistance level. That’s where the neckline of this pattern lies, and the price has been bumping up against it without managing a clean breakout. The current price is around $2.09.

Looking back, the left shoulder formed around April 3–5, followed by a sharp drop that created the head near April 8. Since then, the right shoulder has been taking shape slowly, showing signs of accumulation. If XRP price can finally push above that $2.20 level with solid volume behind it, we could be looking at a move toward $2.50, the level it last touched in late March.

What you'll learn 👉

XRP On-Chain Activity Drops Despite Rising Open Interest

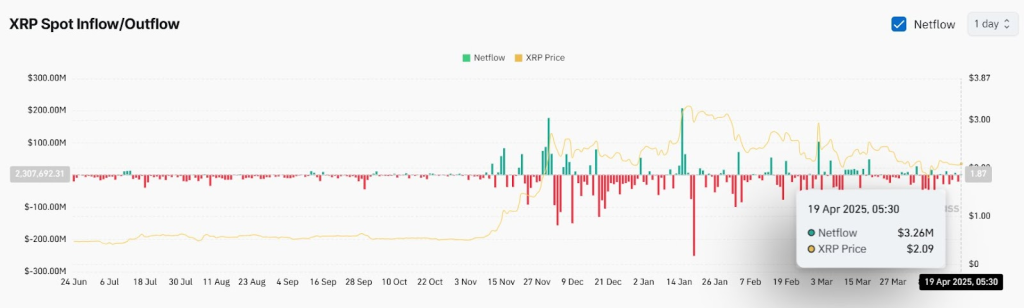

Despite the encouraging chart structure, blockchain data points to a declining level of user participation. According to Coinpedia, netflow data shows a $3.26 million increase in XRP entering exchanges on April 19. This movement often reflects traders’ positioning to sell, indicating bearish sentiment in the spot market.

Executed transactions on the XRP ledger dropped sharply, from 1.56 million to 660,000. Active sending addresses fell to 8,500 from 20,700 within the same time frame. These declines reflect reduced engagement from both retail and institutional users, raising concerns about momentum sustainability.

Read Also: Binance Just Gave Up on JASMY… But JasmyCoin Price Is Exploding; Should You Buy In Now?

Derivatives Market Activity Surges as Traders Take Positions

Open interest on XRP options reached $3.14 billion, alongside a 73.58% increase in options volume in just 24 hours. This surge suggests strong interest in short-term contracts, particularly from speculative traders expecting a breakout. However, Coinpedia’s tweet cautions that derivatives activity alone may not support a broader rally if network activity continues to fade.

This divergence between chart-driven optimism and weakening on-chain metrics highlights the uncertainty surrounding XRP’s next move. While bullish traders monitor the neckline closely, low user activity could limit follow-through unless engagement improves.

XRP Market Conditions Remain Mixed Ahead of Potential Breakout

The XRP price continues to test resistance at $2.20. On one hand, technical patterns and derivatives data point toward a possible breakout. On the other hand, on-chain behavior reveals hesitation among market participants.

The coming days will likely be shaped by how the price reacts to the resistance level and whether user activity on the XRP network can recover. Until then, the rally remains uncertain, despite favorable chart patterns.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.