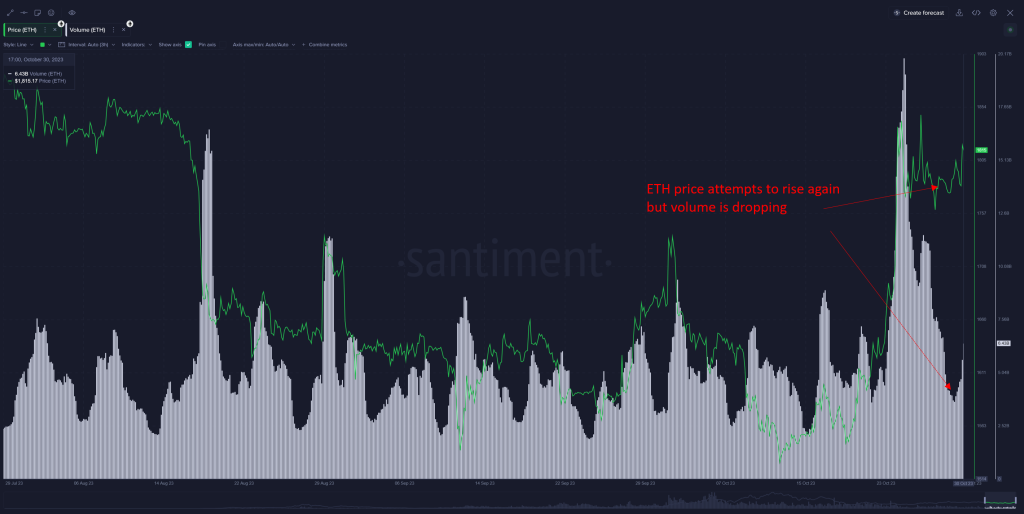

Ethereum’s supply on exchanges has declined significantly as prices rallied, indicating growing confidence and intent to hold from investors, according to Santiment. However, other metrics show overheating risks that could precede a correction.

The amount of ETH held on exchanges saw noticeable declines as the price pushed above $1600 and higher. This suggests buyers are accumulating for the long term rather than looking to sell at the current prices.

Source: Santiment – Start using it today

When holders build up positions off of exchanges, it signals improved sentiment and reduces potential sell-side pressure. This trend indicates confidence in holding ETH at higher valuation levels.

Social Buzz Building

Ethereum’s social dominance and discussion volume continue to expand but remain below prior peak levels. This implies there is still room for hype and retail FOMO to build before hitting overheated conditions. The growing buzz is a positive for prices in the short term.

However, ETH’s MVRV 30D metric, which measures short-term holder profits, recently entered the “danger zone,” where tops are often formed historically. This suggests the rapid price increase of the past month has likely overextended its fair value.

On the positive side, new money appears to be flowing into the crypto markets via USDT liquidity. Fresh capital is entering and fueling speculation in ETH and other assets. Sustained liquidity inflows would support the rally.

Read also:

- Are TRB Whales Stockpiling? Large Exchange Withdrawals Precede 43% Tellor Pump

- Top 5 Cryptocurrencies with Potential to Outperform Bitcoin

- Rollbit (RLB) Surges to New Highs as Analysts Eye Potential Rally to $1, but There’s a Catch

Ethereum on-chain data shows a mixed picture. Reduced exchange supply is a bullish trend, pointing to growing holder conviction. However, the MVRV heating up indicates overextension risks in the short term. As long as new money continues flowing in, ETH could see further upside. But an imminent correction would not be surprising if momentum stalls near the danger zone. Traders should monitor on-chain trends for signs of distribution before committing heavily to new positions.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.