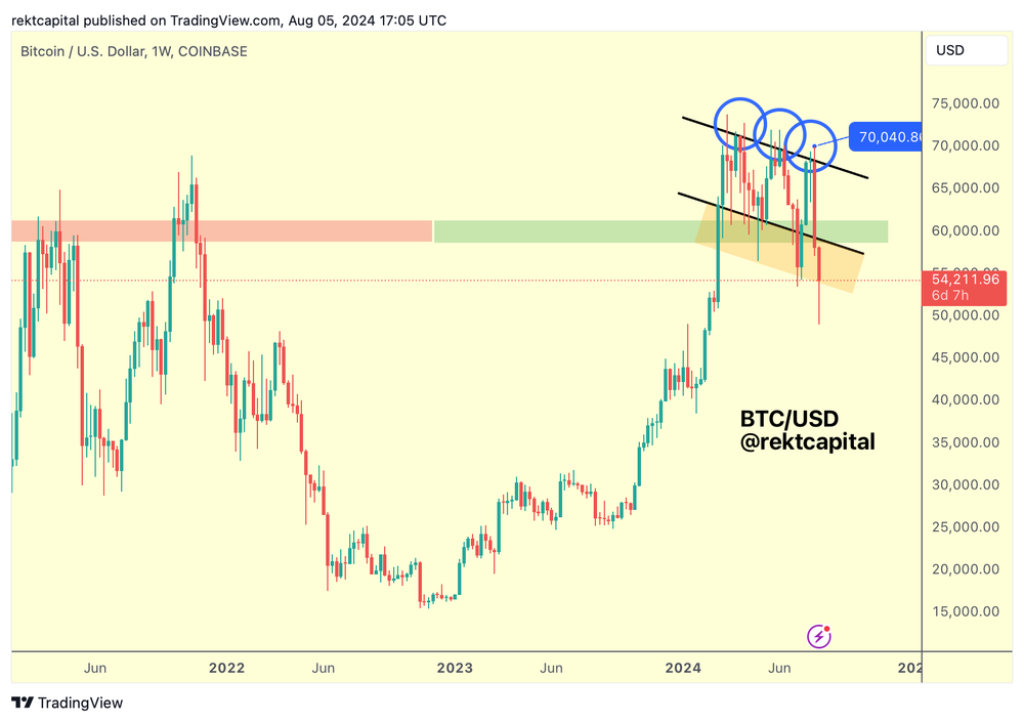

The price of BTC has started to show a green candlestick today after being bearish for the past week. The bearish move was not unexpected as some experts like Rekt Capital, in the newsletter published last week, spoke about some obvious bearish indicators for BTC.

The expert discussed the range high of the reaccumulation range, the weekly lower high rejected price, and a bearish divergence on the daily price. All these technical factors aligned to send the price down.

Bitcoin price has again closed below the range low of the reaccumulation range at $60,600 on the weekly timeframe. This triggered the possibility of more bearish moves.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The analyst noted that the price has formed a new lower low, but for the next two weeks, it will need to reclaim the reaccumulation range as it did a few weeks ago.

What you'll learn 👉

Downside Wicks Point to Potential BTC Price Bottom

Historically, Bitcoin has produced downside wicks below the range low, and it is now becoming a tradition to have an entire candle-bodied downside deviation from the range low. That is, the candlestick starts with a selling pressure and then gets rejected heavily. This pattern has recently signaled short-term bottoms.

Read Also: Why Is Solana (SOL) Price Up Today? Key Resistances Suggest Uptrend May Not Be Sustainable

The newsletter notes that the downside deviation has served as buying opportunities, triggering Bitcoin to rally towards $60,600. We will need to see this in the next two weeks to complete a downside deviation and also affirm that it is not a breakdown.

The analyst highlighted an orange box in a chart showing that the price could be forming lower lows on subsequent downside deviations, which means that for every price retracement, the price may be falling to new lows. However, the bottom of the orange box is still holding despite the downside wick below it.

New CME Gap Increases the Likelihood of Retracement

Therefore, continued support at that point will be important to help BTC price recovery to $60,600, which is the bottom of the black channel on the chart. This point is also in confluence with the brand new CME gap that formed shortly after filling the last CME gap at $57,885 to $60,995.

The brand new CME gap, according to the analyst, is around the $59,415 to $62,550 region. Based on how CME gaps have been filled in previous months, the analyst thinks that there is a high likelihood that the current one will also follow the same pattern.

Indicator Points to Potential Bitcoin Low

Ali, a crypto analyst with more than 68,000 followers on X, analyzed the price of Bitcoin using the MVRV Ratio (30D). The analysis noted that the BTC indicator’s metrics have not been this low since November 2022, when FTX, a major crypto exchange, filed for bankruptcy.

At that time, the low served as an “excellent buying opportunity”.

The analysis seems to encourage accumulating more Bitcoin at the current lower price. However, traders must do their research and make decisions based on a confluence of bullish triggers.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.