If the previous week was a solid one for crypto traders, the current one is completely the opposite. It’s the beauty of being part of the crypto world.

The total market cap is down 6% today and is now below $2.1T. What’s even more concerning is that Bitcoin lost the crucial support and big psychological level at $60k. At press time, the BTC price is down 6% and trading around $59,300.

Ethereum holders are even less happy since ETH lost 8% today and is now trading below $2,500.

According to a report by LookOnChain, 87,405 traders were liquidated for $318.46M in the past 24 hours. A whale was liquidated for $12.67M on an ETH/BTC long position, while another whale was liquidated for $12.6M on a BTC long position.

This all happened around midnight European central time when the BTC price actually plunged from $62,000 to $58,200 before bouncing to current levels. So $58,200 now serves as a support level. Over $110,000,000 was liquidated from crypto markets in just 1 hour during this period.

Read also: Ton Network Is Back Following 7+ Hours Outage – Here’s What TON Users Should Know

Exchange Inflows: A Warning Sign

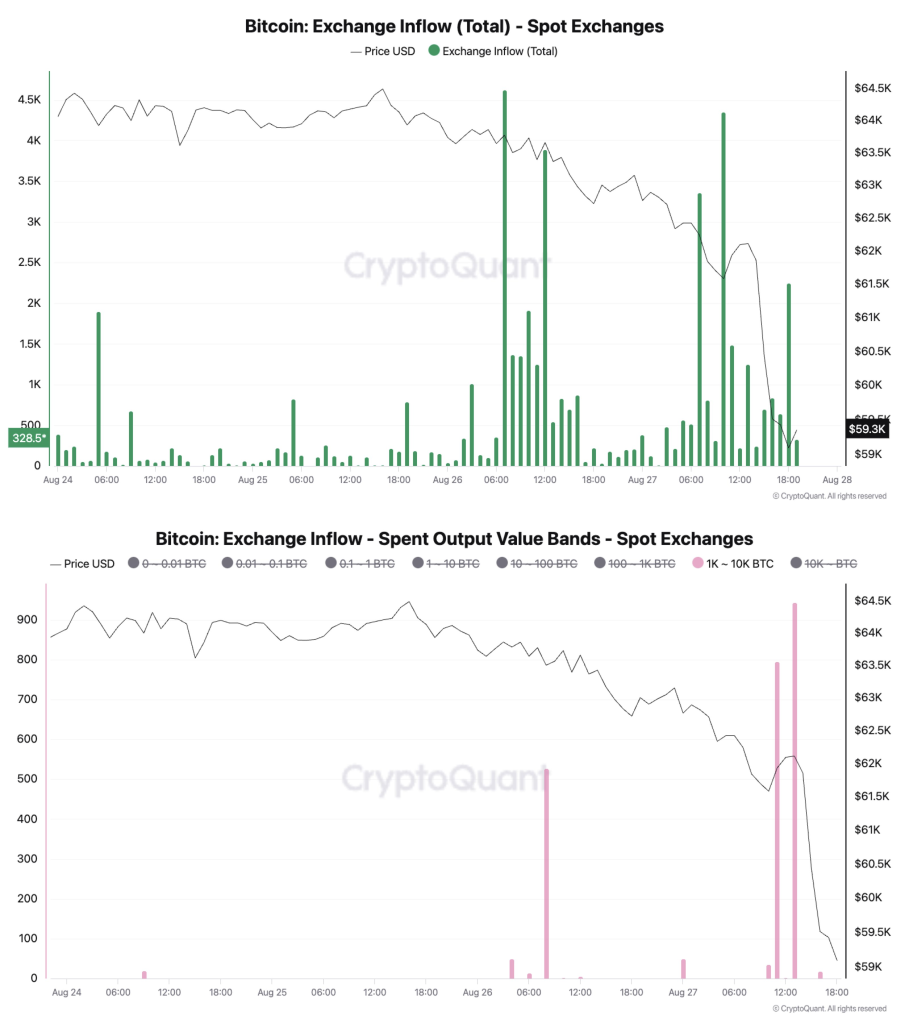

Crypto analyst Julian Moreno shared some interesting insights that could have tipped off traders that the downturn will happen. His analysis of Bitcoin inflows to spot exchanges revealed a telling pattern.

Just before the market crash, there was a spike in the amount of Bitcoin being moved to exchanges. This happened yesterday, right before prices started to tumble. It’s like watching a pressure cooker – as more Bitcoin poured into exchanges, the lid was bound to blow off eventually.

What’s particularly eye-opening is the breakdown of these inflows. Moreno’s data showed that a good chunk of this movement came from the big players – those holding between 1,000 and 10,000 BTC. When these “whales” start moving large amounts of crypto to exchanges, it’s often a sign they’re gearing up to sell.

This whale activity can create a ripple effect. As these large holders offload their Bitcoin, it can spook other investors, leading to a cascade of selling that drives prices down further. It’s a bit like watching dominoes fall – once the big pieces start moving, the rest often follow suit.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.