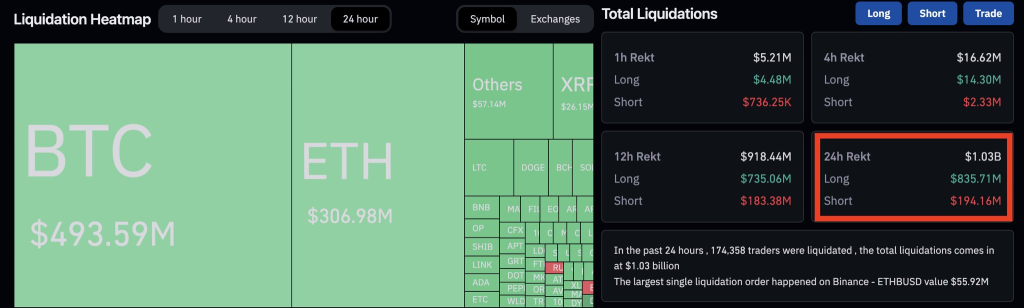

Over the last 24 hours, cryptocurrency markets have seen enormous liquidations totaling nearly $1 billion across major exchanges and assets.

According to data from crypto analyst Miles Deutscher, the majority of liquidated positions were longs, indicating traders had bet on prices continuing to rise. When prices instead took a sharp downward turn, leveraged long positions were forcibly closed out.

Breaking down the liquidations, over $494 million worth of long positions were liquidated on Bitcoin, with another $307 million liquidated on Ethereum. Other major cryptocurrencies like XRP, Litecoin and Dogecoin saw tens of millions more eliminated.

Some speculate a large liquidation of a position held by SpaceX on the FTX exchange may have been the catalyst that kicked off the plunge. Approximately $85 million worth of crypto collateral was liquidated from SpaceX’s account on FTX as prices dropped.

Massive liquidation events like this highlight the high-risk, high-reward nature of leveraged trading in cryptocurrency markets. While leverage allows traders to amplify profits, it likewise compounds losses when positions move against them.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Some analysts argue that cascades of liquidations like this simply serve to accelerate price declines, as underwater positions are forced to sell off in a domino effect. This dynamic means short-term price swings in crypto tend to be more violent compared to traditional markets.

Others maintain that liquidations are a healthy part of the market cycle. They represent overleveraged positions getting flushed out, allowing more rational valuation to resume. Just months ago in June, Bitcoin suffered even larger liquidations near $2 billion but ultimately recovered to new highs.

Despite the brutal liquidations, Bitcoin and Ethereum managed to find support and hold above key technical levels. Bitcoin bounced from its lows around $26,000, defending the crucial support zone between $25,000-$26,000. Meanwhile, Ethereum likewise held above support at $1,600 after plunging below $1,700. As long as Bitcoin keeps trading above $26,000 and Ethereum maintains its footing above $1,600, the crash may be consolidated for now. While further volatility is expected, the fact that BTC and ETH quickly rebounded after dipping below these major supports suggests there is still adequate buying interest at lower prices.

Regardless of perspective, these massive liquidation episodes illustrate why prudent risk management is essential for crypto trading. While the potential upside of leverage is appealing, forced liquidations can rapidly erase an overexposed position. For cryptocurrencies known for their volatility, less leverage is often the safer bet.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.