There is increased anticipation that XRP may soon join Bitcoin and Ethereum in having its own ETFs. After Bitcoin and Ethereum ETFs were approved, the SEC is now looking at similar options for Ripple (XRP).

Several financial companies have already applied, and if approved, these ETFs could boost XRP by increasing demand and bringing in more institutional investors.

What you'll learn 👉

The Exact Approval Date Revealed

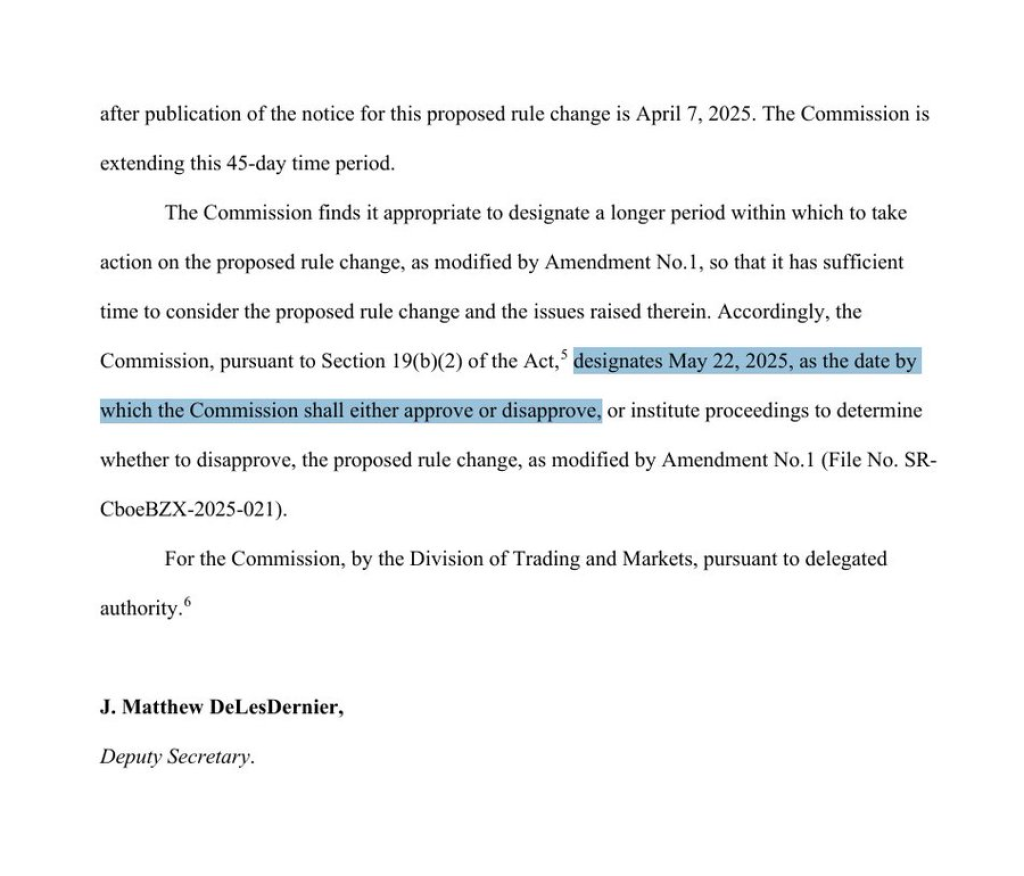

Recent updates suggest investors should watch for late May. Chad Steingraber, with more than 49,000 followers on X, shared an official document on X that provides key timing details. While the SEC initially planned to decide by April 7, 2025, they’ve pushed this deadline back.

The official notice, signed by Deputy Secretary J. Matthew DeLesDernier, clearly states May 22, 2025, as the date when the Commission must either approve or reject the proposal. They could also decide to review it further.

Market Impact and Investor Accessibility

Vincent Van Code, another crypto analyst with more than 30,000 followers, believes multiple XRP ETFs will likely be approved on May 22. He doesn’t expect prices to jump right away but says these approvals would make XRP more legitimate in the market and “open the floodgates to investors looking to hold a liquid, digital asset.”

Read Also: Here’s Why Kaspa Holders Have a Reason to Worry Despite KAS Price Pump

Van Code explains that ETF approval would make investing in XRP much easier for newcomers who aren’t familiar with crypto wallets, custody, and regulations. They could simply buy XRP through their regular trading accounts. However, he cautions that significant price changes might take “12 months plus” despite the fact that “the market will likely pump on its news.”

This approval could be a major step in cryptocurrency’s path to mainstream acceptance and might significantly change XRP’s position in the digital asset world.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.