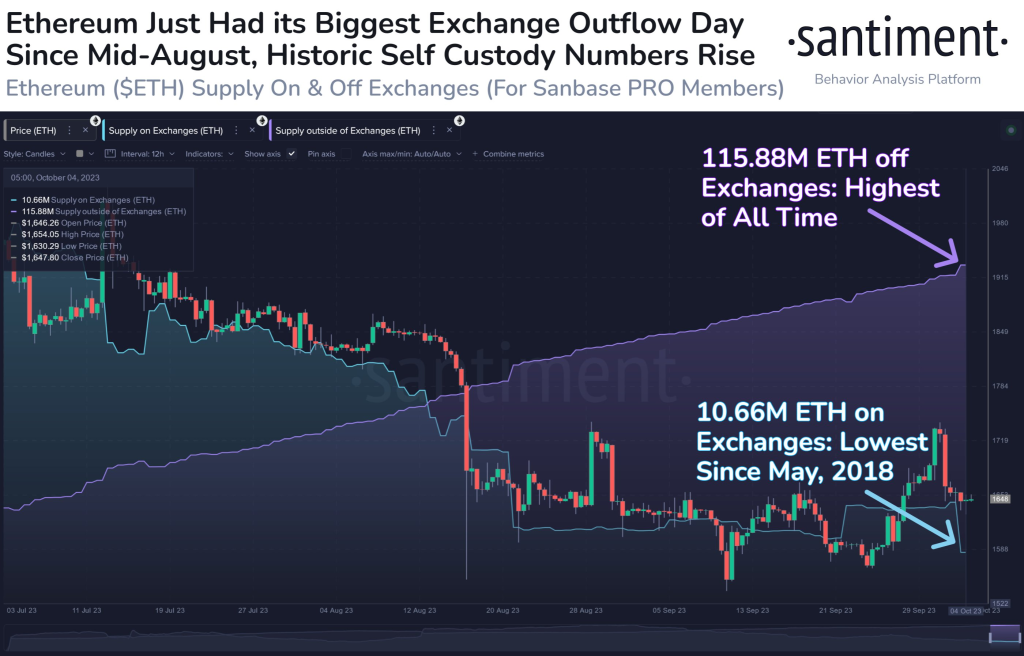

Ethereum presents a peculiar scenario that has left market analysts and investors alike scratching their heads. Despite the amount of non-exchange Ethereum soaring to an all-time high (ATH) of 115.88 million $ETH, the network is experiencing its lowest transaction fees in a year. This seemingly paradoxical situation prompts a deeper dive into the mechanics of Ethereum’s market and network dynamics.

Source: Santiment – Start using it today

What you'll learn 👉

A Closer Look at the Fee Conundrum

Ethereum’s gas fees, essentially the cost to process transactions or execute smart contracts on the network, have hit a yearly low. This occurs against a backdrop where a massive 110,000 $ETH ($181 million) was recently moved off exchanges in a single day, and the non-exchange Ethereum holdings are at an ATH. Typically, high on-chain activity and asset movement correlate with increased gas fees, but the current scenario defies this norm.

Theories Behind the Fee Dip

1. Layer 2 Solutions and Sidechains:

The implementation and adoption of Layer 2 scaling solutions and sidechains, such as Optimism and Polygon, might be playing a pivotal role in reducing the demand for Ethereum’s Layer 1, subsequently lowering gas fees. These solutions enable off-chain computation, reducing the load on the Ethereum network and thereby mitigating fee pressure.

2. Decreased Speculative Trading:

The substantial outflow of Ethereum from exchanges might indicate a decrease in speculative trading activities. With fewer investors engaging in rapid, short-term trading on centralized exchanges, which often involves transferring assets on-chain, the demand for block space may decrease, contributing to lower transaction fees.

3. Technological Advancements:

Ongoing developments and updates in Ethereum’s technology, such as EIP-1559, which introduced a mechanism to burn a portion of transaction fees, might be influencing the fee dynamics by creating a more predictable and stabilized fee estimation system.

Implications of Low Fees and High Non-Exchange Holdings

Investor Confidence:

The ATH in non-exchange Ethereum holdings could suggest a bullish sentiment among holders, anticipating a future appreciation in value and therefore opting for long-term storage away from exchanges.

Accessibility and Adoption:

Lower transaction fees make interacting with the Ethereum blockchain more accessible to both developers and users, potentially fostering increased adoption and development of decentralized applications (dApps).

Market Dynamics:

The scarcity effect, driven by reduced Ethereum availability on exchanges, might exert upward pressure on its price, especially if demand escalates, while supply remains constricted.

Navigating the Future Landscape

While the low fees provide a more cost-effective environment for on-chain interactions and dApp usage, the elevated non-exchange Ethereum holdings hint at a collective investor strategy leaning towards holding. The intertwining of these factors creates a multifaceted scenario that warrants continuous observation to understand the evolving trends and potential future trajectories of Ethereum.

The ability to dissect and comprehend such anomalies and paradoxes becomes indispensable for investors and stakeholders to navigate through the complexities of the digital asset ecosystem.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.