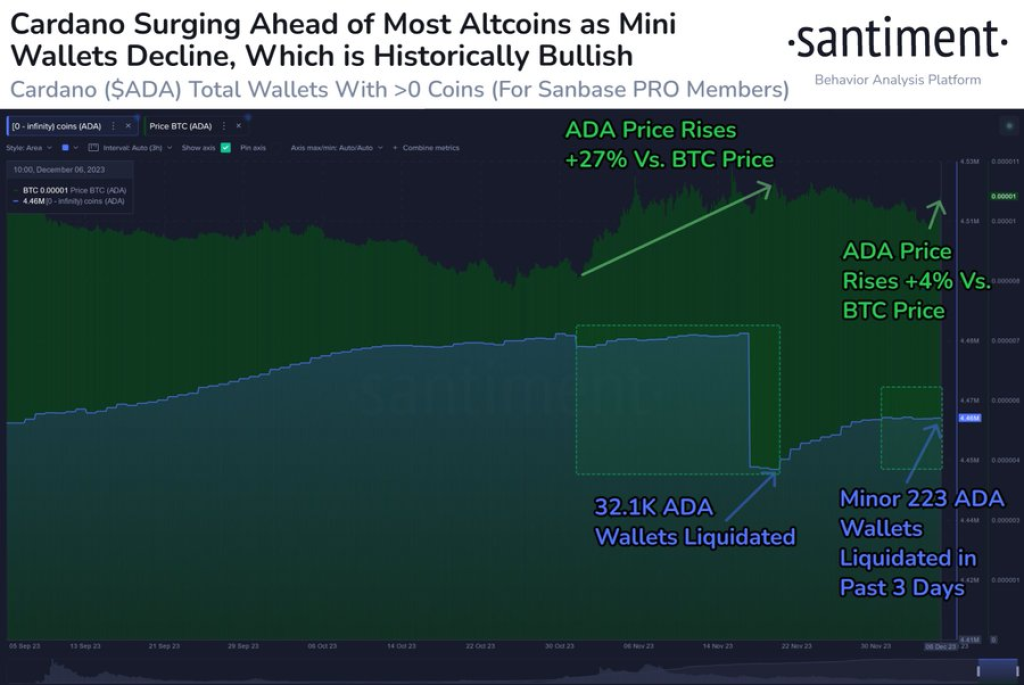

A recent report from on-chain analytics firm Santiment suggests Cardano is showing signs of being bullish, even as broader altcoin prices fall. The analysis indicates small ADA holders have been selling at a loss to large “whales”, consolidating supply.

On Wednesday, Santiment tweeted that Cardano’s market value had risen 7% day-over-day, contrasting with drops across most other major cryptocurrencies. Intriguingly, they note that the total number of Cardano addresses has been declining.

Source: Santiment – Start using it today

What you'll learn 👉

Supply Consolidation to Whales

As Santiment states: “Typically, declining wallets is a sign of small holders capitulating & selling to whales at a loss.” This supply consolidation from smaller holders to larger ones can signify a bottoming out during bearish markets.

Ongoing Positive Momentum

The initial 7% gain highlighted by Santiment has extended even further, as it made 5% gains today, making the total surge a little above 18% for the past 7 days.

This continued positive momentum aligns with the indicators of smaller investors selling at losses and distribution shifting more heavily towards sizable “whale” holders during the recent crypto downturn.

Read also:

- Bitcoin (BTC) Skyrocketed The Last Three Times This Bullish Signal Appeared

- Solana Loses Uptrend; Analyst Warns Failure to Hold Support Could Result in SOL Falling to This Price

- End-of-Year Crypto Boom: Mantle, Filecoin, and Rebel Satoshi Poised for Growth

In conclusion, Cardano’s rallying prices and consolidation of supply to larger holders points to a bullish outlook. Despite prevailing negative sentiment and falling valuations for altcoins in general, on-chain data suggests strong fundamentals for Cardano. An end to capitulation by small holders could signify that a bottom is in place, with recovering prices enticing prominent whales to accumulate more ADA holdings.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.