Earlier today, Matrixport published a report predicting that the SEC would reject all Bitcoin ETF applications in January, causing Bitcoin’s price to plunge 9% within an hour. However, well-respected ETF analysts James Seyffart and Eric Balchunas from Bloomberg have countered Matrixport’s justification, arguing that ETF approval is actually highly likely.

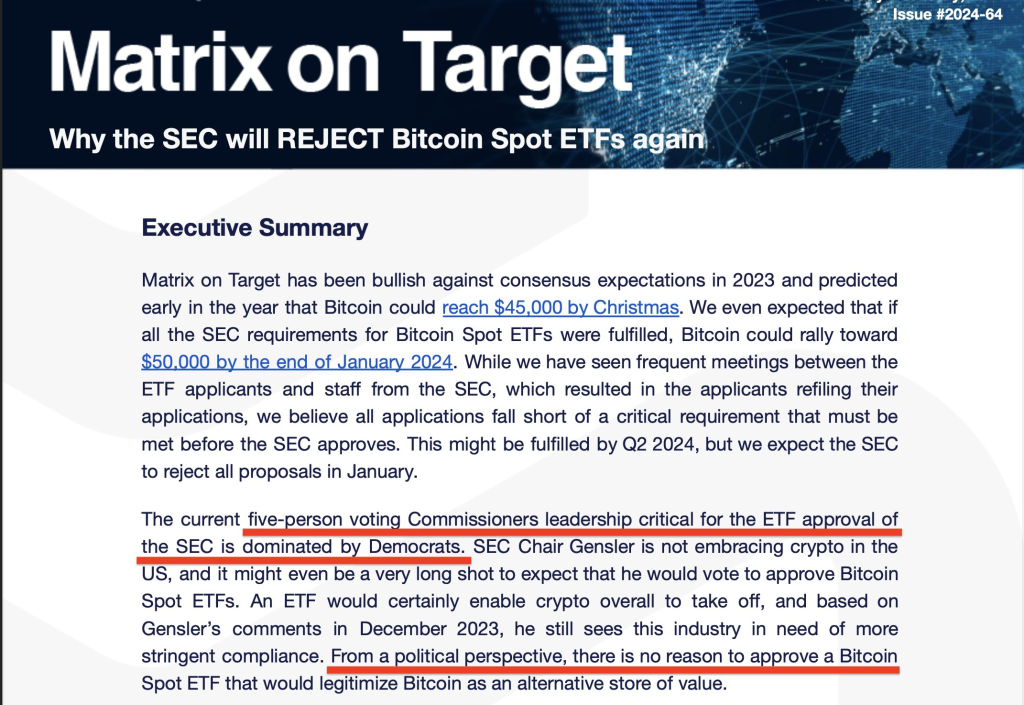

According to Bitcoin Archive, Matrixport claimed ETF rejection is imminent because the SEC’s 5 Democratic commissioners lack political incentives, asserting that “Democrats don’t like ‘crypto'” and that applicants have failed to satisfy requirements.

But as highlighted by Bitcoin Archive, Bloomberg’s analysts paint a completely different picture. Having correctly predicted Grayscale’s recent legal victory against the SEC, Seyffart and Balchunas estimate a +90% chance of ETF approval thanks to the SEC’s evolving stance.

“The SEC’s significant change in behaviour by way of engaging with applicants and providing them with guidance on updating their applications” is a major factor behind Bloomberg’s prediction, according to Bitcoin Archive.

The report then outlines 6 key reasons the ground has shifted towards ETF approval:

- Grayscale’s precedent-setting legal win against the SEC

- The SEC proactively working with ETF issuers

- Applicants addressing the SEC’s past concerns

- Increased Bitcoin market maturity and improved infrastructure

- Advances in market surveillance and compliance

- Rising institutional interest in Bitcoin

With the SEC willingly engaging with issuers to resolve issues, Bloomberg sees politics and partisanship as a fading factor. The merits now matter more to the SEC.

So while further volatility is expected until final verdicts are issued, Bloomberg’s experts and Bitcoin Archive remain confident in ETF approvals materializing. Yet Matrixport is unconvinced without clear political incentives.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.