PrimeXBT Research: WHO Says Worst Is Yet To Come, Will The Pandemic Once Again Shake Up Markets?

At over six months into the year, the new post-pandemic world is now a way of life. Confirmed cases have reached over 10 million, and the death toll has now claimed half a million victims.

The World Health Organization claims that the outbreak “is not even close to being over,” and is even “speeding up” globally.

WHO chief Tedros Adhanom Ghebreyesus even said, apologetically, “the worst is yet to come.”

It’s difficult to imagine a situation worse than things currently are. The initial shock to the world sent the economy in a downward spiral. Jobless claims skyrocketed as companies shut down due to strict quarantine conditions.

The stock market, precious metals, and cryptocurrencies like Bitcoin suffered a severe selloff. Oil prices fell to negative for the first time in history.

Unprecedented Market Volatility: The Silver Lining of the Pandemic

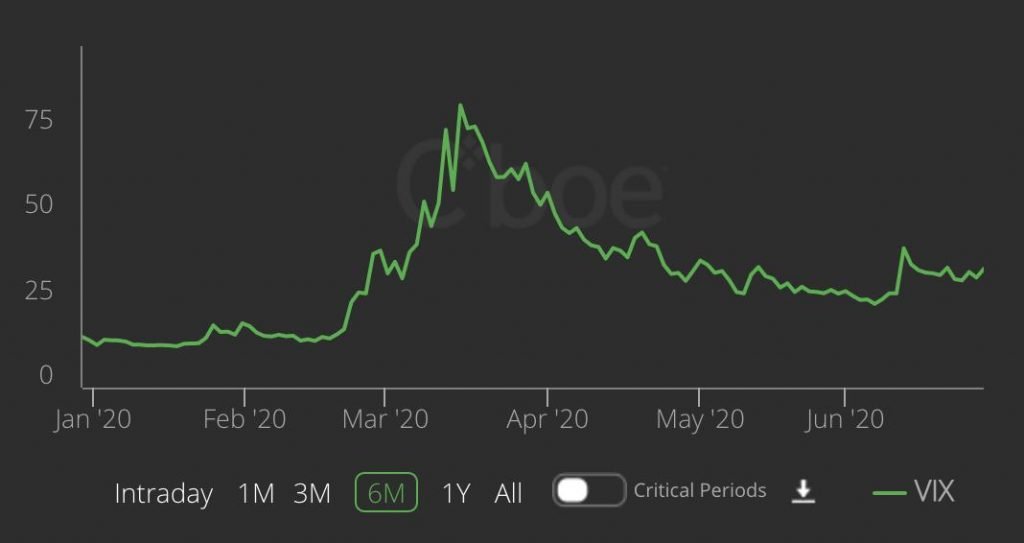

The only silver lining amidst such a disaster is that the pandemic has created an extremely volatile environment in markets. Volatility is what drives the intraday price swings that fuel profitability in trading.

Investors may be suffering, but traders are scrambling to take full advantage of the historical volatility.

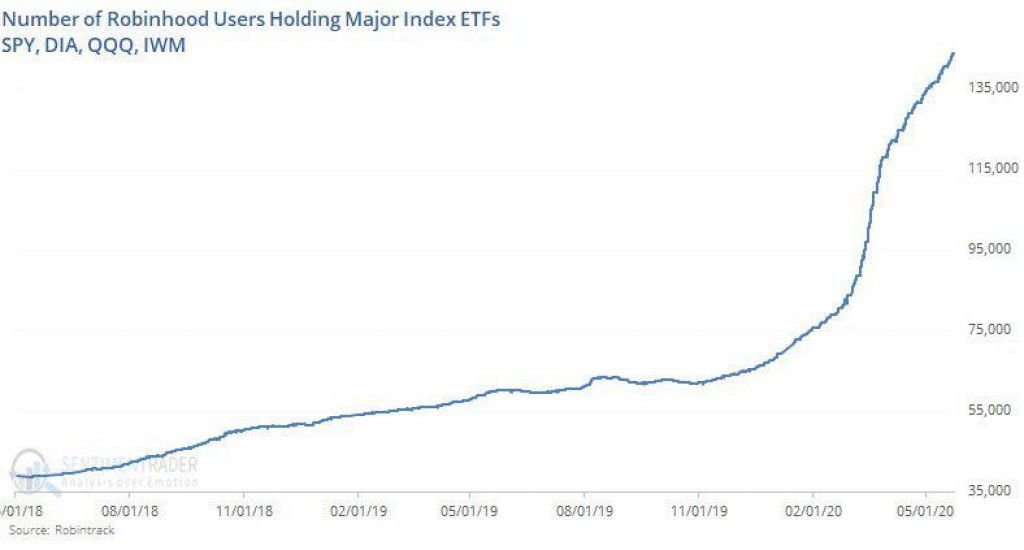

It’s not only prompted an increase in trading volume amongst professional trading platforms, but it also caused a rise of an entirely new generation of traders getting into stocks and other markets for the first time.

Data even shows that sports gamblers have heavily shifted towards trading with their favorite pastimes off the air.

With the first wave of the pandemic causing such chaos, will a second wave create even more havoc? Analysis from PrimeXBT research may shed some light on what to expect for market conditions in the days ahead.

Initial Outbreak Causes White Swan Event, Black Thursday Selloff

The outbreak first began in Wuhan China, but the news was kept relatively quiet coming out of the tight-lipped region. As the United States and the rest of the world learned of the potential impact, the stock market was rocked by a selloff now referred to as Black Thursday.

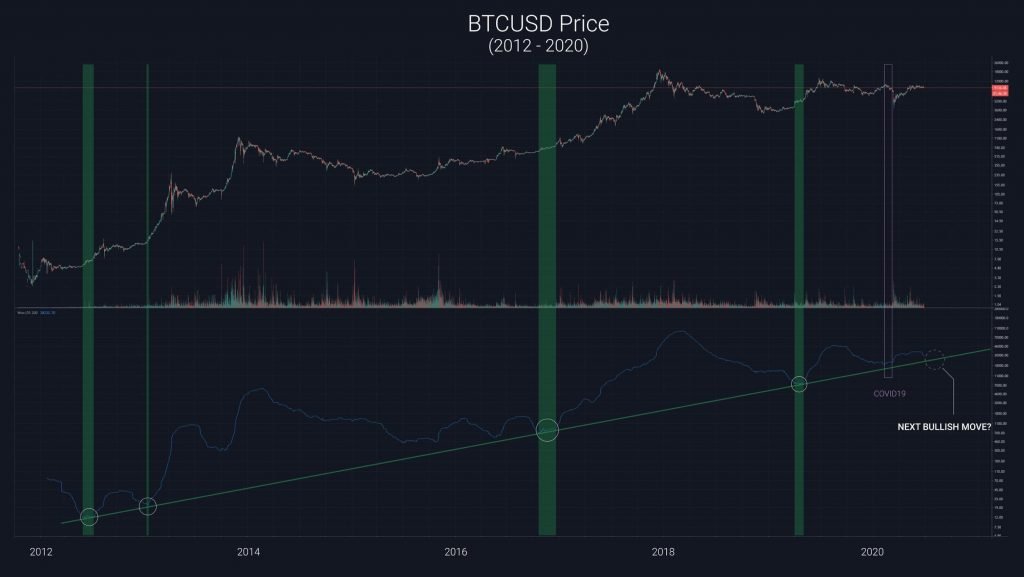

The “white swan” event put an end to a secular stock market bull run, and also took the legs out of the early beginnings of Bitcoin’s next uptrend.

A new indicator developed by Bitcoin expert Willy Woo shows just how close Bitcoin was to breaking out into a new uptrend before COVID-19 happened.

However, when the pandemic struck, fear, uncertainty, and doubt caused panic in the speculative asset class, causing a massive crash across the board.

Record crashes followed by historic rallies came and went in quick succession in the days following the epic collapse, as markets attempted to stabilize.

Markets have only recently begun to pause a powerful bounce into a V-shaped recovery. But a resurgence in new cases spiraling out of control could be an omen to an even more significant selloff, or at the very least, another bout of extreme volatility.

This theory is backed up by a second spike in the Chicago Board Options Exchange Volatility Index (VIX).

Second Wave of Pandemic May Bring A Return Of Market Madness

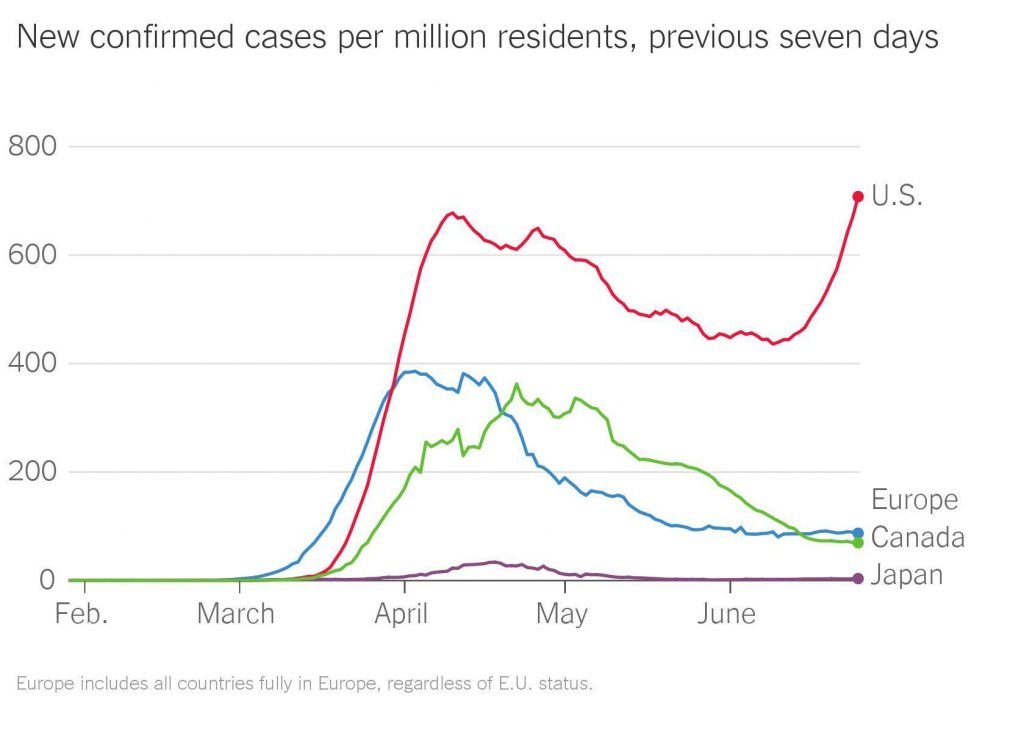

Data shows that in the US alone, cases are once again rapidly rising. The country has not only failed to flatten the curve, but they have begun to curve once again in the wrong direction.

Cases are now climbing again during a particularly sensitive time in the global community. The United States, as a superpower, is being challenged by China, all while the country is vulnerable.

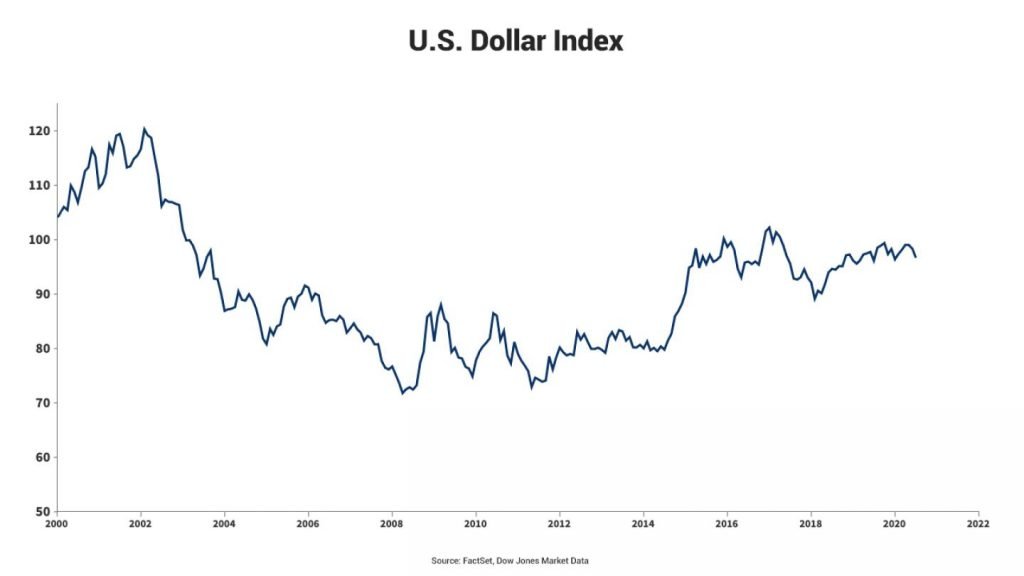

The dollar as the global reserve currency carries with it the weight of the worldwide economy. Most everything is pegged to the dollar in some way. With the dollar itself weakening, markets are fluctuating even more wildly.

Protests, riots, and political unrest have broken out all across the country. And a controversial presidential election is only months away.

The fate of the global economy, markets, and more may all be coming to a head throughout the rest of 2020 – a year that few would argue has been especially painful.

Traders Get Another Chance For Opportunity, Take Advantage With PrimeXBT

The first wave of market volatility caused an incredible surge of trading volume, renewed interest from experienced traders, and even new interest from a new breed of millennial day traders. Will the second wave create even more demand and volatility?

When the next phase of volatility strikes, get ahead of the demand by signing up to PrimeXBT, an award-winning Bitcoin margin trading platform, offering CFDs on stock indices, commodities, forex, and cryptocurrencies.

PrimeXBT offers all the tools necessary to benefit from both rising and falling markets, including long and short positions, as well as built-in charting software and technical analysis indicators from TradingView. Together with stop loss and take profit orders, traders of the platform can embrace the future market volatility and turn chaos into opportunity.

For those that missed out on the first six months of record-breaking volatility, second chances like this don’t come around often. It’s only due to the unexpected impact of an outbreak. The world is still battling that these conditions exist, and they may not last forever.