The price of Maker (MKR), a popular cryptocurrency, surged by approximately 20% in a single day and is currently trading at $1,147.30.

However, this sudden rise has woken up the activities of two major players in the crypto market: venture capital firm Andreessen Horowitz (a16z) and digital asset fund CMS Holdings, reports Lookonchain, one of the top crypto whale analysts in the industry.

What you'll learn 👉

A16z’s Sell-Off and the MKR Price Surge

Andreessen Horowitz, better known as a16z, has been observed making significant deposits of MKR to the cryptocurrency exchange, Coinbase. The firm has reportedly deposited a total of 12,864 MKR, equivalent to approximately $12.6 million. This move has led to speculation that a16z may be preparing to sell off a portion of its MKR holdings.

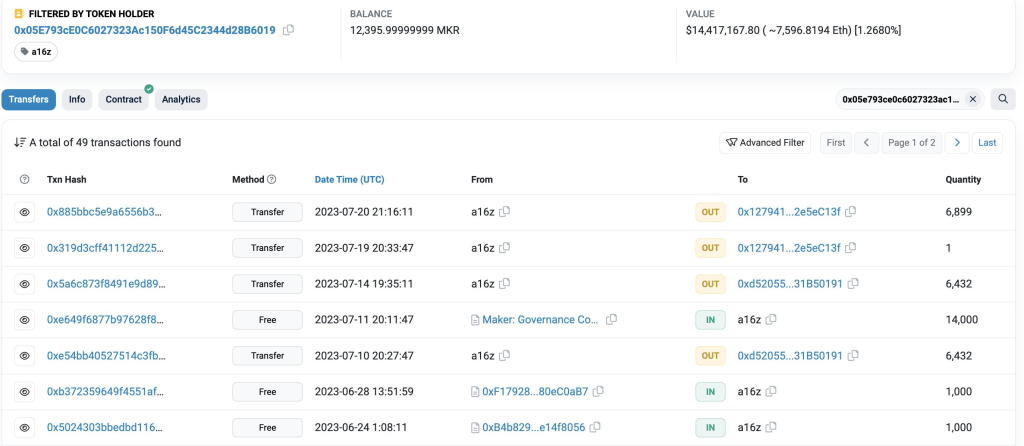

In addition to the Coinbase deposits, a16z also transferred 6,900 MKR (worth around $8 million) to a new address just six hours prior. This has further fueled the speculation that the firm may be planning to deposit these funds to exchanges for a potential sale. As of now, a16z’s remaining MKR holdings stand at 12,396 MKR, valued at roughly $14.4 million. Etherscan link

CMS Holdings Reduces MKR Holdings

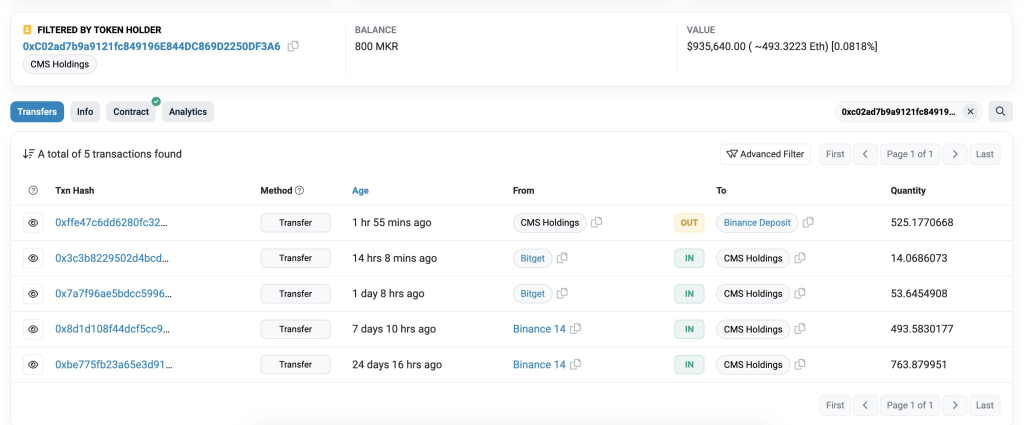

Meanwhile, CMS Holdings has also been making moves in the MKR market. The firm deposited 525 MKR (approximately $614K) to Binance, another major cryptocurrency exchange, two hours ago.

CMS Holdings has also withdrawn 1,325 MKR (currently valued at $1.54 million) from Binance and Bitget at an average price of $793. The firm’s current MKR holdings stand at 800 MKR, worth around $936K. Etherscan link

The Impact on MKR’s Price?

The activities of these two major players have undoubtedly influenced the MKR market. The question now is, what does this mean for the future of MKR’s price? If a16z does indeed sell off its MKR holdings, it could potentially lead to an oversupply of the cryptocurrency in the market, which may cause the price to drop.

However, it’s important to note that market dynamics are complex and influenced by a multitude of factors. While a16z’s potential sell-off could exert downward pressure on MKR’s price, other factors such as market demand, investor sentiment, and broader market trends could counterbalance this effect.

In the world of cryptocurrency, uncertainty is the only certainty. As such, investors should keep a close eye on the unfolding drama of MKR and make informed decisions based on a comprehensive understanding of the market dynamics.