The crypto world is taking notice of Raydium (RAY) as its price keeps climbing higher. Looking at the data, we can see why – there’s been heavy buying activity and more people are trading it than before. Top analysts including McKenna discussed on X how things are changing in the Solana ecosystem, with Raydium emerging as a strong performer.

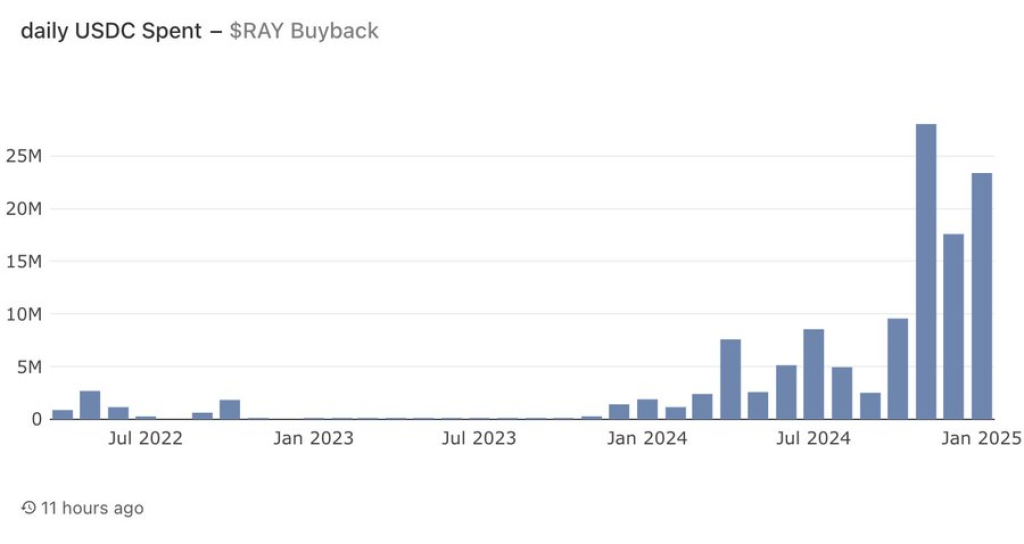

One of the primary drivers behind Raydium’s price surge is the intensified buyback activity. According to on-chain data, daily USDC spent on RAY buybacks has skyrocketed, particularly in late 2024 and early 2025.

The buying pressure has been intense – in just one day, over $25 million was spent buying back tokens from the market, which helps push the price up by reducing how many tokens are available to trade.

Read Also: JasmyCoin May Dip Further as Key Indicators Turn Bearish: JASMY Price Analysis

McKenna pointed out that Raydium’s trading activity is now reaching levels similar to Uniswap, one of the biggest names in crypto trading. This increased activity is bolstered by protocol fees being redirected to fund buybacks, creating a feedback loop that benefits RAY holders.

What you'll learn 👉

Raydium Technical Analysis: Bullish Price Movement and Technical Momentum

Looking at the price charts, Raydium is showing clear upward momentum. After spending most of 2023 either falling or moving sideways, the price has now broken through important resistance points. Various technical indicators back up this bullish trend. The recent breakout has pushed RAY above previous resistance zones, with new targets potentially in the $0.08 to $0.10 range.

This bullish price action is further supported by rising volume, indicating growing market interest. Analysts suggest that the improved sentiment may be linked to the combination of buybacks and the broader growth of the Solana DeFi ecosystem.

Read Also: Whales Invest $165 Million In XRP and These 2 Undervalued Altcoins

Insights from Industry Leaders

Prominent voices in the crypto space have also pointed to Raydium’s potential. McKenna described RAY as a top pick within the Solana ecosystem, suggesting it could outperform the base asset, SOL, over the next 3 to 6 months. He emphasized how speculation in Solana DeFi, combined with increased trading volumes, positions Raydium for further growth.

Similarly, Mando revealed that Raydium generated $32 million in fees within a single day. This figure underscores the growing activity on the platform, further enhancing its appeal. In his words, “you can get smashed by another celeb coin, or you can own the casino,” pointing to Raydium as a reliable option for investors amid the speculative landscape.

Solana DeFi and Raydium’s Growing Role

As more people start using Solana’s network, its trading platforms are seeing more action. Raydium is benefiting from this wave of new users, who are drawn in by both speculation and interesting new projects. The combination of its robust buyback mechanism, increased trading volumes, and bullish technical setup places RAY in a strong position to capitalize on this growth.

Read Also: Elite Analyst Says Chainlink (LINK) Price Could Explode to New All-Time Highs Soon – Here’s Why

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.