Recent analysis from cryptocurrency analyst Ali (@ali_charts) suggests that Cardano (ADA) might be preparing for a significant price move upward, following a new bullish signal from a key technical indicator.

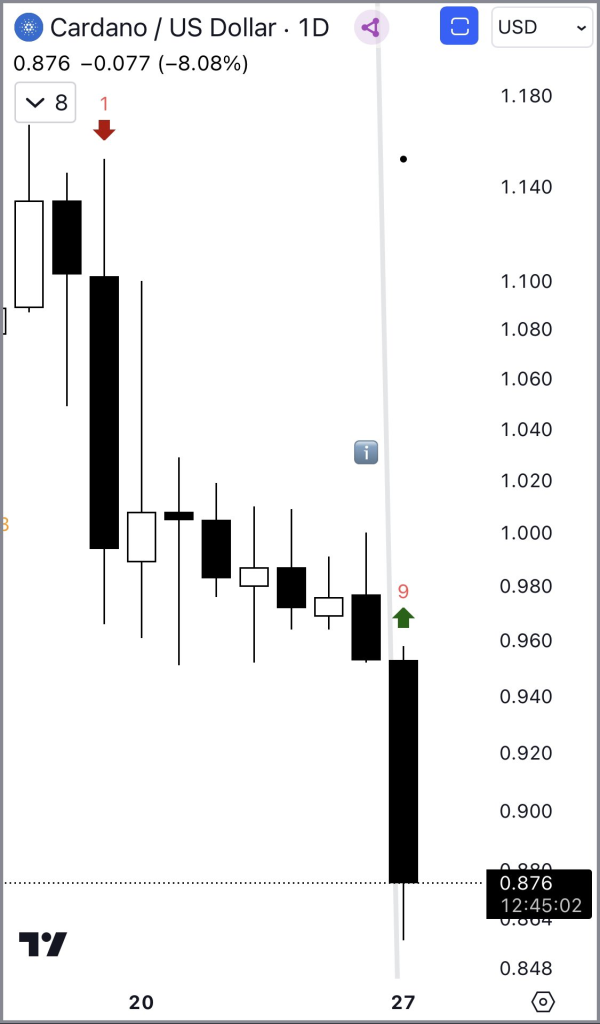

The TD Sequential indicator, a popular tool for identifying potential market reversals, has just flashed a buy signal on Cardano’s daily chart. According to Ali’s analysis, this technical development could herald an upcoming price rebound for the digital asset.

Looking at the current market structure, Cardano has recently experienced notable downward pressure, with the latest trading session showing a substantial red candle pushing prices toward the $0.876 level. However, the presence of a long lower wick on this candle tells an interesting story – while sellers initially dominated the session, buyers stepped in with considerable force to push prices back up from the lows.

This buying pressure at lower levels aligns perfectly with the TD Sequential’s buy signal, marked by a green “9” candle on the chart. This particular signal typically emerges after an extended period of downward movement, often indicating that the selling pressure may be exhausting itself.

Ali’s observation of this technical pattern comes at a crucial juncture, as Cardano has reached a significant support zone between $0.85 and $0.88. This price range has historically attracted buyer interest, and when combined with the TD Sequential signal, it strengthens the case for a potential reversal.

Read Also: Toncoin (TON) Price at a Key Support Level: Could This Be the Turning Point?

A Confluence of Factors for Potential ADA Spike

It’s worth noting that while Ali’s analysis focuses on the TD Sequential indicator, the current market structure adds weight to the bullish thesis. The convergence of technical signals, including the strong buyer response at lower levels and the presence of a key support zone, suggests that Cardano might indeed be positioning itself for an upward move.

However, traders should consider additional confirmation from other technical indicators and broader market conditions before making investment decisions. The cryptocurrency market’s inherent volatility means that while technical signals can provide valuable insights, they should be part of a comprehensive analysis approach.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.