I think that the name ‘Bitcoin’ needs no introduction because, now more than ever, people around the world are talking about this magical internet money. Bitcoin has become one of the biggest buzzwords of the year and a perfect vehicle for the modern world to protect their buying power.

However, there are always two sides of the coin. Some people are optimistic towards Bitcoin, which already has established a market cap larger than that of many national currencies, while others are pesimistic about it.

Optimistic because people normally like to talk highly of things they invested in, even if it isn’t that big of an investment. For example, Winklevoss twins are extremely optimistic about Bitcoin and they say that they will not sell even if its market cap hits $8 trillion or price hits $380,950.

On the other hand, pessimistic because Bitcoin is very volatile and is prone to price manipulation. Some people also say that Bitcoin is a Ponzi scheme where no one will benefit. I agree that Bitcoin is highly volatile and it takes some time to get used to its big brush moves up and down. However, that doesn’t mean that it is a Ponzi scheme. Sure it may go up when it’s bought and go down when it’s sold. However, fiat currencies do this as well.

Most of the people don’t understand what volatile or volatility means in the world of cryptocurrencies is and some gets it wrong. In this post I will explain what volatility means in the Bitcoin and cryptocurrency world.

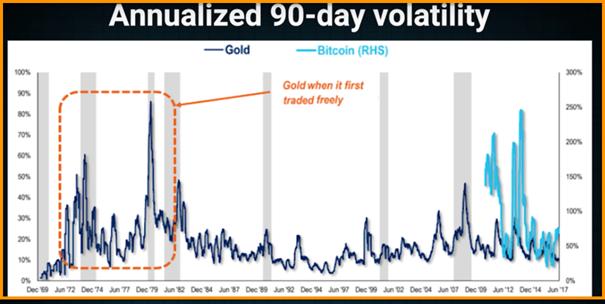

Volatility is nothing new to cryptocurrency investors. Gold is a safe-haven asset prized by investors for its stability, but during the era of the Gold Standard, gold prices were incredibly volatile.

Paper money is no different. The value of Weimer Germany’s Reichmarks hyper-inflated to impossible proportions between the First and Second World Wars, ruining the country’s finances. The same thing happened in Zimbabwe less than a decade ago.

In the picture above, you can see the gold market compared with the BTC market. You can see that by late 1995, the volatility on the Gold market had reached its lowest level since the late 1960s.

What Is Volatility?

Volatility (denoted by symbol σ) is a finance/economics term, which refers to the pace at which prices move higher or lower, and how wildly they swing.

Here is the definition of Volatility:

„Volatility is a rate at which the price of a security (or commodity) changes over time. It shows the range to which the price of a security may increase or decrease, and as such is an indicator of the risk of a security. It is used in option pricing formulae to gauge the fluctuations in the returns of the underlying assets“. (source https://www.platts.com/risk)

I know some of you may find this definition to be complicated, but volatility in the Bitcoin and cryptocurrency world is no different from the finance world.

In the simplest terms, volatility is a mathematical statistic that is determined by measuring daily changes in stock price, and calculating the annualized standard deviation of these daily price changes. Hence, measuring that price movement attributes that can be used to analyze or forecast price targets and price movement behavior for Bitcoin and other cryptos is called volatility in crypto world too.

Therefore, if you are looking to invest or trade in the cryptocurrency space, it is very important to understand the volatility of Bitcoin and other cryptos.

According to Coinbase, one Bitcoin was valued at $15,872 around 10:40 a.m. Pacific Time, and it briefly surged above $19,000 earlier in the day. It’s worth to mention that one Bitcoin was worth less than $1,000 at the start of the year.

Volatility Index Of Bitcoin From 2010

The price of Bitcoin can change drastically if a single person decides to release huge amounts of Bitcoin into the market at any moment, completely upending its value.

The price can also change as financial institutions and countries adapt to the idea of cryptocurrency. For example, Bitcoin experienced massive spike in value when one of South Korea’s biggest banks tested out the technology. On the other hand, the value of Bitcoin dropped when when China announced plans to crack down on sketchy. The same thing happened when China announced plans to crack down on sketchy.

Many people refer to volatility as stability and say crypto market including Bitcoin is highly unstable and that it is still in its experimental stage.

But for those people, I recommend to check the picture above and see how the gold price volatility in 1970s has completely negated the safe haven myth.

And those who have been into the crypto space for some time now know that it is so because cryptos, including Bitcoin, cannot be controlled by institutions, banks and government because they are not owned by anyone and they are only depending on the buyers and sellers in the market so as long as there is buyers and sellers in the market.

Note: A free market is an economic system that is created by interactions between buyers and sellers, and in this system the prices of goods and services are determined by market forces, i.e. supply and demand, rather than government controls, a price-setting monopoly, or some other authority.

The reason that prices are volatile right now is because these currencies have not yet permeated financial culture enough to be widely accepted.

That is why I think the best bet for Bitcoin and other cryptos is that as they become more popular and more people buy them, these types of changes in value will go down. Speculation will become less profitable, which will allow every day people to focus on the use of cryptocurrencies, rather than their values.

Until then, I would suggest not to invest in crypto and Bitcoin if you can’t handle such volatility for emotional reasons or rational reasons such as needing to use the money soon.

On the other hand, if you are fine with the volatility, have only a small percentage of your money in cryptos.