The Ethereum network is showing signs of weakness according to the latest on-chain data, potentially signaling further declines in the ETH price, as reported by top crypto trader Ali.

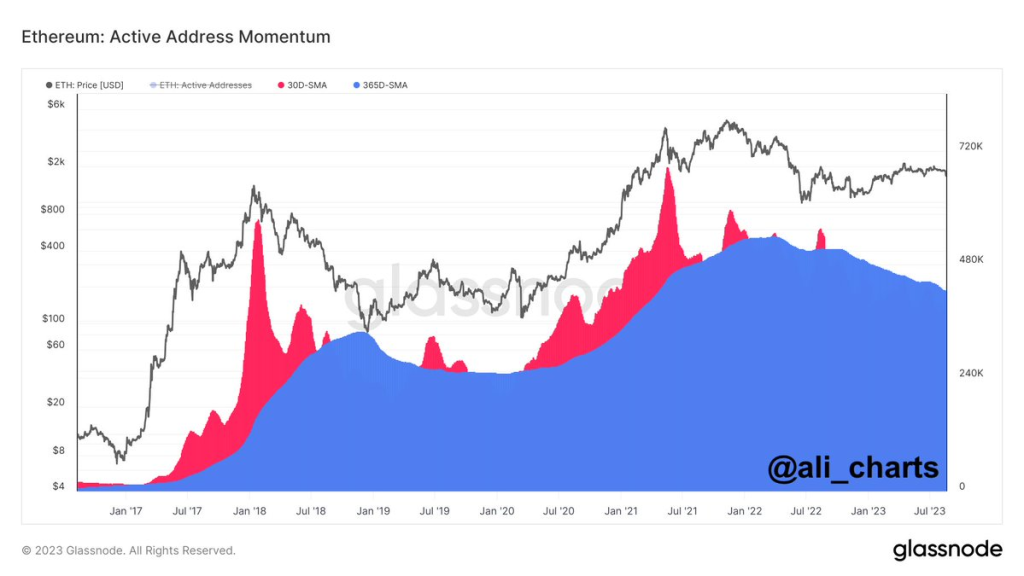

The number of active addresses on the Ethereum network provides insight into overall usage and adoption. An active address refers to an Ethereum wallet that has made at least one transaction during the time period.

Comparing the monthly average to the yearly average shows how short-term network activity is trending relative to the longer-term trend.

The fact that the monthly average has declined below the yearly average means network usage and transactions have slowed over the past month compared to the wider year-long period.

This decline in active addresses suggests deteriorating network health and waning user adoption in the near-term. It is considered a bearish signal, as rising network usage and activity is associated with bullish sentiment and increasing demand to transact on Ethereum.

Slowing network growth could translate into decreased demand for ETH itself, exerting downward pressure on the Ethereum price. This makes the active address metric an important barometer to monitor network health and a leading indicator of potential price moves.

After breaking down from a rising wedge pattern, the ETH price also fell below the key $1,800 support level and 200-day moving average. This breakdown puts the long-term uptrend under threat.

In the near-term, the ETH price is deeply oversold with an RSI of around 22, suggesting a bounce could be due. However, unless ETH can reclaim the 200-day moving average, the downtrend looks set to continue with potential downside towards the $1,500 support zone.

The overall trend remains bearish in the short- and medium-term, but remains in a long-term uptrend. Downward momentum continues to build, with the MACD line crossing below the signal line and RSI below 45.

Key support zones lie at $1,650, $1,625 and $1,500, while resistance is expected at $1,800, $2,000 and $2,140. Ethereum bulls will need to see a break above $1,800 to signal any upside recovery.

You can view our Ethereum price prediction here.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.