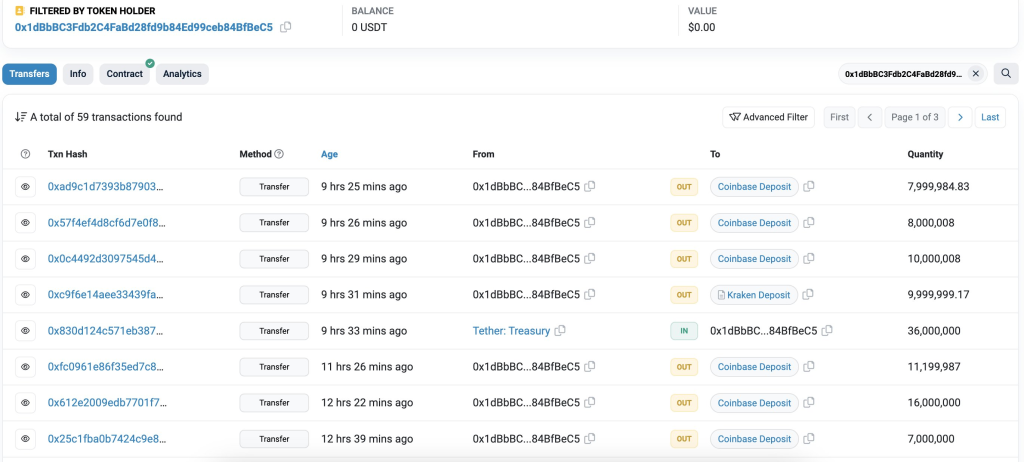

Today, blockchain data tracker LookOnChain reported that over $412 million in Tether’s USDT stablecoin has been withdrawn from Tether Treasury and deposited into major exchanges like Coinbase, Kraken, OKX, and HTX since October 20th.

This large influx of funds into cryptocurrency exchanges often signals positive sentiment and impending activity in the crypto market. When major investors and institutions transfer large amounts of capital into trading platforms, it typically means they plan to buy cryptocurrencies, anticipating price increases.

The crypto market has seen a recent uptick in trading volume as well. According to data, 24 hour trading volume is up over 13% to $46.98 billion. Higher volume points to more market participation and liquidity.

With the inflows into exchanges, the overall sentiment appears bullish for the crypto market in the short term. The new funds represent fresh capital ready to be deployed into digital assets. This extra buying power could propel cryptocurrency prices higher across the board.

Read also:

- Why is Moonriver (MOVR) Price Up? Exploring the Catalysts Behind the Rally

- Estonian Banker’s $469,000,000 Ethereum Fortune Locked Away Forever After Losing Keys – Can Anyone Crack the ETH Wallet?

- Join eTukTuk’s revolution – Only few hours left at the current price

The large USDT transfers into major exchanges likely signals bullish sentiment and increasing enthusiasm for the crypto market. More money flowing into crypto trading platforms often precedes uptrends as investors buy more digital assets. The higher 24 hour trading volume also confirms more market activity. As a result, the overall outlook looks positive for cryptocurrency prices to potentially trend upwards.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.