August is shaping up to be a pivotal month for several high-profile cryptocurrencies due to scheduled token unlocks. For crypto investors and enthusiasts, keeping an eye on these upcoming unlocks is essential to understand their potential impact on token prices and make informed decisions. This August, tokens worth hundreds of millions of dollars across projects like Sandbox ($SAND), Worldcoin ($WLD), Avalanche ($AVAX), Optimism ($OP), and Injective Protocol ($INJ) are set to be unlocked.

While token unlocks inevitably increase supply and tend to create downward price pressure, their overall impact depends on various factors like the unlock amount, recipient details, project fundamentals, and market conditions.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Here’s a breakdown of what to expect and some insights to guide your decisions:

1. $SAND – Unlocking on August 14th

$SAND tokens worth $133.14M, which constitutes 16.16% of the circulating supply, are set to be unlocked. This hefty amount is primarily earmarked for the team, advisors, and key investors. Historically, advisors and investors tend to offload their tokens, so we might see some downward price pressure post-unlock. However, given that $SAND’s current price is hovering near its 2023 low, the market may have already factored this in.

2. $WLD – A Potential Powder Keg?

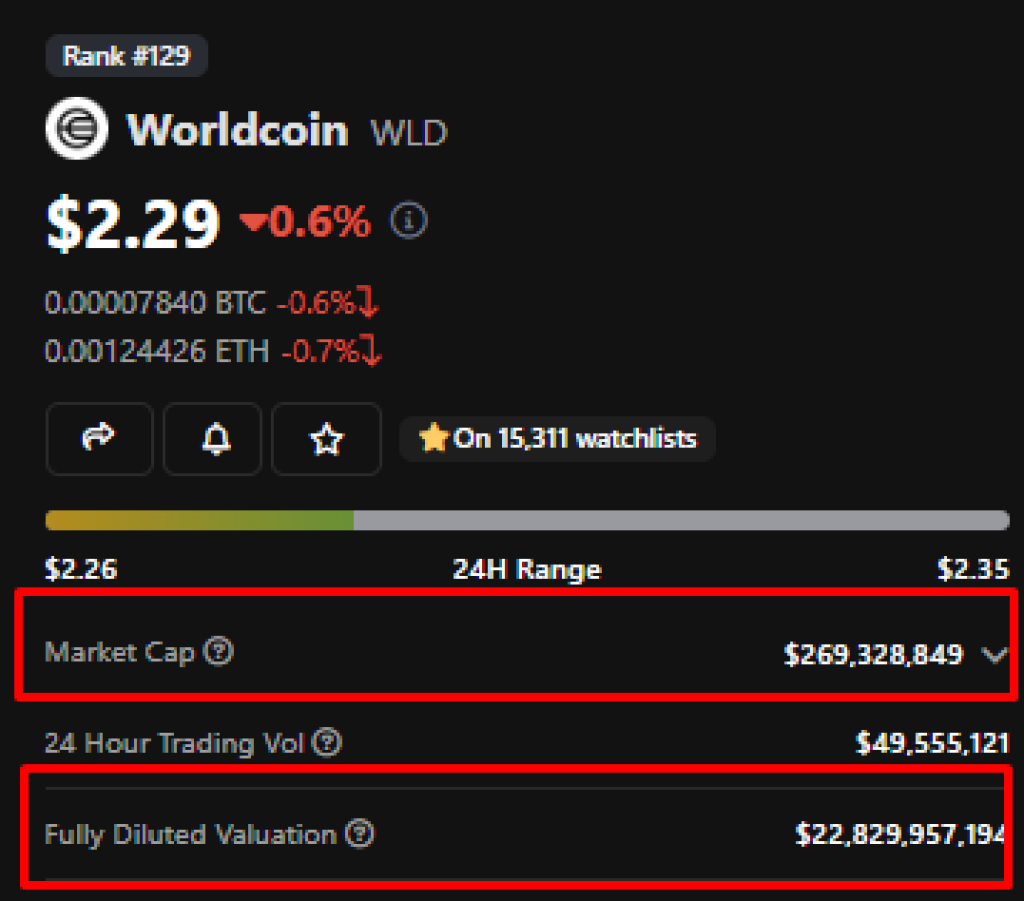

Worldcoin’s token, $WLD, is in a precarious position. Despite its market cap of $270M, its fully diluted valuation is a staggering $22.8B. A majority of the tokens set to enter circulation are community-allocated and team-governed. Notably, market makers hold sway over most of the existing circulating supply.

3. $AVAX – Unlocking on August 26th

Tokens worth $118.7M, making up 2.76% of the circulating supply of $AVAX, will be unlocked. The primary recipients of these tokens will be the team and strategic collaborators. Previous unlocks have led to a short-lived dip in the $AVAX price, so history might repeat itself, but any impact is expected to be transient.

4. $OP – Unlocking on August 30th

$OP tokens valued at $41.3M, representing 3.37% of its circulating supply, are on the unlock radar. These are designated for investors and core contributors of the project. Given the current buzz surrounding $OP, a significant price dip post-unlock seems improbable. As someone deeply immersed in the crypto landscape, I’d advise against betting on a downturn.

5. $INJ – Unlocking on August 21st

Come August 21st, 3.41% of the $INJ circulating supply will be unleashed. These tokens, earmarked for “ecosystem development”, are likely to remain under team control. Should the team decide to liquidate these assets, it would likely be a gradual process spread over months. Some selling pressure is anticipated, but a drastic plunge seems unlikely.

There are a few ways that token unlocks can impact the price of a cryptocurrency token:

- Supply increase – Token unlocks usually refer to tokens that were initially locked up or restricted from being traded becoming freely tradable. This increases the circulating supply of the token, which could put downward pressure on the price if the new supply outpaces demand.

- Selling pressure – Founders, employees, investors etc whose tokens are unlocking may want to sell some or all of their newly tradable tokens to realize profits or get liquidity. This selling pressure could drive the price down.

- Reduced scarcity – Locked tokens create artificial scarcity for a cryptocurrency, so unlocking them reduces this scarcity. Lower scarcity tends to lead to decreased prices.

- Vesting schedules – Some token unlocks happen according to vesting schedules that space out the unlocking over time. This can minimize negative price impact vs a sudden, large unlock.

- Positive factors – In some cases token unlocks are indicative of progress being made by the project. This could actually boost confidence and offset selling pressures.

- Other fundamentals – Ultimately the impact on price will depend on overall token demand, use cases for the token, the wider crypto market conditions etc. The unlocking itself may not outweigh these other factors.

Token unlocks tend to create downward pressure on price, all else being equal. But the overall price impact will vary depending on the specifics of the unlock and the project’s fundamentals. Monitoring the unlock schedule and amount can help gauge potential impacts.

In conclusion, August promises to be an eventful month for crypto aficionados. As always, stay informed, do your research, and tread wisely.

Stay savvy, crypto community! 🌐