THORChain’s native token, RUNE, is currently trading at $1.581, marking a 5.9% increase in the last 24 hours and a 3.02% uptick over the past week.

Source: altFINS – Start using it today

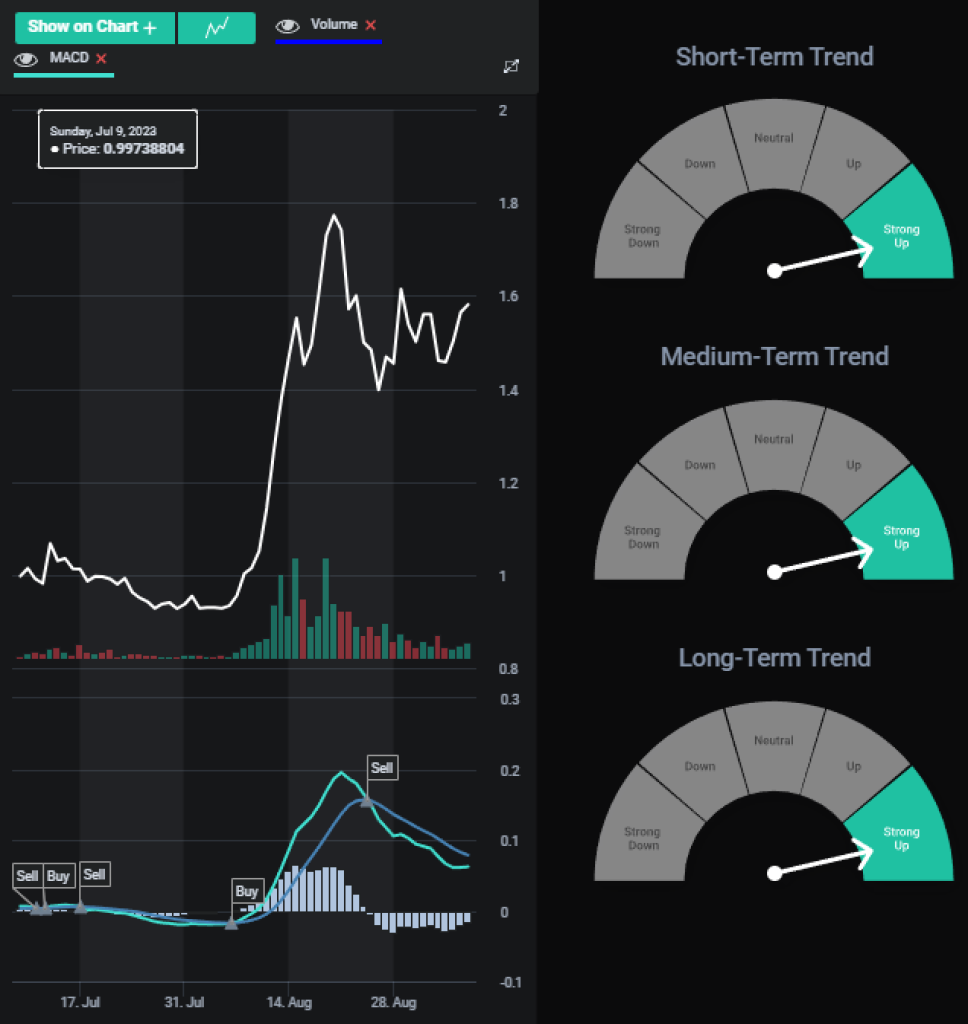

The short, medium, and long-term trends for RUNE all point in a “Strong Up” direction, suggesting a robust bullish sentiment in the market. However, the near-term momentum presents a mixed bag. The Moving Average Convergence Divergence (MACD) Signal Line crossover indicates a bearish trend, while the Relative Strength Index (RSI-14) center line crossover (RSI > 50) signals bullish momentum.

Interestingly, the RSI-14 levels suggest that the asset is neither overbought nor oversold at the moment, hovering between RSI > 30 and RSI < 70.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +What you'll learn 👉

Technical Patterns: Bullish Pennant and Fibonacci Retracement

RUNE has formed a Bullish Pennant in the H4 timeframe, a pattern often considered a precursor to another upward move. Should this pattern break out, market analysts predict that the token could surge towards the $2.50 mark.

The asset recently hit a resistance level at $1.975, following which it experienced a pullback to the 0.382 Fibonacci retracement level. This pullback came after RUNE broke free from a Falling Wedge pattern and crossed the 1-week Moving Average 50 (1W MA50), indicating a possible trend reversal.

Shorting Opportunities: What to Watch For

For traders interested in shorting RUNE, there are specific conditions to monitor:

- Strong Rejection After Tagging Range 2 High: If the price experiences a strong rejection after reaching the Range 2 High, it could be an ideal shorting opportunity.

- Clear Invalidation: On the flip side, if the price reclaims the Range 2 High and sustains it as a support level, shorting would be invalidated.

THORChain’s RUNE token is navigating a complex landscape, marked by both bullish and bearish indicators. While the overall trend remains strongly upward, traders must exercise caution and closely monitor key technical levels and patterns to make informed decisions. Whether you’re looking to go long or considering a short position, the current market conditions offer opportunities for both.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.