Today’s thread on X by popular Ripple analyst EDO FARINA sheds new light on a decades old prediction about the future of global currencies. In a Twitter thread, Farina draws attention to the January 1988 cover of The Economist magazine, highlighting key passages that appear remarkably prescient of the role that Ripple and its native digital asset XRP may play.

Farina quotes the magazine stating that “The phoenix will be favoured by companies and shoppers because it will be more convenient than today’s national currencies, which by then will seem a quaint cause of much disruption to economic life in the last twentieth century.”

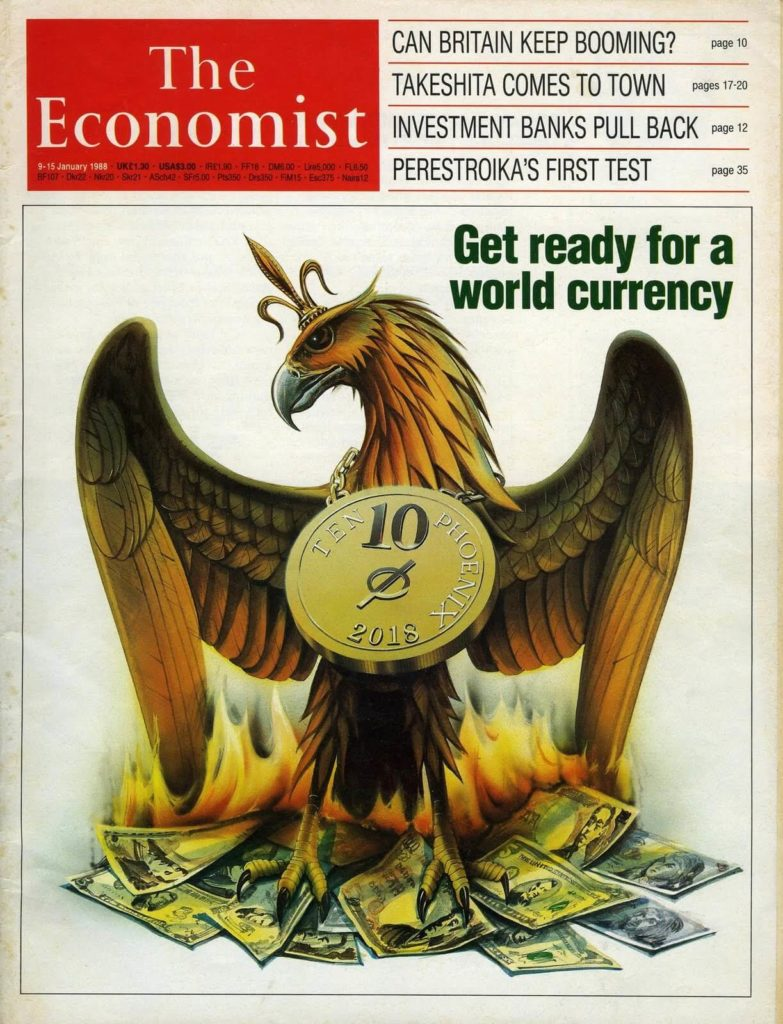

This new “World Currency” was dubbed the Phoenix, depicting how it will rise from the ashes of burned banknotes. According to the publication, it will be favored for its ease of use and stabilized value worldwide.

As Farina notes, “We all see how damaged economies damage lives! We finally have the ‘Phoenix Standard’.” But the magazine acknowledged that governments would be hesitant to relinquish economic sovereignty. However, it predicted that catastrophic events like pandemics that severely impacted economies may ultimately force their hand. As quoted by Farina, the magazine stated “Until governments surrender some economic sovereignty, further attempts to peg currencies will flounder.”

Another prescient insight was that “The flows of money have replaced trade in goods as the force that drives exchange rates.” Volatile exchange rates could really damage national economies. The solution, as the magazine presented, would be greater coordination of economic policies between countries. But any standard adopted would need to enable extremely fast and low cost transactions, a description that closely aligns with XRP’s capabilities.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Farina draws attention to how the magazine acknowledged that a “Phoenix zone would impose tight constraints on national governments. There would be no such thing, for instance, as a national monetary policy.” Control would shift to a new centralized banking authority, potentially descended from the IMF. National governments could still influence domestic inflation, but their powers would be curtailed.

In a truly stunning prediction, the article envisioned remote work becoming commonplace, stating “Indian computer operators will be processing New Yorkers’ paychecks.” This echoed the massive work from home shift sparked by the Covid pandemic decades later.

Farina makes a compelling case that very few if any other cryptocurrency matches this vision apart from XRP. As a digital asset controlled by Ripple and optimized for cross-border payments, it exhibits the characteristics the magazine laid out presciently in 1988 for a future “World Currency.” The Rothschild owned Economist may have inadvertently predicted XRP’s role over 30 years before its creation. EDO FARINA’s thread raises fascinating questions about whether decades old forecasts could be coming to fruition through Ripple’s work with XRP.

You may also be interested in:

- ‘Ethereum Will Likely Outrun Bitcoin (BTC) This Week’, Analyst Forecasts Next Leg Up for ETH

- Japan’s Jasmycoin Price Soars Amid Whale Movements: Can JASMY Hit New ATH? Pay Attention To This Metric

- BlockDAG’s $2 Million Giveaway and 5000x ROIs Pull in Investors from ScapesMania and Solana

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.