Selling behavior has likely increased among SHIB holders as the token’s price trades sideways, slipping over 7% in the past 24 hours.

There are likely several factors driving selling behavior among SHIB holders at current price levels.

First, day traders and those seeking short-term gains from volatility are likely profit taking as SHIB’s price has shown little movement recently. Day trading and volatility plays are common strategies for some SHIB investors.

Second, earlier investors who have seen large gains on their initial SHIB investments may be realizing at least some of those profits at these prices. Taking some profits is a reasonable strategy for those up significantly on their investment.

Third, SHIB’s potential as a “meme coin” likely means it has a higher proportion of shorter-term holders compared to more “fundamental” cryptocurrencies. These types of investors may be more prone to selling on lackluster price action.

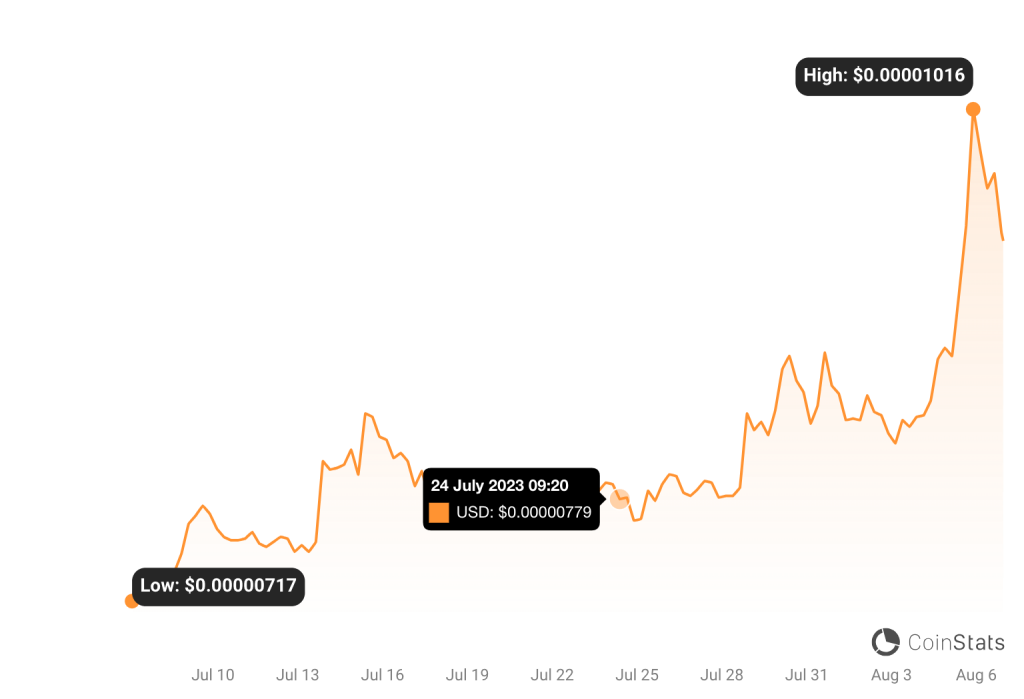

Fourth, SHIB’s recent -7.92% price decline in the past 24 hours, according to the provided information, could be triggering some downside protection selling from investors with tight stop losses. This decline may also be shaking out weaker holders.

However, there are also factors that suggest HODLing sentiment remains strong among at least a portion of SHIB investors:

- The project’s +11.13% gain over the past week could be discouraging some would-be sellers.

- SHIB’s massive community and hype could be propping up its price and supporting a strong base of long-term holders.

- Some holders may simply have a higher risk tolerance and patience to ride out dips and periods of stagnation.

In summary, while selling behavior is likely somewhat elevated currently, factors like day trading, profit taking and price volatility are probably bigger drivers than a wholesale loss of faith in SHIB’s potential among long-term holders. For SHIB to break out to new highs, it will need to balance selling pressure from short-term holders with buying pressure from its most ardent supporters.