Crypto influencer Crypto Rover recently declared “Bitcoin is about to move big!” in an enthusiastic tweet. This proclamation coincides with growing optimism that the SEC may finally approve a Bitcoin spot exchange-traded fund (ETF) in early 2024 after years of rejection.

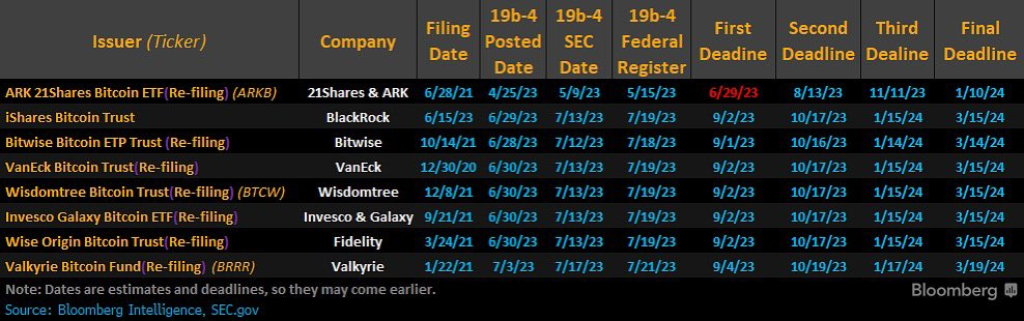

The likelihood of the SEC approving a Bitcoin spot exchange-traded fund (ETF) is rising, according to analysis by Alessandro Ottaviani. Several key dynamics seem to bolster the chances for acceptance ahead of the final ETF decision deadline on January 10, 2024.

For starters, Grayscale recently won its legal battle with the SEC regarding converting its Bitcoin trust into an ETF. This precedent bodes well for spot ETF applicants like Fidelity and BlackRock, both titans in the asset management space.

BlackRock in particular boasts an immense 99.8% ETF product approval rate historically. Unlike past applicants, these established Wall Street firms wield the resources and regulatory credibility to get a Bitcoin ETF greenlit.

Ottaviani also notes the SEC has taken the unprecedented step of engaging with applicants to iron out concerns during the review process. The collaborative approach suggests a receptiveness to finally endorsing a spot-based Bitcoin fund.

The convergence of these promising factors points to a watershed moment in early 2024, where the SEC issues a blanket approval for the outstanding spot ETF requests. Such an event would trigger significant inflows and represent Bitcoin’s long-awaited endorsement as a mature investable asset.

With the next supply halving also occurring in 2024, Ottaviani predicts the confluence of events could propel Bitcoin into its next parabolic bull market. The coming years may cement Bitcoin’s status as a scarce digital store of value as demand soars and new adoption avenues open up.

For hopeful Bitcoin investors, the light at the end of the ETF tunnel finally appears within reach. The SEC seems to be paving the way for the approval cryptocurrency enthusiasts have awaited for years. If granted, it promises to accelerate Bitcoin’s mainstream adoption and transformational impact.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.