Bitcoin continues to be a subject of intense scrutiny and speculation. Recently, two top analysts on TradingView provided an insightful analysis of Bitcoin’s current market situation, while a crypto analyst on Twitter suggested a potential price target for Bitcoin before its next halving.

The Bitcoin network’s computing power, also referred to as the hash rate, may experience a decline of up to 30%. This potential drop is due to unprofitable miners anticipated to discontinue their operations following the upcoming halving event, which is projected to occur in April 2024.

What you'll learn 👉

Profit Targets, Resistance, and Support Levels

VantageMarkets‘s analysis on TradingView indicates that Bitcoin, currently priced at $29,360, is in a bearish flag formation. This suggests a negative short-term bias, with a break of $29,000 needed to confirm this outlook. If the recent low of $28,825 is breached, it could result in a further downward move. The market is currently at overbought extremes, and losses could be extended.

The analyst sets profit targets at $27,588 and $27,088, with resistance levels at $29,360, $29,700, and $30,000, and support levels at $28,825, $28,000, and $27,500.

Bitcoin is in the Distribution Phase

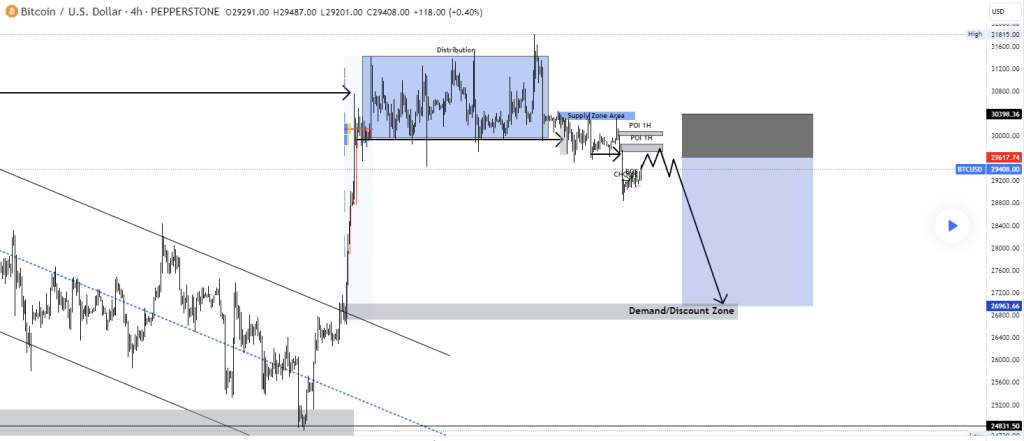

In another recent analysis on TradingView, the current market behavior of Bitcoin was described as a distribution phase. The cryptocurrency, currently priced at $29,360, has broken its structure to the downside to fill an imbalance.

This suggests that there will be a retracement back into the first point of interest created in the 1-hour timeframe, which is at $29,717. This retracement is expected to occur after mitigating the supply zone area.

For confirmation entries, the analyst suggests heading to the 15-minute timeframe and waiting for a break of structure. Investors can look for the start of the impulsive candle that broke the structure.

Alternatively, for those who prefer a more aggressive approach, they can enter at $29,717 and ride it down, which is something traders should avoid. This analysis underscores the dynamic nature of the cryptocurrency market, where shifts can occur rapidly and require careful observation and strategic decision-making.

BTC’s Price Might Skyrocket to $180,000 before Halving

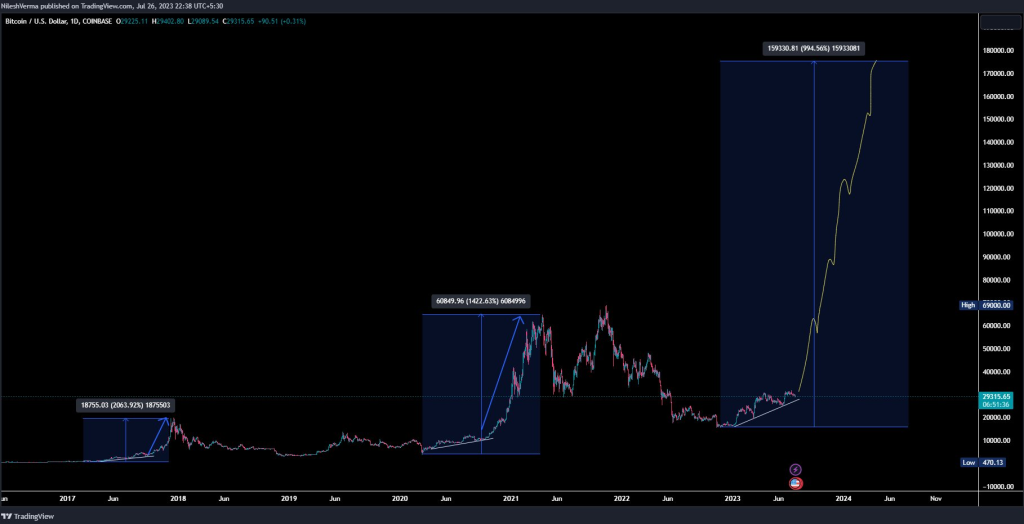

On the other hand, a crypto analyst on Twitter, Nilesh Rohilla, has proposed a bold prediction for Bitcoin’s future. He wonders whether Bitcoin can jump toward $180,000 before Halving this time.

“Ask yourself after seeing 2013/2017/2021 move, i am 100% sure you can’t say NO.” says Nilesh Rohilla

Citing the significant price movements of 2013, 2017, and 2021, he expresses confidence that such a leap is not out of the question at all!

The analyst Nilesh Rohilla is likely looking at these significant price jumps, particularly the ones in 2013 and 2017, and predicting a similar pattern could occur again. The prediction of Bitcoin reaching $180,000 would represent a significant increase from its 2021 closing price.

However, it’s important to note that while historical price movements can provide some insights, they are not a guarantee of future performance. Many factors can influence the price of Bitcoin, including regulatory news, technological advancements, market demand, and global economic conditions.

Long-Term Bitcoin Holders Reach Record-Breaking Milestone

Our recent article discusses the unwavering faith of Bitcoin’s long-term holders, with their supply reaching a record-breaking milestone. According to Glassnode, a prominent on-chain analytics firm, the Bitcoin balance held by long-term investors, defined as addresses that have held their coins for at least 155 days, has surged by an impressive 62,882 BTC this month alone.

This has led to the Bitcoin Long-Term Holder Supply reaching a new all-time high of 14.52 million BTC, accounting for a staggering 75% of the total circulating supply. The data suggest that Bitcoin is still in its early adoption phase, with a considerable portion of investors preferring to hold their Bitcoin rather than actively trading or selling it. This indicates a belief in Bitcoin’s long-term value and potential for further growth.

Conclusion

These contrasting views highlight the volatility and unpredictability of the cryptocurrency market. While the TradingView analysis suggests a potential downturn, the Twitter prediction offers a more bullish outlook.

As always, investors are advised to conduct their own research and consider their financial situation before making investment decisions.